After a prolonged period of underperformance, value experienced a strong rebound that began in September 2020. Subsequently, value gave up nearly half its gains by mid-May 2021 with the emergence of the more-contagious Delta variant of Covid-19. The economy faltered in response as many governments imposed renewed lockdowns, investor confidence flagged, and the focus returned to tech stocks.

Even after the partial rebound, value stocks remain priced at very attractive valuations across most regional markets—discounts are not only in the cheapest decile in history, they are in the bottom half of the cheapest decile! In the US market, the discount is wider than the discount observed during the height of the tech bubble and is approximately halfway between its peak last year and the extreme discount reached during the tech bubble.

As expected, vaccination against Covid has been effective in curbing hospitalization and mortality. We expect renewed economic growth as the emerging markets and other regions slow to vaccinate their populations make significant progress on that front. The cyclical sectors of the economy, and consequently value investors, should benefit.

When most liquid asset classes are set to deliver a negative or near-zero real return, value stocks stand out as the only asset class likely to generate a 5%–10% real return over the coming decade. The opportunity to buy value stocks may be short-lived and we may wait decades for an opportunity of a similar scale.

In mid-March 2020, we wrote in “This Too Shall Pass” that disruptions such as the Covid-19 pandemic are not permanent and that investors can look beyond immediate travails to an eventual return to normalcy. Who knew that 17 months later the world would still be dealing with the pandemic and its fallout? Yet, the truism remains: This too shall pass.

In the spring of 2020, value stocks were out of favor, left behind in the years leading up to the pandemic by the high-flying tech darlings, so very well-positioned for both the Covid and post-Covid worlds. Until early September 2020, tech stocks dramatically outpaced value stocks, but in a “reopening trade” value stocks (largely, in the cyclical sector) delivered an impressive rebound through mid-May 2021.

In late spring and summer of 2021, the emergence of the Delta variant precipitated fears of more lockdowns and potentially more-virulent future variants. As a result, tech stocks were reinvigorated and over half of value stocks’ gains were wiped out. Is now a second chance to rebalance into value stocks, to buy the dip? Will value regain its footing or resume its slide into irrelevance?

Value’s Travails and Recent Partial Recovery

The magnitude and duration of value investing’s pre-pandemic drawdown relative to the broad equity market depends, of course, on how we define value.

