Although diversifying asset classes underperformed relative to core assets in the last decade and provided only moderate relief in 2022 when core assets underperformed, it’s unwise to abandon them.

Asset allocation into diversifying assets is a straightforward and powerful way to manage macro exposures. Understanding those exposures defines a strike zone and explains recent results.

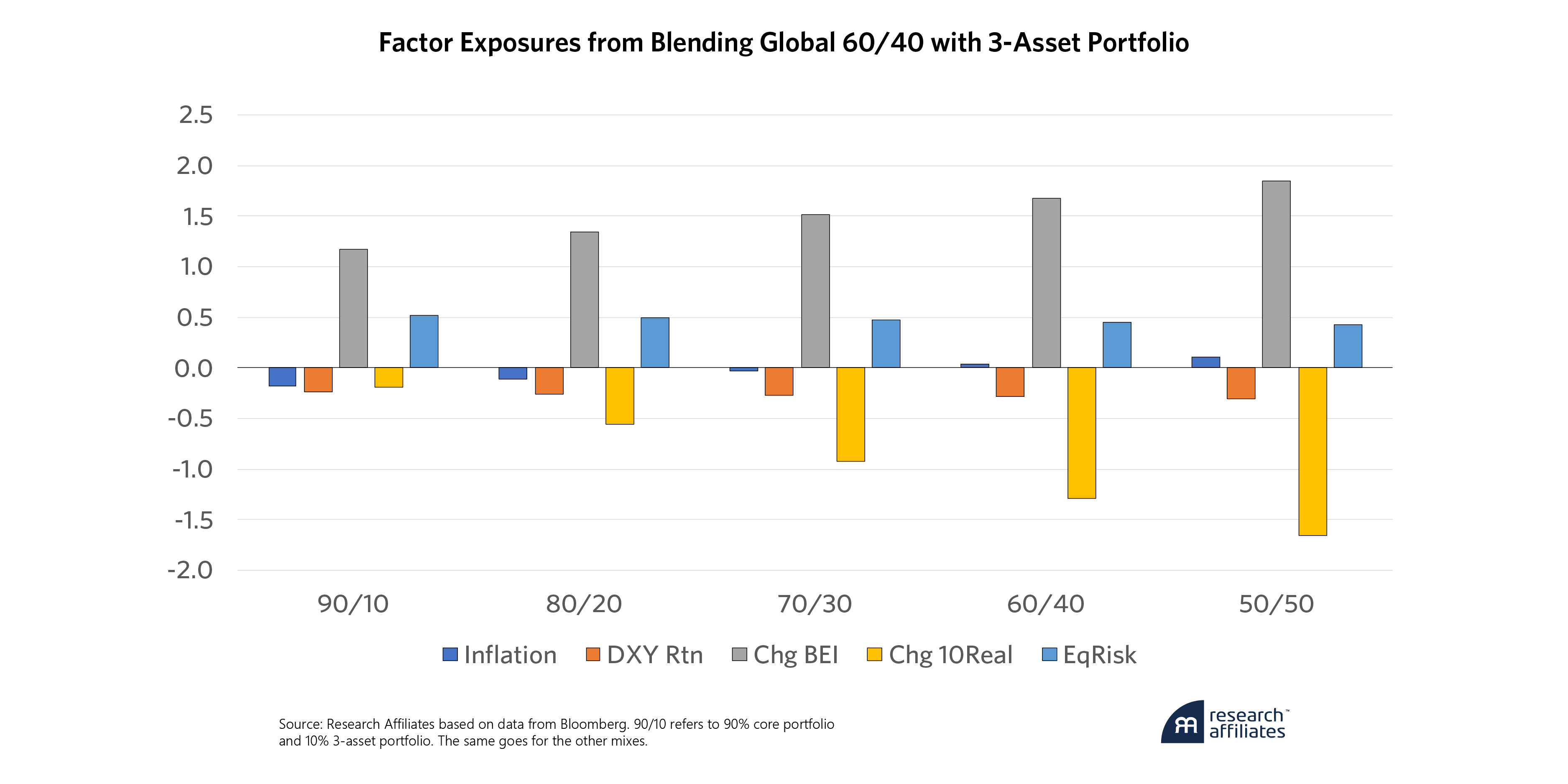

Introducing a simple three asset portfolio of TIPS, REITS, and commodities into a core 60/40 portfolio is an effective way to manage major macro exposures and reduce the overabundance of equity volatility in a standalone core portfolio.

As the calendar closed on 2023, investors were once again treated to magnificent returns in their stock and bond portfolio. Global stocks as represented by the MSCI All Country World Index (ACWI) returned 22.8% while global bonds (Bloomberg Global Aggregate Index) also ended the year in the black, with a return of 5.7%. Put those together, and a Global 60/40 portfolio provided strong 16.5% returns in 2023 to cap off a 6.3% annualized return over the last decade. Investors focused exclusively on the U.S. corollary of the 60/40 portfolio did even better, returning 17.7% in 2023 and 8.1% annualized over the trailing decade.

Create your free account or log in to keep reading.

Register or Log in

We have long been advocates of adding exposures to other asset classes in order to diversify macroeconomic risks present in the core 60/40 portfolio. However, with returns topping 6% for a decade, and underwhelming returns for diversifying asset classes in 2022, when core also suffered, some see that as two strikes against this approach. While we may not agree with that particular take, our view is that understanding the strike zone aids in not swinging at bad pitches.

Hall of Famer Tony Gwynn, a baseball legend here in Southern California, had a .302 batting average with two strikes. He discussed the need to keep it simple and return to basics when hitting from behind. Likewise, we think now is a good time to review the strike zone.

In this article we take Tony’s advice and define a strike zone through the lens of a framework of asset exposures to a few simple factors. We then use this framework to review what happened in 2022 and how it aligns with our views of the future.

Here we focus exclusively on using allocation to asset classes to manage exposures. Adding allocations to active strategies in a portfolio is another way to manage exposures. We embrace the benefits of strategies like trend following and alternative risk premia but acknowledge not all investors are comfortable with these strategies and therefore they are beyond the scope of this particular article.

Framework for Diversification

Most portfolio construction starts with some form of equity allocation, be it a country, region or global allocation, and then other assets are added to diversify equity risk. In order to properly diversify a portfolio, one first needs a framework for thinking about portfolio risk exposure, the strike zone. For that we utilize a simple 5-factor model, the standard Capital Asset Pricing Model for equity risk, plus four additional factors.

