We believe Generative AI (GenAI) has transformative potential. If we are right, GenAI is in the early stages of becoming an investment bubble.

Using the internet bubble of the 1990s as a guide, we draw lessons for today’s investors:

- The most successful companies to emerge from tech transformations are often not the existing stars at the beginning.

- Although a bubble will end in a bust, the mania generates capital investment that yields long-term benefits.

- A fundamental approach with disciplined rebalancing can capture GenAI mania’s gains and mitigate risks in the bust.

Chat GPT. Co-Pilot. Gemini. DALL-E.

These are only some of the exciting new applications on everyone’s lips at business gatherings these days, where the conversation often veers to artificial intelligence, which has become the latest “new new thing.” Of course, the technology wouldn’t be at this point without decades and billions of dollars in research and development already having been spent by both academia and industry. Many types of applied AI have been used ubiquitously for so many years with enough success that we don’t even think of it as AI (though my auto-correct still can’t recognize my children’s names). Still, the most recent iteration in this field—generative AI (GenAI)—appears to be an inflection point.

Create your free account or log in to keep reading.

Register or Log in

“Generative AI may be the largest technology transformation since the cloud (which itself, is still in the early stages), and perhaps since the internet,” Andy Jassy, CEO of Amazon, wrote in the company’s 2023 annual shareholder letter. “The amount of societal and business benefit from the solutions that will be possible will astound us all.”1 What is already astounding investors is the performance of Nvidia stock, up 500% over the past 15 months through the end of March 2024. Currently trading at an impressive 75x trailing earnings, Nvidia has experienced EPS growth of 400% over the past year, and the analyst consensus expects EPS growth of 100% over the next year. Can such extreme growth rates continue?

The Early Days

We believe GenAI is still in its infancy as both a technology and an investment theme. As value investors, we are hardly a font of prognostications on technology revolutions. As students of market history, however, we can draw some parallels (and differences) with the internet boom of the mid-and late 1990s.

As with GenAI today, businesses and individuals in the early days of the internet boom believed that the nascent technology would prove to be transformative, but uncertainty remained around the specifics of that opportunity set. Even though the new technology had created excitement, its use was just beginning to spread. The release of ChatGPT in 2022 has been likened to the release of the Mosaic browser in 1993, which popularized access to the World Wide Web, releasing a torrent of investment and interest in the emerging technology. If GenAI were to follow the evolution of the internet, enthusiasm and capital deployment would only be beginning.