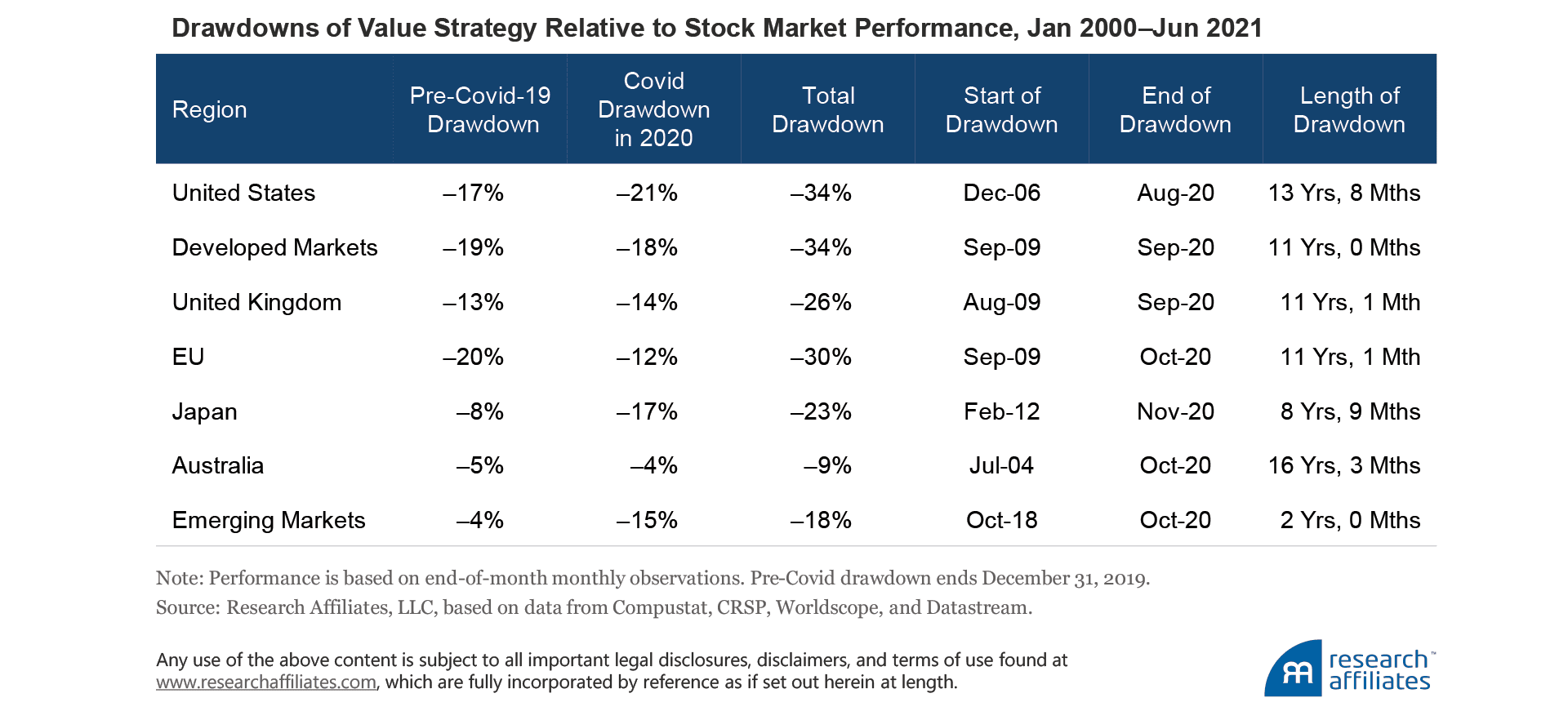

The most popular definition, the price-to-book value ratio (low is value, high is growth) has shown the worst performance of any of the popular value metrics. As the following table illustrates, in the US equity market, value reached its peak performance in December 2006 and then underperformed for the next 13 years, posting a relative drawdown versus the market of 17% at the end of December 2019.1

If, however, we define value based on the price-to-earnings ratio, value reached its last all-time high in relative performance in 2013; using the price-to-book value ratio adjusted for intangibles, the last peak was in 2014; and using the price-to-sales ratio or the fundamental-weight-to-cap-weight ratio (where fundamental weight is a blend of five-year average sales, cash flows, and dividends and the most recent book value), the peak was in early 2017.

Regardless of how we define value, value investing posted the worst drawdown in its history over the years 2017–2020. Value’s pre-pandemic drawdown in the developed markets was slightly shorter than in the US market, starting in September 2009, but was even deeper at 19%. In the emerging markets, a value investing strategy continued to beat the market until late 2018.

The Covid pandemic and subsequent lockdown was the largest blow to the global economy since World War II, affecting most sectors, but hitting the capital- and labor-intensive sectors associated with value stocks the hardest. The virtual economy (frothy growth stocks) was largely unscathed. Investors’ rejection of value stocks in the pandemic environment makes sense because these companies tend to have anemic growth and thin profit margins. Very legitimate bankruptcy fears drove investors to shun these value stocks and pursue growth stocks, more aggressively even than during the tech bubble of 1999–2000.

The pandemic-driven value crash savaged value stocks around the world, in most cases piling even more losses on top of prior years’ losses. Value racked up another 21% of underperformance from January 2020 through August 2020 as a result of the Covid crisis, leading to a cumulative drawdown of 34% from the performance peak in December 2006. In the developed markets, value stocks lost an additional 18%, leading to a cumulative drawdown, matching that of the US market, at 34%.

Arnott et al. (2021) find that the relative valuation of value versus growth stocks is the key variable that explains value’s underperformance since January 2007. By definition, a portfolio of value stocks is always cheaper based on price-to-fundamentals ratios when compared to a portfolio of growth stocks, however, the relative discounts of the two portfolios vary widely over time.