\(r_{t}=\alpha+B_{1}(ExcessEquityReturn) + B_2(\triangle RealBondYields)\:+\)

\(B_3(\triangle InflationExpectations) + B_4(DollarReturn) + B_5(MOMInflation)\)

- \(Equity =r_{S\&P500,t} - r_{3M\:TBill,t}\)

- \(\triangle Real Bond Yields=Yield_{10Yr\:TIPS, t} - Yield_{10Yr\:TIPS,t-1}\)

- \(\triangle Inflation Expectations = BEI_{10Yr,t}-BEI_{10Yr,t-1}\)

- \(Dollar = Return\:of\:DXY Index\)

- \(Month\:Over\:Month\:Inflation¹ = \frac{US\:CPI_t}{US\:CPI_(t-1)}-1\)

These particular factors were chosen as they capture major macro variables that impact asset returns. For example, equity exposure forms the backbone of most investor portfolios as investors desire to take part in the growth of the economy. Changes in bond yields and inflation expectations, when taken together, combine to form changes in nominal interest rates which drive changes in the bond returns of the core 60/40 portfolio. By breaking them apart we can independently understand the impact of each. For investors with some global exposure, which is most investors, portfolio returns are impacted by changes in currency rates. Finally, while in the long term, relative differences in inflation affect currency prices, in the short term there can be a divergence and it’s beneficial to capture the impact of realized inflation separately. This is especially top of mind relative to the last few years where purchasing power was eroded due to higher-than-average inflation and investors expected their portfolios to cover the difference.

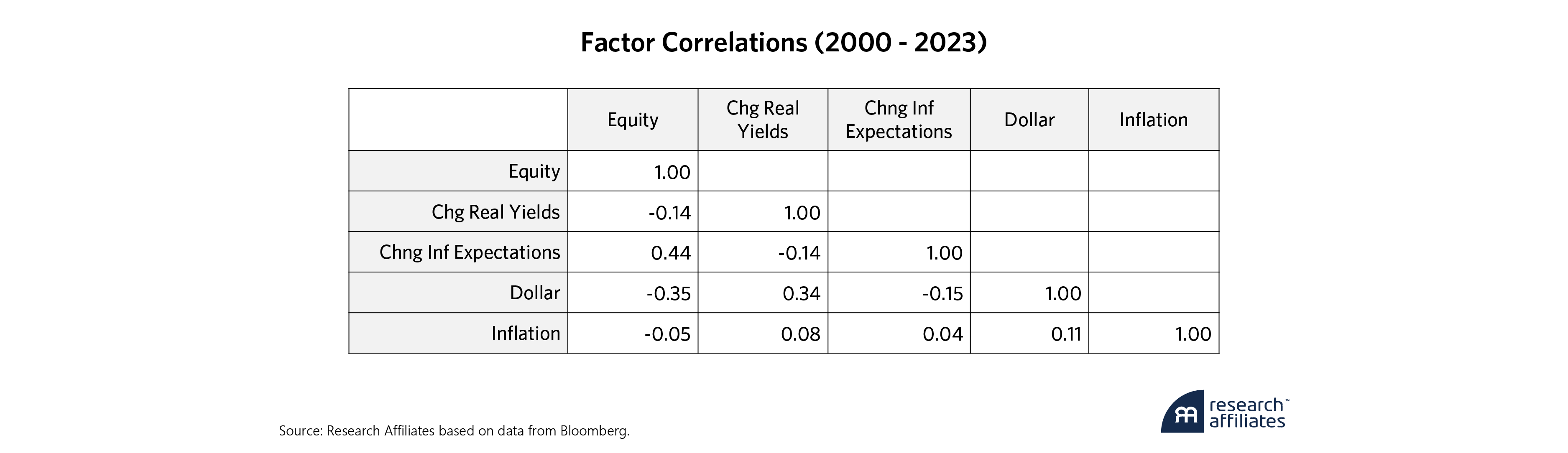

Our definitions for each factor aren’t completely uncorrelated. Although it’s possible to alter the definitions to reduce correlations, this would also reduce interpretability of the results. With an average correlation of 1.8%, we view the interpretation benefits to outweigh the need for a theoretically perfect model.

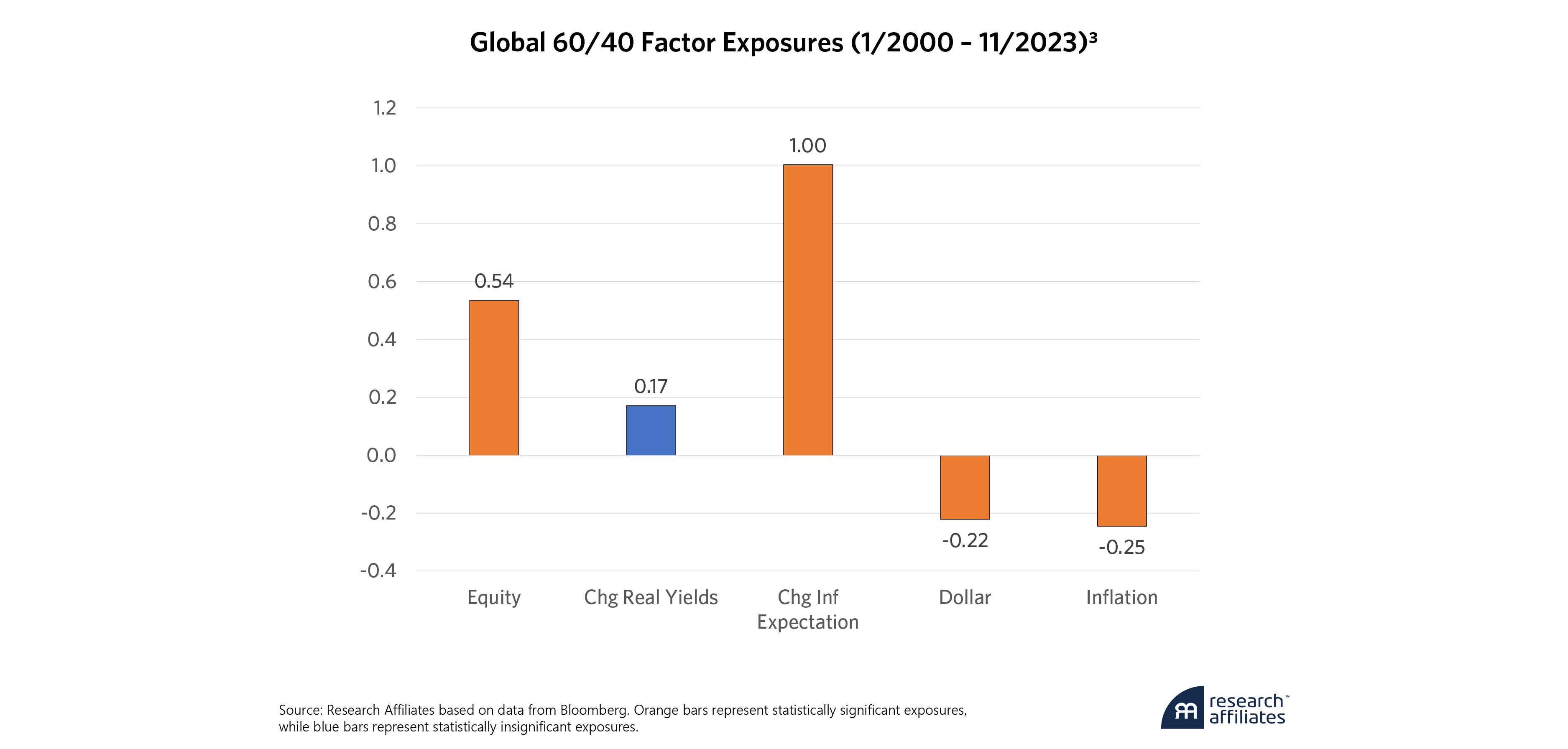

Using these five simple factors explains 95.5% of the contemporaneous variability in returns of the Global 60/40 portfolio. We also see that all of the five factors are statistically significant with the exception of the change in real interest rates. The 60/40 portfolio is described as adding bonds to diversify stock risk, but in fact the stocks are diversifying away the impact of changes in real interest rates. The opposite is not true as equity risk remains strong, meaning the 60/40 portfolio provides little diversification to a stock portfolio. The fact that the exposure to stocks is slightly less than 60% is due to the factor definition using the S&P 500 instead of global stocks2, and the fact that our factors are not perfectly uncorrelated.