The Backbone

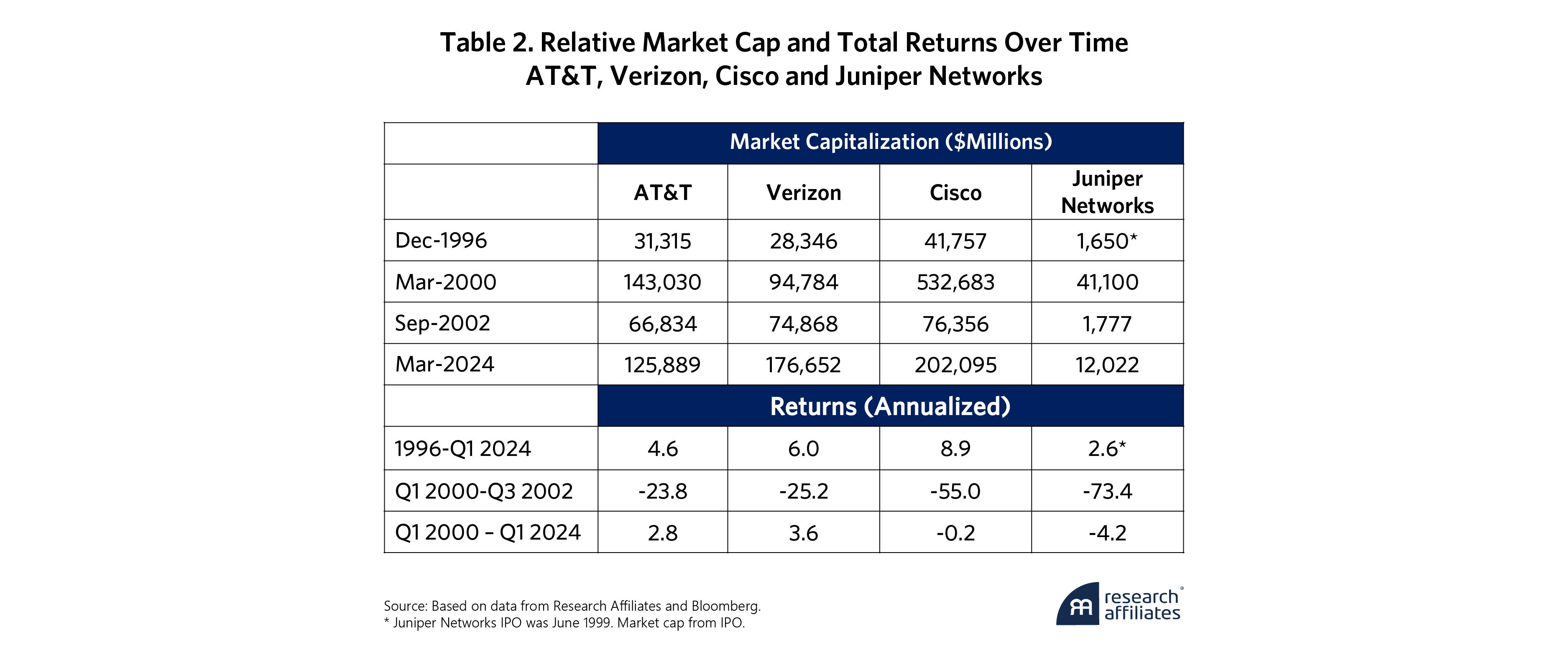

One of the core investment areas needed to broaden internet adoption was connectivity. These investments encompassed communication companies, such as telecom and cable companies, and included the hardware used in connectivity, such as routers, switches, and servers. Advancements in wireless communications added to the enthusiasm, complexity, and capital intensity. In the five years following the Telecommunications Act of 1996, there was increased competition in the sector. Telecom and cable companies invested over $500 billion in laying new lines, installing new switches and routers, and creating wireless networks.2 Some of these companies, such as Verizon and AT&T, still exist today, while others, such as WorldCom and Global Crossing (along with most of the competitive local exchange carriers, or CLECs), became defunct. Hardware suppliers (e.g., routers, switches, servers) and network expansion companies, including Cisco, Juniper Networks, and Sun Microsystems, also participated in the boom.

Today’s most-talked-about GenAI stocks tend to be backbone-like investments, such as chip companies Nvidia and Micron, hardware company Super Micro Computer, and cloud services companies like Amazon and Microsoft Azure. Businesses are just beginning to build out the infrastructure to deploy GenAI, and the investment cycle is likely to last years.

The Gateways

In the mid-1990s, households and businesses needed to purchase computers and modems to access the Internet. The percentage of US households owning a computer rose from 23% in 1993 to 51% in 2000.3 PC makers such as Hewlett Packard, Dell, Compaq, and Gateway were big beneficiaries of the trend as their sales soared. Behind the growth of PC adoption was the “Wintel alliance,” in which computers ran the Windows operating system on Intel chips. Windows’ graphical point-and-click operating system made computers easier to use (compared with the previous DOS-based operating system, which had a command-line interface), and Intel’s chip design enabled efficient processing of the graphical interface, bringing PCs into the mainstream domain. The intuitive interface was such a revolution in personal computing at the time that industry commentators began to predict that PCs would become ubiquitous. (Meanwhile, as wireless connectivity increased, certain mobile phone manufacturers ascended, among them Nokia, Ericsson, Motorola, and Blackberry.)