Although time-varying, the average discount for US value stocks over the period July 1963–June 2021 is about 21%, or put another way, US growth stocks typically sport a price-to-book value ratio about five times that of value stocks. From January 2007 to September 2020, the relative valuation moved from the most expensive quartile (specifically, the 22nd most expensive percentile) to the cheapest percentile in history (100th percentile); this revaluation explains more than 100% of value’s underperformance through September 2020. In other words, net of this downward revaluation relative to growth, value would have beat growth by a respectable margin.

Was value investing’s 2020 pandemic-induced underperformance characteristic of its normal behavior during an economic recession? Yes, it was. Kalesnik and Polychronopoulos (2020) find in their analysis of the six bear markets associated with recessions between 1963 and 2019 that four were triggered by shocks to economic fundamentals, while the other two were triggered by the bursting of relative-valuation bubbles.2

During the two recessions spurred by the bursting of an asset bubble, value markedly outpaced growth during the associated equity bear market. In the recessions triggered by shocks to economic fundamentals and unassociated with a bursting bubble, value typically performed in line with growth. The relative performance varied: sometimes value performed a bit better and sometimes worse as during the more-severe shocks of the global financial crisis of 2008-09 and the Covid crash of 2020.

In the first two years after the end of a recession-related bear market, Kalesnik and Polychronopoulos (2020) observe that, in five of the six cases they analyze, value outperforms, typically by an immense margin. Value’s outperformance during recoveries should not be surprising, because as recessions ease, the risk of bankruptcy—typically afflicting value stocks with their slower growth, thinner profit margins, and weaker revenue prospects—recedes. As uncertainty dissipates and recession turns the corner into recovery, the companies once viewed as vulnerable usually enjoy a strong bounce back as the economy improves.

As recessions near their end, value strategies rebalance into beat-up value stocks at their cheapest levels of the cycle. And as the recovery advances, the cheaply priced value stocks, bought when most unloved, begin to reward the investors who had the courage to buy them.

The value rebound that began in September 2020 was consistent with historical precedent. By late summer of 2020, value stocks were priced at extreme valuation discounts—by some measures including price-to-book value and price-to-sales ratios, the deepest discounts ever. Combined with the recognition that vaccines were coming soon, the prices of value stocks responded very positively. The value rebound persisted into 2021 as investors gained confidence, reassured that enough vaccine could be produced and distributed for the rapid vaccination of a significant part of the developed markets’ population.

Through mid-May 2021, value was rebounding across all regional markets in our analysis. The US, Australia, developed, and emerging markets each showed outperformance relative to their respective equity market of 8% for the period that began with the bottom of the relative valuation of value versus growth until June 2021. Value’s best (13%) and worst (7%) outperformance was in the UK and EU markets, respectively. We can hardly consider the United Kingdom an accidental outlier. Its impressive rebound can be attributed to the noteworthy success of the British vaccination program (only Israel and the UAE vaccinated the majority of their populations faster than the UK).

The relative performance of value versus growth has declined slightly in recent months with the appearance of the Delta variant, which spreads more readily—and is no less lethal—than the original “Alpha” virus. Governments at all levels are reacting, many by imposing new lockdowns, and the general public is displaying a renewed caution. Both are contributing to fresh fears about the economy. We believe the economic pullback and value’s retraction are temporary.

Vaccines are demonstrating efficacy in reducing adverse health effects and deaths even for the Delta variant. Pharma is already developing and testing vaccines that target the new variants, which should curb the spread and severity of illness of future variants. Are we at “peak fear” for the value sector and the emerging economies? If so, buy. If not, begin to average in.

Value Remains Impressively Cheap

How can we evaluate if the recent value rebound, cresting in May, is over or is the start of a bigger rebound?

We have observed before that relative valuations are a powerful instrument both for understanding the past and for evaluating the likely path forward. We analyze the current valuations of value stocks relative to growth stocks in several major regional markets and compare them to their historical relationships. We calculate the discounts based on two fundamental measures: the price-to-book value ratio and a more expansive price-to-composite measure, which averages four valuation ratios.3

We believe the economic pullback and value’s retraction are temporary.