A bond allocation much greater than the 40% in a core 60/40 portfolio is needed to diversify equity risk.

”It's also important to note equity exposure contributes 85% of the volatility of the core 60/40 portfolio. Another impact of the limited diversification in this portfolio.

The portfolio has a duration close to 1 to changes in inflation expectations as defined by break-even inflation (BEI), meaning the return of the portfolio increases by 1% for every 1% increase in BEI. However, the portfolio also has negative exposures to both the dollar and realized changes in month-over-month inflation. Said differently, the Global 60/40 portfolio suffers when the dollar strengthens and when monthly CPI changes are positive, losing about 25% of the change in either variable.

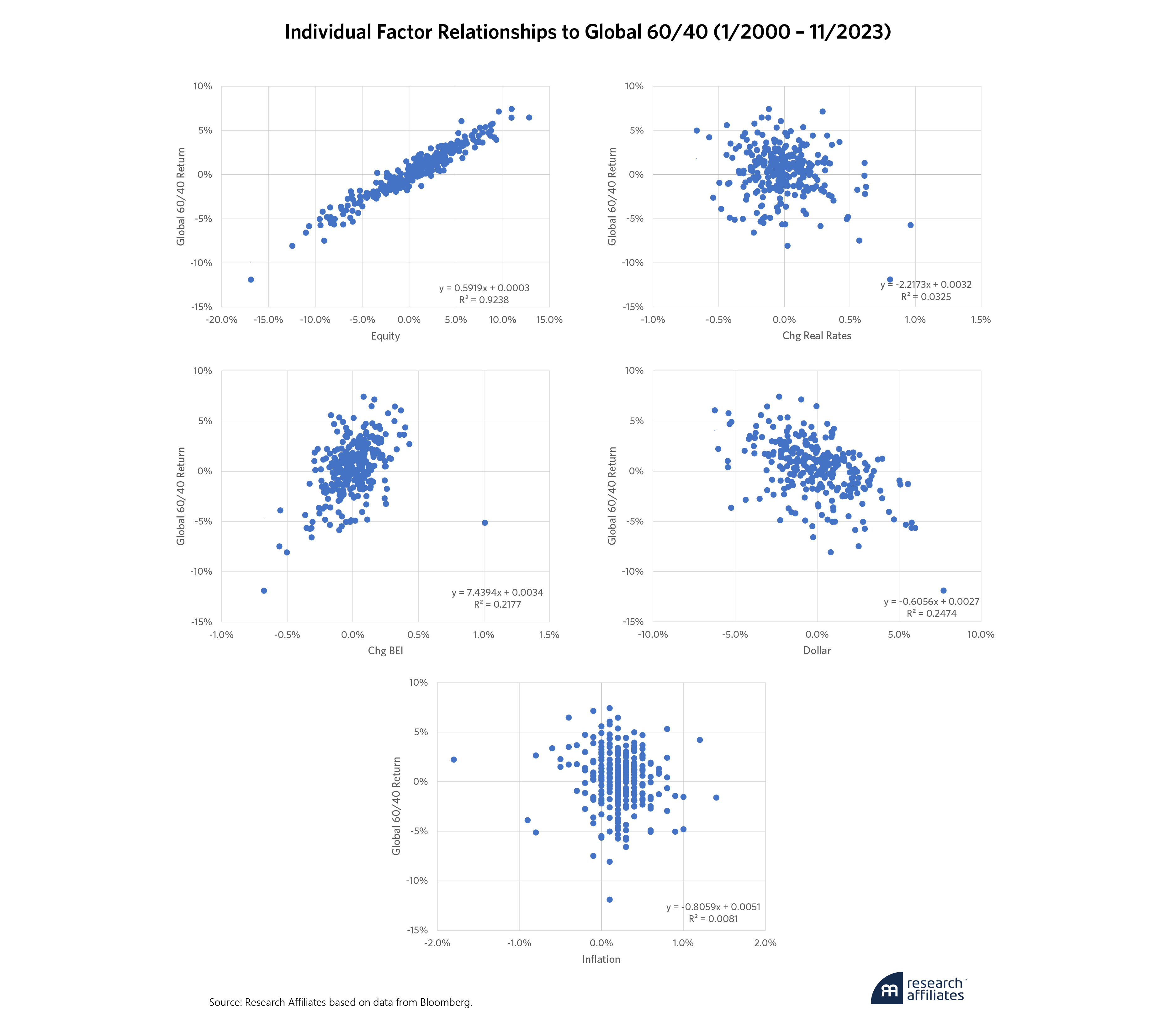

This model is a multi-factor model, meaning that we look at the exposures to all five factors simultaneously. However, just looking at full period results can sometimes be misleading and mask biases from outlier datapoints. To ensure these results aren’t being biased by outliers, it’s also good to graphically view the results. As it’s visually impossible to create a 5-dimensional plot, we instead choose to look at the univariate plots which do not appear to show outliers unexpectedly biasing the relationships.