Today’s GenAI gateways include OpenAI’s ChatGPT, Microsoft’s CoPilot, and Google’s Gemini/Bard. Though these services are useful, they have not yet reached the ease-of-use levels that Windows provided, which enabled ubiquitous adoption. Recent progress in accessibility for a wider set of users has been rapid, and the changes we will experience in the next few years should prove exciting.

The Destinations

Among the investment themes of the internet boom, none captured the imagination more than the destination companies. The proliferation of these businesses gave rise to the term “dot-com era.” They raised capital with abandon but had mixed (at best) business plans. The dot-coms gave users a map of the internet (e.g., search engines or list servs) and a reason to be online (e.g., email, retail, news, etc.). Some notable companies from that time are still around today, including Amazon and eBay. Others have been acquired, such as AOL and Yahoo, while many more have perished, including Pets.com, UrbanFetch, and WebVan. When we speak of the excesses of the tech bubble today, the numerous failed companies are usually the ones that first come to mind.

The Bust

The end of the tech boom created winners and losers in every category. Within the backbone category, overinvestment relative to demand growth created an oversupply of bandwidth and forced prices so low that many carriers could not service their debt. The CLECS, being smaller and undercapitalized, were the worst hit, and most of them folded. Even some larger companies, namely WorldCom and Global Crossing, also filed for bankruptcy. Companies providing the telecoms with routers, switches, and servers saw their revenues decline precipitously. Well-capitalized and market-dominant stalwarts, such as AT&T, Verizon (formerly known as Bell Atlantic–GTE), and Cisco survived the bust but saw their stock prices drop by as much as 80%.

Companies in the gateway segment also suffered from overinvestment but to a lesser extent than telecoms. While the late 1990s were littered with companies producing PCs, most of these companies either went bankrupt or were merged away. For example, Compaq merged with HP and Gateway was acquired by Acer.

The most memorable losers in the tech bust were the dot-com destination companies that had no realistic plan to reach profitability, burned through cash quickly, and had little capital cushion or recourse. Most of these companies, such as WebVan and Pets.com (with IPOs in November 1999 and February 2000, respectively) emerged late in the tech boom. Investors, including the venture capitalists who bought these equities so late in the cycle, were also significant losers. At the beginning of 2000, there were between 7,000 and 10,000 substantially funded internet companies. Three years later, 5,000 of those companies had either been acquired or had closed their doors. The capital destruction amounted to trillions of dollars.

The Winners

If the GenAI boom is still in its early phase, however, comparing it to the late-cycle dynamics of the dot-com era holds little relevance. A better comparison would begin in 1996 or even before.