”The discount for value no longer falls in the 100th percentile as was the case in late summer of 2020, yet for both fundamental measures, value still displays impressively cheap discounts across all regions but one. In most markets, the discounts are not only in the cheapest decile in history, they are in the bottom half of the cheapest decile! The only exception is Australia where the discount falls beyond that range based on composite valuations. For all regions except Australia, percentiles as of June 30, 2021, are in the cheapest relative valuation decile in history. In Australia, the relative valuation using the price-to-book value ratio is 89% and using the composite measure is 51%.

Implications for Asset Allocation

Let’s consider the return prospects for value investing within the broader context of the returns offered by a global portfolio of investable liquid asset classes.

For the last almost four decades, we have experienced a prolonged period of shrinking interest rates. During the global financial crisis (GFC), the developed economies embraced so-called Modern Monetary Theory (MMT) (which is arguably none of the three!) and associated unprecedented pumping of liquidity into the capital markets, along with unprecedented fiscal stimulus. Or so we thought! The stimulus packages during the Covid-induced lockdown dwarfed the GFC stimulus packages. This drove government interest rates to near-zero, and in many economies, beyond. Negligible rates can easily become fuel for malinvestment, such as propping up zombie companies, and crony capitalism (seeking government favors to protect the best-connected large businesses from upstart competitors).

From the spring of 2009 until today, the TINA (there is no alternative [to equities]) mantra propelled the US equity market to atypically high valuations and developed-world bond yields to record lows, while valuations for many other major asset classes struggled to keep pace. Meanwhile, interest rates steadily declined from their highs in the early 1980s, and today more than $13 trillion bonds in markets around the world are priced at a negative yield to maturity. Many more assets—including the most expensive tech stocks—are also priced to generate a negative real return, even if those companies are able to achieve the lofty growth the market currently expects.

Most of the major developed-market bond markets, including investment-grade corporate bonds, have negative or near-zero expected real returns for the next 10 years—yet global markets are hardly devoid of opportunity. International and EM stocks are far cheaper than US stocks, currently priced to support an annualized real-return forecast of 3% to 5% (5% to 7% in nominal terms) over the next 10 years. For investors who aim to earn double-digit returns, these forecasts perhaps sound bleak, but against near-zero bond yields, they’re not bad!

The biggest outliers in long-term expected real returns are value stocks. EM value is projected to generate the highest real return, nearly 10% a year, over the next 10 years, of the asset classes and value strategies we compare. Of course, investing in EM value stocks comes at the highest levels of risk. Alternatively, UK, EU, and Japanese value stocks are priced to generate an anticipated real return of 6% to 8% a year over the next 10 years, likely with less risk compared to EM value stocks.

The bottom line is that even after value’s recent partial rebound, the strategy in most regional markets is still priced at very attractive valuations. In the US and developed markets, value discounts have only been cheaper at the very height of the tech bubble and during the summer of 2020. When most other liquid asset classes are priced to generate negative or near-zero real returns, only equity value strategies are priced to generate long-term real returns higher than 5%. The peak fear around further Covid spread and the extreme valuations for value strategies may prove to be short-lived. A well-diversified portfolio positioned for long-term real returns should today anchor on value stocks across the globe.

As Life Returns to Normal…

Market commentaries attribute the retreat of value since May 2021 to the economic repercussions of the rapidly spreading (mainly among the unvaccinated population) more-contagious Delta variant. Yet, experience to date shows that vaccines are working. In the United Kingdom where 71% of the population had at least one dose of the vaccine and 63% were fully vaccinated as of August 2021 (and 91% of the adults in England and 94% in London tested positive for antibodies, which means a significant portion of the unvaccinated have had Covid and recovered), the estimated ratio of deaths to known Covid cases is about 0.2%, not too different from the same ratio for seasonal flu (Arnott, Kalesnik, and Wu, forthcoming).4 As greater numbers of the unvaccinated become vaccinated or acquire natural immunity, the world’s prospects for living with the endemic presence of Covid are good. This too shall pass and the stalled economic recovery will resume.

As the pandemic wanes, many of the tech companies that greatly benefitted from the lockdowns and widespread work-from-home policies will likely cede some of those benefits. While some pandemic-era behavior changes will prove lasting, we believe most people will revert partway to the normal habits of the past. Amazon, for example, grew its revenues by 84% in 2020 relative to 2019, profiting from the massive switch to primarily online purchasing behavior; some of that behavior will mean revert. As this happens, many of the economic and behavioral trends that supported these high-flying companies are likely to reverse course.