Exposures From a Broader Set of Asset Classes

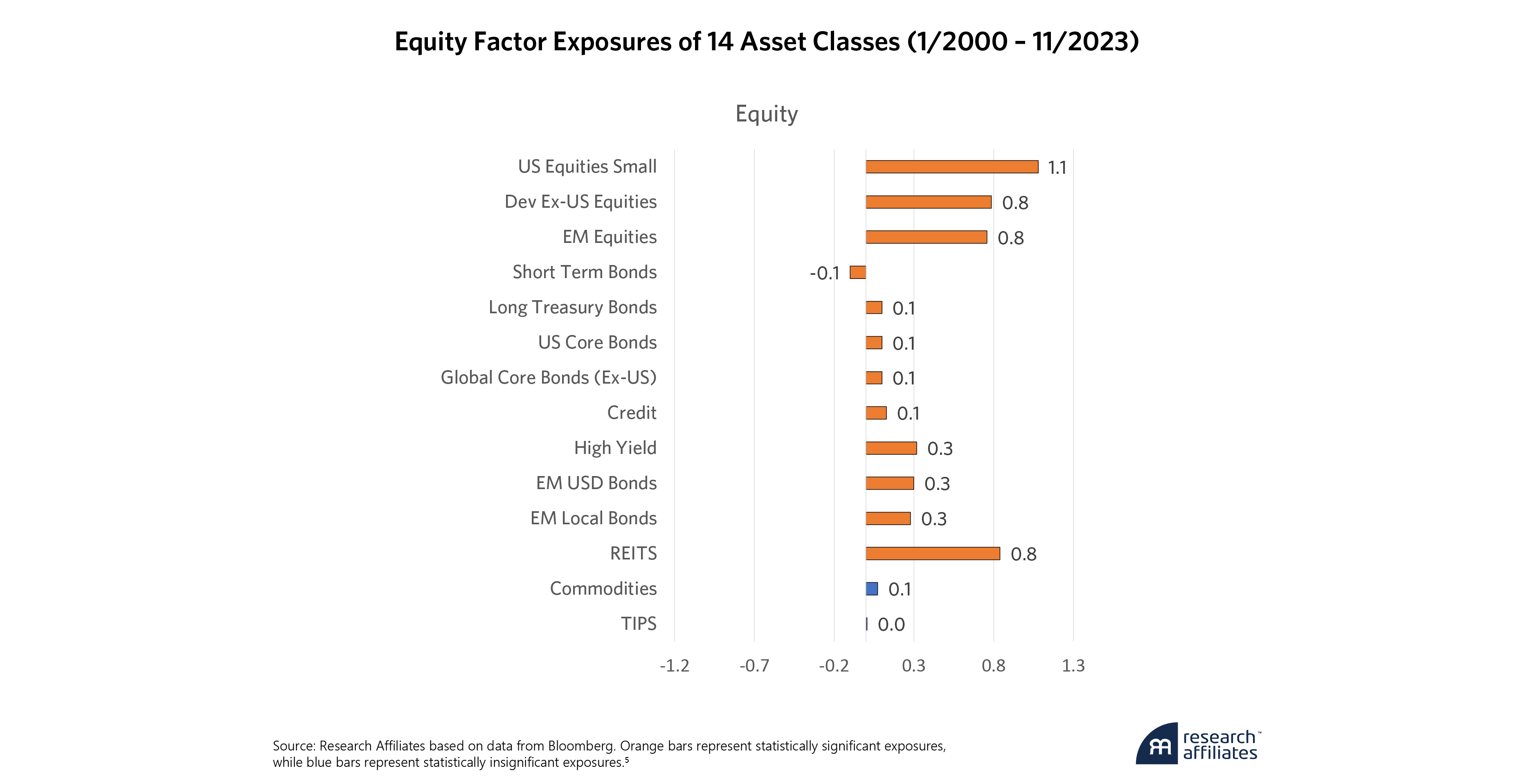

Our goals should be to add allocations to other asset classes to manage the factor exposures of our portfolios, in line with our investment objectives, while also reducing the 85% risk that comes from equity exposure. Instead of magically picking a set of assets to meet these objectives, we instead look at a broad set of 14 asset classes and their exposures to each factor in our multi-factor model. Often, we chose to look at a set of 16 asset classes, but since US equities, as proxied by the S&P 500, and the DXY currency index are explicit factors in our model, we remove those assets from our analysis4.

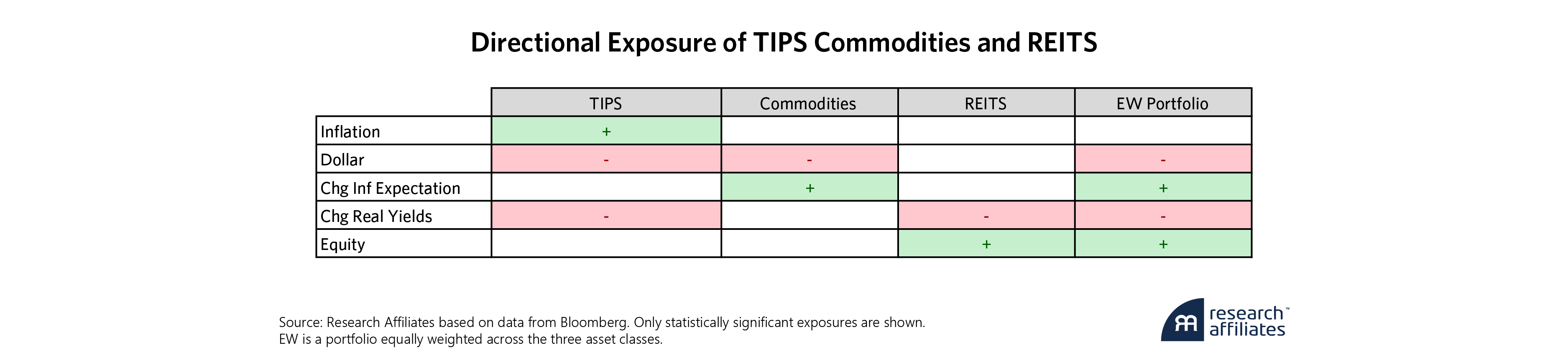

With the exception of short-term bonds, commodities and TIPS, all assets have a statistically significant positive exposure to equity risk. Short-term bonds tend to do well during equity selloffs as they become an asset of choice during risk-off events. However, as we’ve seen, a bond allocation much greater than 40% is needed to diversify equity risk.