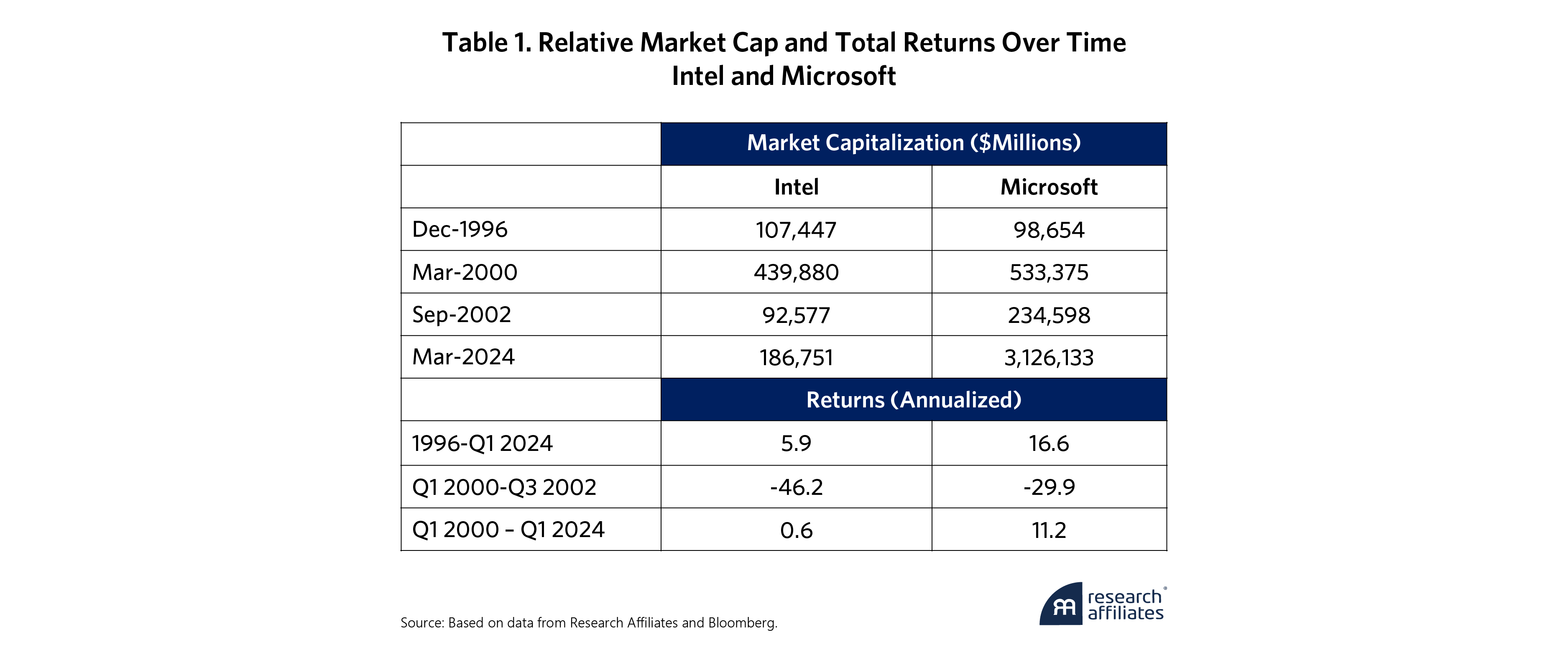

Within each category, some companies have gone on after the bust to greater heights, though not uniformly. The starkest difference is in the fortunes of Microsoft and Intel, which developed the much-vaunted Wintel partnership. The table below shows their relative market cap and total returns over time. While Microsoft has retained and even expanded its market leadership, Intel has struggled to maintain its prominence. Both companies survived the tech bust, but Microsoft today is a big, thriving winner (though not without some missteps along the way, such as Zune, Vista, and Bing), whereas Intel’s fortunes have meandered.

Another example of this contrast is in the backbone segment. Although the early aughts were a wasteland for stock price performance, the surviving companies have delivered positive performance to investors over the longer term. In the case of Cisco, an investor who bought the stock at the end of 1996 (still in the early days of internet adoption) would have realized a very reasonable 9% compounded returns through March 2024. AT&T and Verizon would have delivered 4.8% and 5.5% annualized returns, respectively. Even Juniper Networks, which had its IPO in mid-1999 at the height of the bubble, would still have delivered positive returns over the next 25 years.