The high valuations and high market concentrations typical of these (mainly tech) stocks create further risks to investors who hold them. Cisco, for example, has had double-digit growth in sales, profits, and book value in the 21 years since it was briefly the largest-cap stock in the world, and yet its share price is still down from its 2000 peak price. As one wit during the 2000 tech bubble quipped: “Some of these share prices are not only discounting the future, but also the hereafter.”

A well-diversified portfolio positioned for long-term real returns should today anchor on value stocks across the globe.

”Certain cyclical sectors may also have ample room for further recovery. Specifically, the energy sector has ridden a wave of bankruptcies over the lockdown period. Industry survivors should be able to operate with richer margins. Further, OPEC+ (the OPEC countries and major non-OPEC oil producers, notably, Russia) agreed during the pandemic to tighten control on oil production to stabilize prices as energy demand plummeted. In the recovery, the combination of potential underinvestment from bankruptcies and tighter supplies by the major producers led to short-term oil shortages, with oil prices reaching much higher levels. Given the cheap valuations of some of the major energy companies, these shocks could be great news for value investors.

So, No. We Don’t Think You Missed the Turn!

All indications are that 10 years from now Covid-19 will be an awful, but fading memory, with the virus having morphed into yet another strain of seasonal flu, against which most of the world’s populace will have attained some measure of resistance.

In May and June 2021, the value turn that started in September 2020 gave back over half its gains as the third Covid wave swept the globe. The good news is that value is still remarkably cheap with discounts relative to growth at near-historical highs. Value was only ever cheaper relative to growth in the summer of 2020—not even during the height of the tech bubble.

The demonstrated effectiveness of vaccines, particularly in reducing the risks of hospitalization and mortality, should continue to boost the major global economies. Worldwide economic strength should accelerate as the emerging markets and other regions that were slow to vaccinate their populations make significant progress on that front. The cyclical sectors of the economy, and consequently value investors, should benefit. When peak fear rules investors’ mood, as is currently the case for value strategies, it’s time to buy, not sell.

In the seven years that followed the bursting of the tech bubble in 2000, value more than doubled relative to growth, chalking up over a 100% relative performance gain! Might the value rebound already begun rival or even exceed the 2000–2007 experience? We see it as being entirely possible and would be more than happy with only half as much relative outperformance!

Value is also cheap on an absolute level. When most liquid asset classes are set to deliver a negative or near-zero real return, value stocks standout as the only asset class likely to generate a 5%–10% real return over the coming decade. We may never again see a better opportunity to buy value stocks.

Value stocks standout as the only asset class likely to generate a 5%–10% real return over the coming decade.

”Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- Although the strongest impact of Covid on the US market began in February 2020, internationally the impact was felt as early as January 2020. Given that we use monthly frequency return data in our analysis, for consistency, we define the pre-Covid period as ending December 31, 2019.

- Kalesnik and Polychronopoulos (2020) limit their analysis to only recessions accompanied by bear markets, excluding, for example, the crash of 1987 (bear market without an associated recession) and the first dip of the 1980 recession (recession without an associated bear market).

- For the composite measure, we compare the price-to-fundamentals ratios of the value portfolio and the growth portfolio, using four ratios: price to book value, price to five-year average sales, price to five-year average cash flow, and price to five-year average dividends. This composite is mathematically identical to the ratio of fundamental weight (the average of individual fundamentals each scaled to sum to 100%, or RAFI weight) to cap-weight.

- Based on data from https://ourworldindata.org through August 31, 2021.

References

Arnott, Rob, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa. 2021. “Reports of Value’s Death May Be Greatly Exaggerated.” Financial Analysts Journal, vol. 77, no. 1 (First Quarter):44–67.

Arnott, Rob, Vitali Kalesnik, and Lillian Wu. 2021. Reason Foundation (forthcoming).

Arnott, Rob, and Jonathan Treussard. 2020. “This Too Shall Pass.” Research Affiliates Publications (March).

Kalesnik, Vitali, and Ari Polychronopoulos. 2020. “Value in Recessions and Recoveries.” Research Affiliates Publications (June).