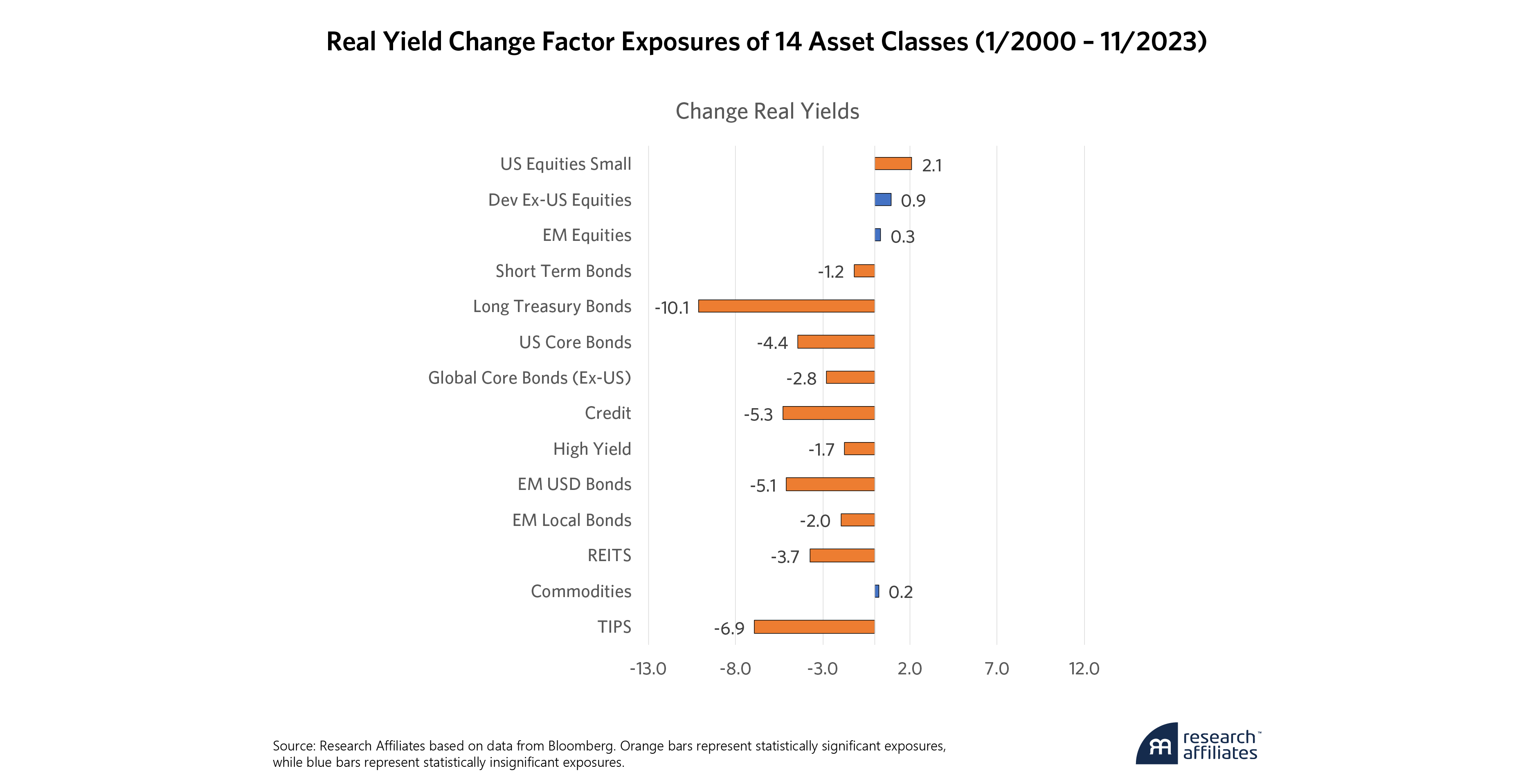

With respect to the change in real yields, these exposures correspond closely to the duration of each asset class, with some limited impact from the other factors. Here again, most of the exposures are statistically significant and negative, as increases in yields correspond to lower prices. REITS also have a negative exposure due to increases in funding costs of leverage from rising rates. The positive exposure of small cap equities is a bit surprising as smaller companies tend to be more negatively sensitive to changes in rates. In this case, although the exposure is significant, its significance is quite low relative to most of the other asset classes and may simply be statistically spurious.

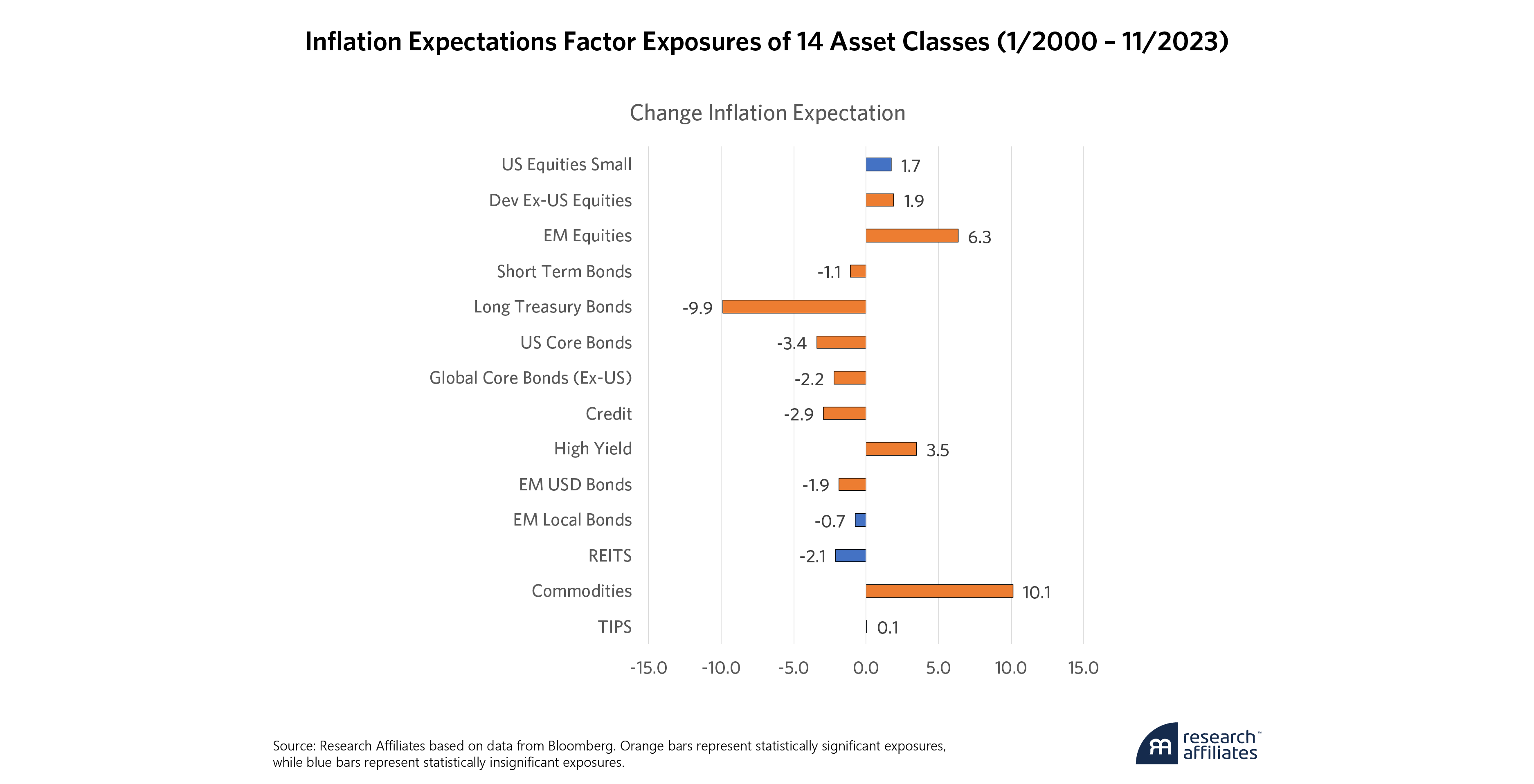

Non-US equities tend to rise when US inflation expectations rise due to expectations of future dollar depreciation, while bonds fall as inflation expectations directly drive changes in nominal bond yields. The negative exposure to global bonds is surprising but is mostly likely explained as an expectation of increases in global rates from inflation exportation. High yield is the one part of the fixed income market that benefits from rising inflation expectations as credit risk dwarfs interest rate risk with these assets. Finally, and not surprising, commodities do very well with rising inflation expectations as the market anticipates those expectations to flow to a cheapening currency via realized inflation.