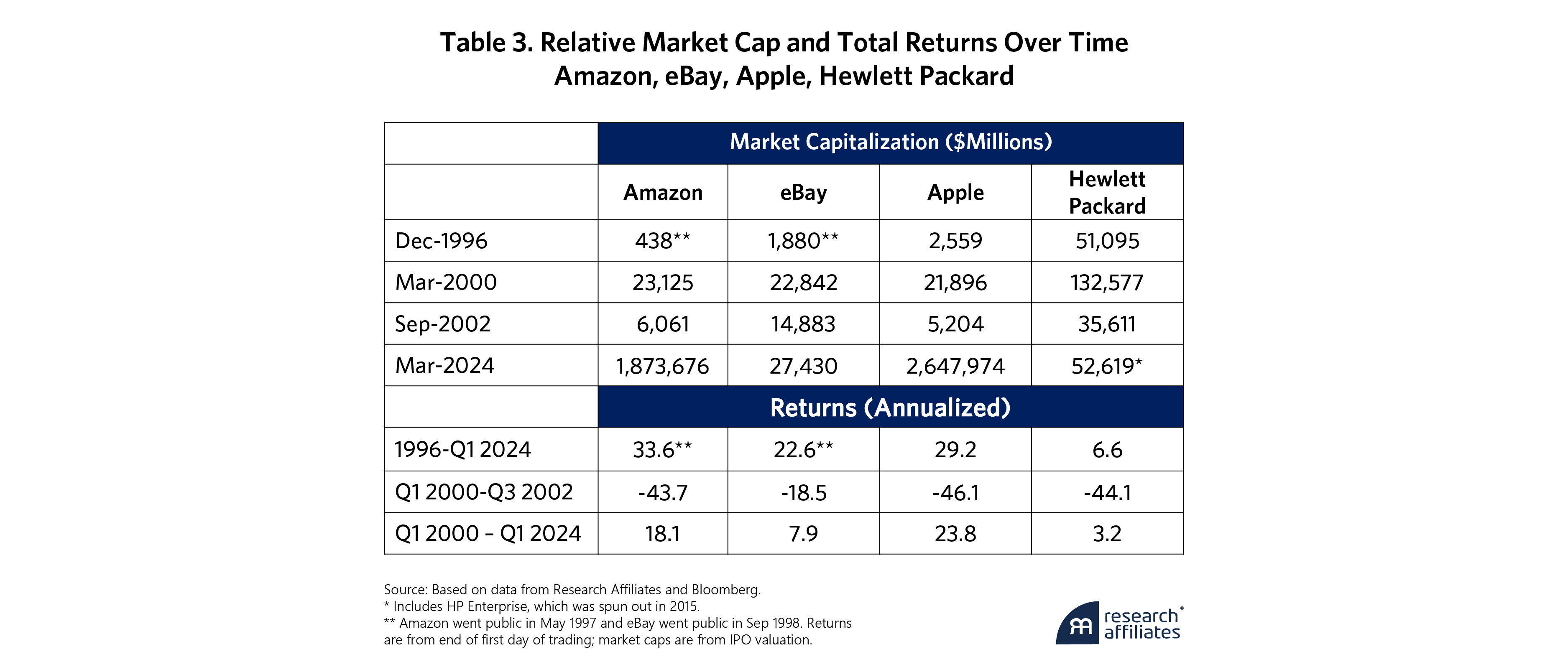

Within the destinations category, winners include Amazon and eBay. Comparing these companies, Amazon's dominance relative to eBay is clear. While eBay has largely stuck to its roots as a marketplace for buyers and sellers of goods, Amazon has morphed from a seller of books to a third-party marketplace, a payments processor, a cloud services provider (AWS), and a video streaming service, to name a few of the businesses. Amazon’s valuation has been less dependent on its retail operations than its cloud business for a number of years.

Switching from a focus on the companies that dominated at the height of the tech boom, the story gets more interesting when we consider three of the most dominant companies of the tech ecosystem today. Alphabet did not go public until after the internet boom (2004), and Meta wasn’t founded until 2004, going public in 2012. Apple existed during the bubble but was a dark horse.

Indeed, Apple has the most impressive and unlikely story. Not only was the company considered an also ran to the main internet darlings during the bubble, but it nearly went bankrupt in the 1990s. At the bubble peak in 2000, Apple, Amazon, and eBay all had similar market caps. Today, Apple’s market cap is 40% larger than Amazon’s and 96x larger than eBay’s.

In various ways, the ultimate success of today’s giants depended heavily on the results of the internet boom. While the tech bust destroyed capital, the investments made during the boom in communications, chips, software, and hardware allowed companies to build newer and more innovative applications and businesses. Apple’s iPhone, for example, would not have been possible without the investment in mobile communications infrastructure. These investments and new products have also accrued to the benefit of society. The lower price of broadband makes high-speed internet and mobile communications affordable to a wider audience, enhancing productivity and convenience for all of us.

Lessons Learned

- Capital discipline is paramount—fundamentals ultimately matter

The worst failures of the internet boom were the companies that could not finance their own growth and had no tangible plans to earn a return on capital. Not all financially strong companies had an easy time in the bust, but these companies at least survived and delivered some value to their shareholders over time. Capital discipline is necessary not just for corporations but also for investors. Those who invested in profitable, well-capitalized tech companies in 1996 fared well over the long term. Those who piled into speculative companies at the height of the mania while eschewing “old economy” stocks often experienced significant losses. - Picking winners (and losers) is hard—better to own a diversified portfolio.

With hindsight, picking winners looks easy. But even once seemingly invincible companies, such as Intel, can falter, and some of the biggest winners of the internet revolution only emerged later. Likewise, picking losers is difficult, as technology and its use evolve in unexpected ways. For example, while some prognosticators predicted the end of using office paper, the spread of personal computing and printing peripherals actually increased paper use for many years. The evolution of GenAI will also be unpredictable, and it is likely that some of the greatest GenAI companies have yet to emerge. - Technological progress benefits us ALL—stay invested and diversify

The internet excesses that culminated in the bust were extremely painful and capital destructive. Despite the massive misallocation of much capital, some of that capital built useful networks, software, and databases, creating a framework to launch great businesses and increase productivity. While dot-com companies were once seen as niche businesses, every company now has a website. Households enjoy the convenience of online shopping from a myriad of businesses. Zoom would not have been possible without prior broadband investment.

Those who invested in profitable, well-capitalized tech companies in 1996 fared well over the long term. Those who piled into speculative companies at the height of the mania while eschewing “old economy” stocks often experienced significant losses.