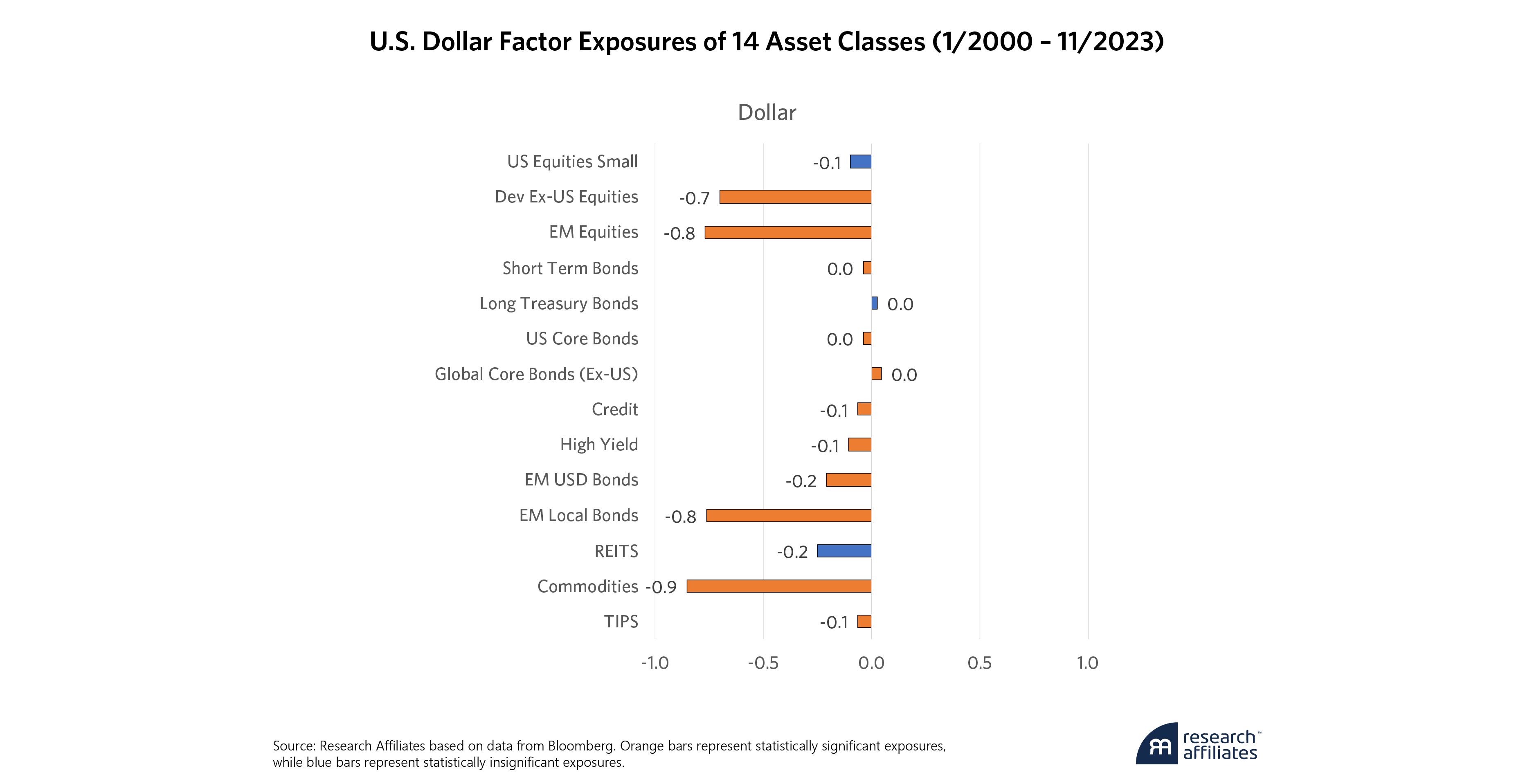

Dollar strength is a headwind to assets across the board. An appreciating dollar has the largest impact on assets denominated in other currencies. This includes commodities which are essentially physical currencies. Hard currency emerging market debt, although mostly denominated in dollars, highlights the risk of repayment. To the extent countries don’t have sufficient dollar reserves to pay the debt, they need to acquire those dollars by selling their own local currency, thus affected by the same headwinds of using cheaper local currency to acquire more expensive dollars.

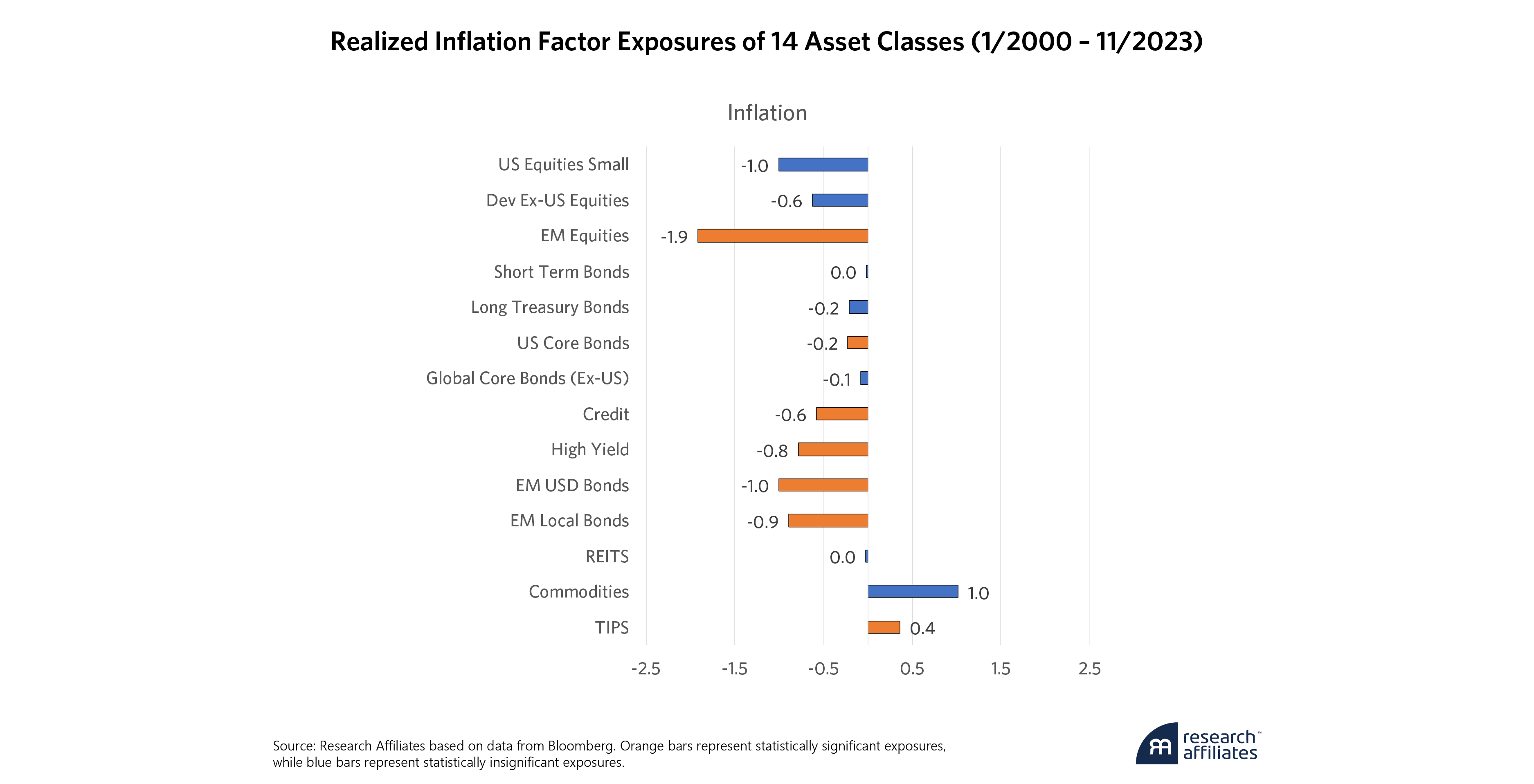

Finally, the results for realized inflation are similar to that of the dollar for most stocks and bonds. This is interesting given that higher inflation is usually tied to a depreciating currency in the long term. However, here we see even EM assets are impacted by changes in US inflation due to a global inflation correlation and inflation’s effect on investor risk aversion. Commodities, which have the largest positive exposure, still have an insignificant exposure with a t-statistic of 1.5. This shows the insidious nature of realized inflation on asset returns and gives partial evidence as to what occurred in 2022.