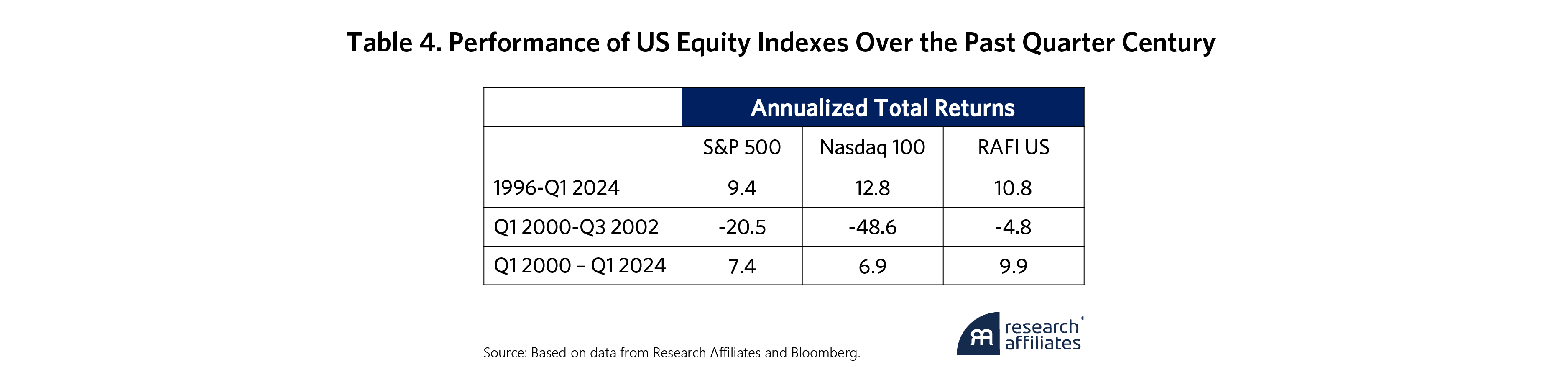

”Reflecting these broad qualitative benefits, investors who had investment discipline also gained. The table below shows the performance of three broad US equity indexes over the past quarter century. The S&P 500 is broadly diversified across 11 sectors, holding some of the largest US companies weighted by their market capitalization. As the price mania in internet companies unfolded, the S&P became more exposed to tech stocks in early 2000. The Nasdaq 100 is more tech-heavy than the S&P 500, and its increase in exposure to internet themes was even greater than that of the S&P 500 at the tech-boom peak. RAFI™ US Fundamental Index owns almost all the companies in the S&P 500 and Nasdaq 100 but weights these stocks by their fundamentals rather than mania-induced prices. An investor who allocated capital early in the internet boom at the end of 1996 would have achieved double-digit returns with the RAFI strategy and Nasdaq 100 over the next 27 years. Had the same investor allocated at the peak of the bubble in March 2000, returns would have been lower but would still be good, particularly for RAFI US investors, because that index did not get as over-allocated to tech in 2000. The only investor to suffer significant capital loss was the one who piled in at the peak and sold out over the next 18 months. Even then, a RAFI US investor would have suffered a much smaller drawdown. In the long run, the productivity benefits of the internet boom have benefited businesses and investors beyond the tech sector.

A Note of Caution

As optimistic as we are about the potential of GenAI, we would not be acting responsibly if we failed to point out some challenges the new technology could face. The main challenges are carbon intensity, regulation, and de-globalization.

- Large language models (LLMs) that read and process thousands of documents in seconds consume large amounts of energy. As use of these models spreads, the competition for energy resources could drive prices to a level that would make certain GenAI activities uneconomic. Additionally, as governments and companies increasingly commit to environmental goals, would society continue to allocate energy resources towards GenAI? Could GenAI continue to grow without cheap computing power, which increasingly means cheap energy?

- New technologies always spawn some level of fear and distrust. While the internet emerged during a time of de-regulation, the tech bust and the Great Financial Crisis curtailed that ethos. Today, our society is more amenable to reigning in large tech and new tech. Already, copyright challenges are putting limits on the amount or types of information that GenAI models can use. Regulation could emerge in other areas as well, including privacy, safety, and discrimination. Can the cost of adaptation be overcome?

- The internet emerged during a long period of globalization. The Berlin Wall had fallen, the number of former communist nations was increasing, and movement of goods as well as human capital flowed more freely. This global integration provided resources in capital and human capital to make rapid progress in technology and business ideas. With today’s world possibly on a path of de-globalization, there could be a sustained trend of rising barriers to the movement of people, capital, and ideas. Will the necessary resources be available to make the rapid advancements that a GenAI boom would require?

While we do not believe these challenges to be insurmountable, investors should bear these risks in mind as GenAI evolves.

Concluding Remarks

To be sure, not every mania creates something useful and enduring. Tulips and perhaps cryptocurrencies can be said to be among such less-than-useful manias. However, if GenAI is as revolutionary as we believe it to be, a mania is likely to develop. In the event of a GenAI bubble, capital will be misallocated and fortunes lost. On balance, though, the gains will be greater than the losses. Society and investors will ultimately benefit, and these benefits will be felt very broadly beyond the immediate GenAI companies.

In the event of a GenAI bubble, capital will be misallocated and fortunes lost. On balance, though, the gains will be greater than the losses.

”If investors believe that GenAI will be as impactful as the internet, they will need to participate by getting invested, and the best approach will be to stay diversified and be prepared to hold through ups and downs. Those who have a high threshold for risk may opt for a highly concentrated approach in current behemoths, such as the Nasdaq 100. Those who believe the benefits of AI will be shared broadly and that winners may change over time should opt for a fundamentally based approach with disciplined rebalancing, such as the RAFI Fundamental Index strategy.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.