2022 – What Happened?

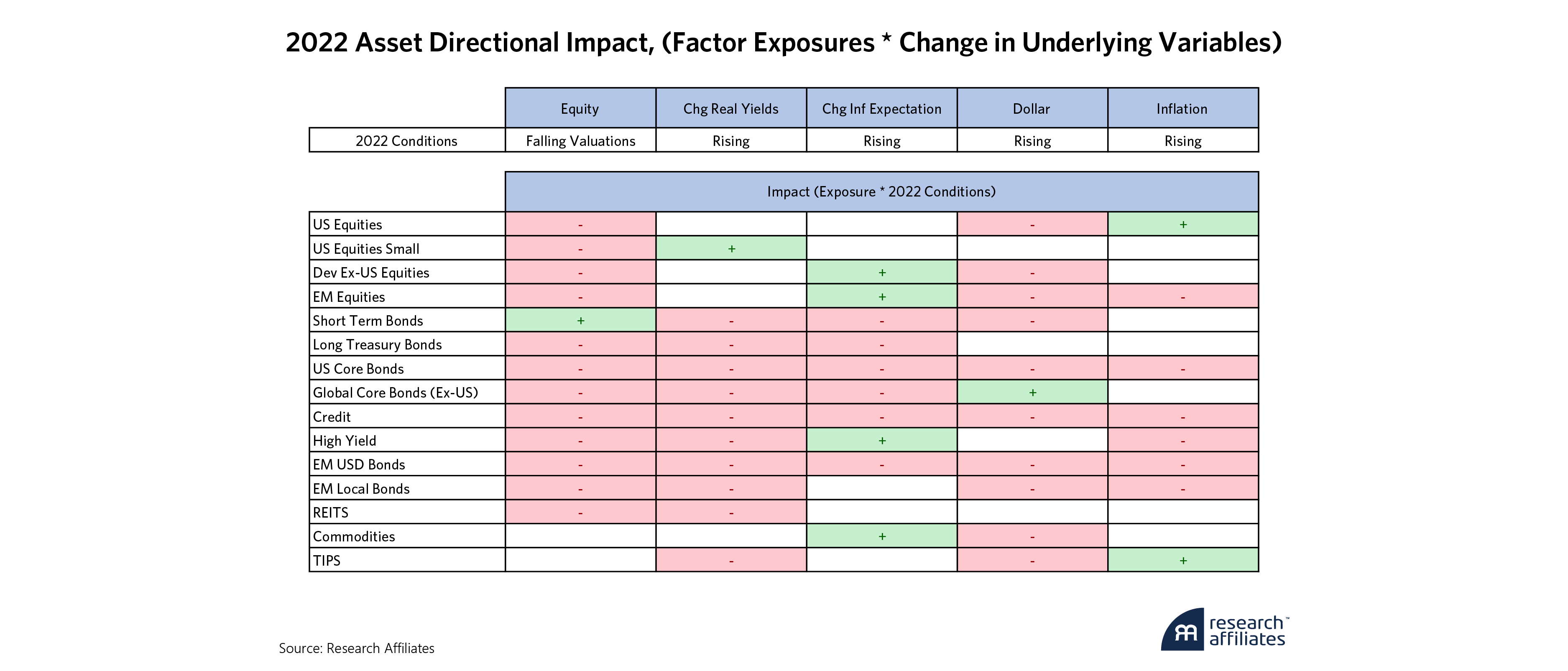

We often hear from clients that 2022 was a validation that asset class diversification doesn’t work. This is an understandable perspective, but in light of our strike zone framework, the starting conditions of that year were a perfect storm that goes above and beyond inflation alone.

The year started with exceptionally high asset valuations, most notably in equities and bonds, as well as inflation that continued to rise on its way to near 9% in the US and similar levels globally. Inflation expectations were also on the rise, but to a much smaller degree, as were interest rates as global central banks looked to slay the inflation dragon. Coupling all of this with a strengthening US dollar pushed for risk reduction. The previous analysis shows the combination of these factors should wreak havoc on asset returns, and it did.

By multiplying our asset exposures to each factor by the conditions occurring in 2022, we see a lot of red, negative impacts, and few green positive tailwinds from this combination of storm clouds. This was a hard slider that started in the strike zone, but did a nasty turn, ending up off the plate.

However, just because asset allocation was limited in its ability to neutralize the conditions in 2022, does not mean that asset diversification is useless. In fact, as we saw in 2023, returns of every single asset class flipped from negative to positive and opposite for commodities. In the next section, we look at how to manage these factor exposures using a simple equal weight portfolio of TIPS, REITS and commodities which are best positioned for realized inflation while also providing a means to manage other exposures.

Allocating TIPS, Commodities and REITS

Based on the collective information from the 14-asset class analysis, let’s narrow down our asset list to a simple 3-asset portfolio. We pick these assets because individually they allow us to gain positive exposure to three factors: realized inflation, changes in inflation expectations and the equity factor. Additional equity risk is not ideal, but we include REITS due to the benefits of real asset holdings. In addition, these assets provide additional duration exposure since the core 60/40 portfolio has little. This portfolio will increase the negative exposure to the dollar, meaning a strengthening dollar is still a headwind.

Creating an equal blend of these assets maintains the individual asset exposures with the exception of realized inflation which becomes insignificant. Again, this reiterates that only a large exposure to TIPS, and at times commodities, will protect against realized inflation, and this assumes other factors remain constant6.

The fear is that this message about realized inflation will persuade some to abandon diversifying asset allocation strategies all together. That would be a mistake as these other exposures are just as important and can be effectively managed simply by blending the equal weight 3-asset portfolio with the core portfolio. The more of the 3-asset portfolio we add, the more we lean into these exposures. The right amount to add depends on views of the coming regime, we detail our thoughts in the next section.

Positioning Today

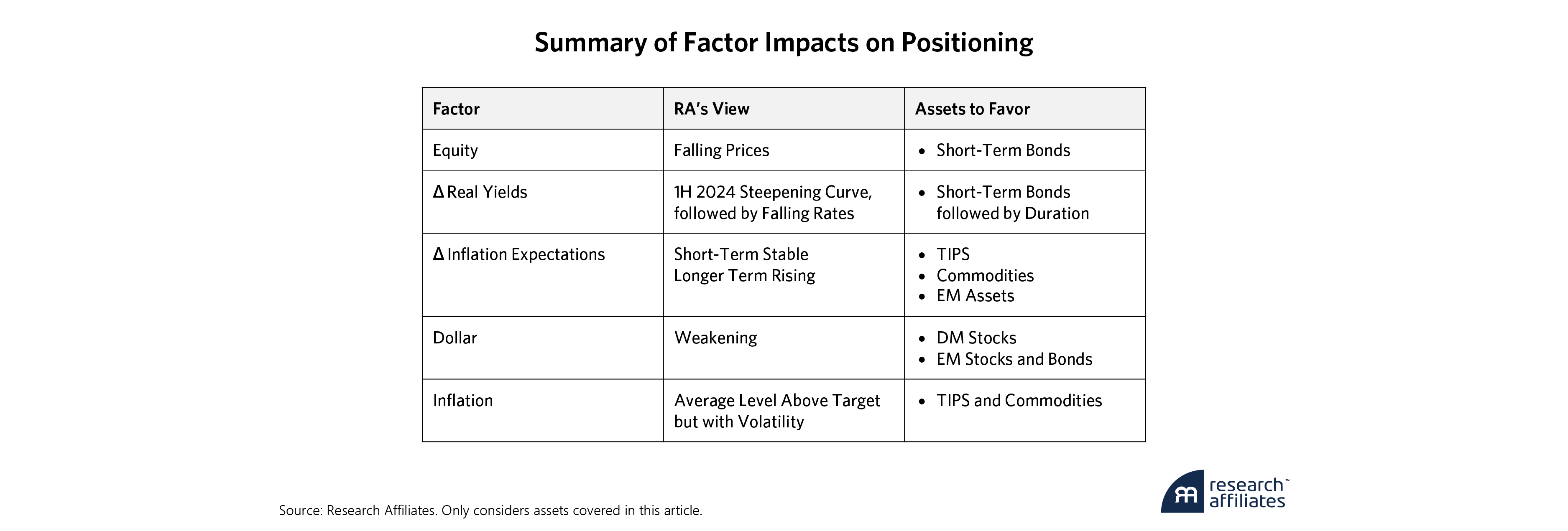

As most know, macroeconomic risks in the five years prior to 2020 were benign. Inflation was consistently low and not volatile, and inflation expectations were below average at 1.8% against a prior decade (2005-2014) average of 2.2%. That all changed in the aftermath of COVID, and we think increasing volatility of macro factors will be a key theme for the next decade. At the outset of 2024, our perspectives on these five factors are such that we urge investors to reconsider if they are overallocated to core assets.

We do not expect equity exposure, especially U.S. equities, to be nearly as profitable in this decade as it was in the last. As I wrote a few months ago7, the extended strength of the economy through 2023 was a bit of a surprise, but the elimination of excess savings for consumers, as well as higher interest rates, pose strong headwinds going forward. In addition, from a valuation perspective, with global stocks at a cyclically adjusted PE ratio near 25 (4% earnings yield), and global 10-year interest rates also near 4%, the equity risk premia is nil.

We think increasing volatility of macro factors will be a key theme for the next decade.

”In our estimation, real yields also look stretched. After spending most of the fourth quarter over 2%, 10-year TIPS yields dropped 30 bps in December as the buy the dip folks moved into these assets. In the very short term, real yields may certainly rise back toward 2.25% or even 2.5%. In our estimation, those levels provide an asymmetric buying opportunity for this factor as provided by the 3-asset TIPS, commodity and REIT portfolio.

Inflation expectations have also come down from their October highs but remain elevated relative to history. For those who are fully into the “inflation has been beaten” camp and expect inflation expectations to fall further, the 3-asset portfolio would not look attractive. However, as we’ve written, elevated inflation, periods when inflation rises above 4%, usually persist much longer than the duration of this particular inflation episode8. It could be that this time is different, or possibly this period mimics the 1940s and the 1970s which experienced multiple waves of inflation. For example, inflation peaked at 19% in 1947 before going negative in 1949 and then rebounding to over 9% in 1953. To the extent the bond market picks up on this, inflation expectations could resume their upward trend.

On a secular basis, we continue to see the dollar as expensive, a thesis I wrote about a year ago, and continue to support9. This is certainly not a “doomsday dollar loses its reserve status” perspective but is based on current conditions and global headwinds that come from a dollar that has been strengthening for over a decade.

Finally, if high inflation does prove to be cyclical, turbulent times and asset headwinds are ahead. However, 2022, with high asset valuations and rising rates, posed unique challenges to assets such as REITS, a sector that has had multiple years of bad news but may just be over the hump of peak fear. In our estimation, exposure to the underlying real assets of land and property should fare better in future bouts of inflation.

For those that believe asset diversification has two strikes against it, we ask you to remember that two strikes are not out. Although it is certainly frustrating to see diversification’s lack of efficacy recently, frustration is dangerous in that it can cause us to lose faith in things we know that work. Tony Gwynn didn’t change his whole approach at the plate when down 0-2. He was effective because he knew the strike zone intimately and remained disciplined. Similarly, a decade dominated by strong returns from a small subset of US growth stocks doesn’t warrant a revamped approach. It didn’t make sense to abandon valuations and conditional return expectations in 2000 at the peak of the tech bubble or in 2009 at the bottom of the global financial crisis and it doesn’t make sense to do so now. Patient investors who understand their strike zone and position for fat pitches will ultimately be rewarded.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

- Even though this is meant as an explanatory model, and not a predictive model, we delay the inflation data by one month to account for the release date that is after the end of a month.

- We could also decompose the equity factor into specific regions or countries. Although that would give an additional level of detail to the results, it wouldn’t change the overall findings in this article.

- We use the Global 60/40 portfolio as the baseline going forward, making an assumption that most investors are already comfortable with some amount of global diversification. For completeness, the only significant factor exposures for the US 60/40 portfolio are equity and dollar, although the beta to the dollar factor is 1%, meaning a 1% move in the dollar corresponds to a 1bp change in the portfolio.

- Some will argue for an explicit allocation to gold. This is reasonable, but we prefer a commodity basket approach.

- Representative indices for these asset classes include S&P 500 for US Equities, Russell 2000 for US Equities Small, MSCI EAFE for Dev Ex-US Equities, MSCI EM for EM Equities, Bloomberg 1-3 Year Treasury for Short Term Bonds, Bloomberg Treasury Long for Long Treasury Bonds, Bloomberg US Aggregate for US Core Bonds, Bloomberg Global Agg Ex-USD for Global Core Bonds, Bloomberg US Credit for Credit, Bloomberg US Corporate High Yield for High Yield, JP Morgan EMBI+ for EM USD Bonds, JP Morgan GBI-EM Global Diversified for EM Local Bonds, FTSE NAREIT All Equity for REITS, Bloomberg Commodity for Commodities and Bloomberg US TIPS for TIPS.

- We saw this in 2022 when TIPS, Bloomberg US Treasury TIPS index was down close to 12% in the face of rising interest rates.

- In From Abundance to Austerity, we argue that the reserves built up during a decade of accommodative policy are rapidly unwinding as economies normalize through a period a higher interest rates and inflation, amplifying the risks of US budget deficits on GDP growth and limiting the Federal Reserve’s ability to stave off recession.

- Inflation: Don’t Pop the Champagne (Yet)

- As we explain in The Buck Stops Here, the dollar’s direction is an important consideration in portfolio positioning because of the asymmetric relationship between global asset returns and the price of the US dollar.