The Efficient Market Hypothesis vs. Roaring Kitty (JPM Series)

Conventional finance views risk, risk aversion, and risk premia as investors’ key motivations, while behavioral finance perceives fear, greed, herding, and other all-too-human emotions as the principal movers of the capital markets.

Modern finance may have been better served if, in its early days, an inefficient market hypothesis had been proposed. Such a premise would have been easier to validate and harder to disprove than its more “rational” counterpart, the efficient market hypothesis.

When it comes to the equity risk premium, we need to define three concepts: the risky asset (global stocks, U.S. stocks, etc.), the risk-free asset (cash, Treasuries, TIPS), and the expected return difference between the two.

This is part of a series of articles adapted from my contribution to the 50th Anniversary Special Edition of The Journal of Portfolio Management.

Introduction

Much of modern finance falls into one of two camps, neoclassical finance and behavioral finance. The former posits efficient markets, the latter posits the opposite. The former identifies risk, risk aversion, and risk premia as the fundamental drivers of investor behavior. The latter identifies fear, greed, herding, and various other all-too-human emotions as key drivers of the capital markets, though such inefficiencies may vary across markets and across time and will, therefore, confound most investors most of the time.1

Create your free account or log in to keep reading.

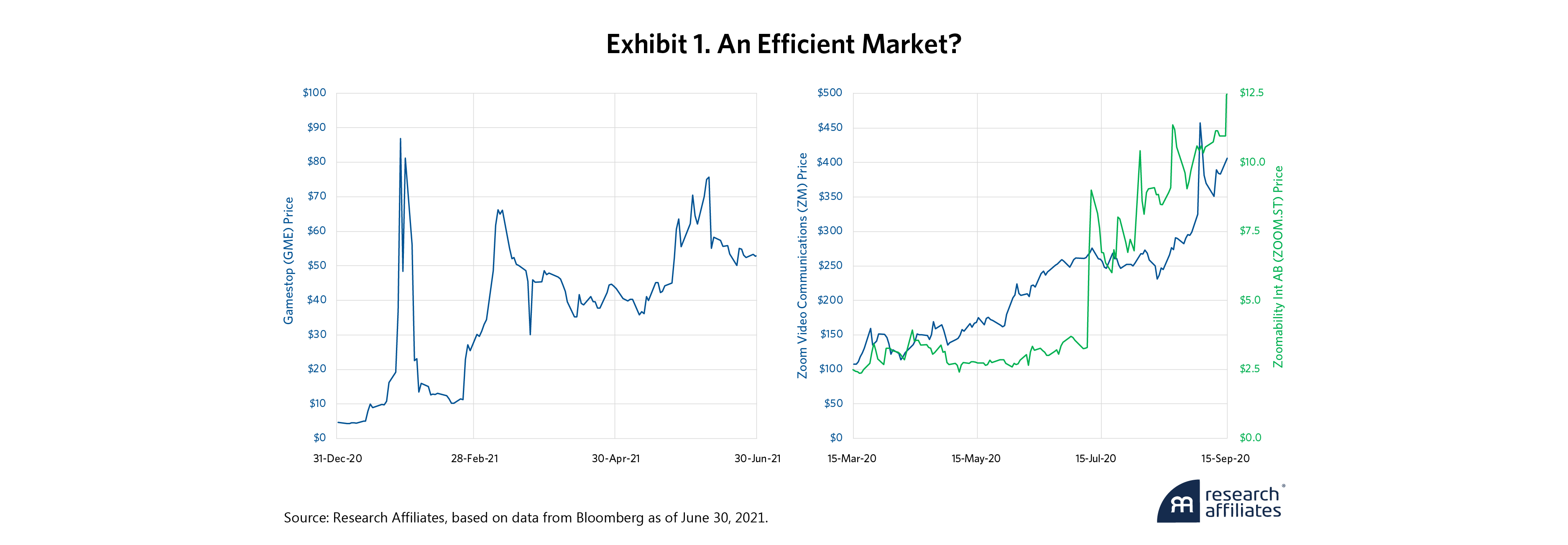

While academic finance embraced the efficient markets hypothesis (EMH) for decades, with many adherents accepting it as an incontrovertible fact, the practitioner community was more skeptical. Exhibit 1 demonstrates why. The first graph shows what happened when a social media stock picker called “Roaring Kitty” advocated for a short squeeze on GameStop (GME) in January 2021. The stock rose 17-fold in two weeks on no fundamental news about the company’s underlying business. The second graph depicts how the stock of the video conference company Zoom Video Communications (ZM) soared during the pandemic in 2020, along with that of Zoomability (ZOOM), a Swedish manufacturer of recreational vehicles. Both stocks quadrupled in six months, the former because of its timely technological innovations, the latter because of its ticker.

David Hirschleifer conducts a simple thought experiment in a wonderful 2001 article. He imagines an alternative reality in which the foundations of modern finance are a “Deficient Markets Hypothesis” (DMH) and a “Deranged Anticipation and Perception Model” (DAPM), instead of the EMH and Capital Assets Pricing Model (CAPM).2 He suggests that had an inefficient market hypothesis been embraced at the dawn of modern finance, it would have been more easily validated and less readily falsifiable than the EMH.

The Equity Risk Premium

Words have consequences. A risk premium presumes a logical homo economicus who makes investment choices based on sound reasoning and objective reality. At a minimum, a risk premium presumes a collectively rational market, with individuals’ emotions canceling in some psychological variant of the central limit theorem. The “madness of crowds” cannot exist. But suppose in the early days of the EMH, academia had thought like Hirschleifer and acknowledged the human component of capital markets and sought to understand the nature and magnitude of a “fear premium” instead of an ostensibly quantifiable “risk premium.”

A fear premium accounts for human emotion and renders many of the “anomalies” and “factors” that have consumed academic finance in recent decades unsurprising, perhaps even expected. In an efficient market, can a frothy growth stock be priced at a negative risk premium? Under most conditions, of course not.3 Its risk—and its contribution to portfolio risk—is objectively higher than that of the risk-free asset. The market must therefore expect sufficient future growth to justify the premium valuation multiples, no matter how large they may be.

A fear premium accounts for human emotion and renders many of the ‘anomalies’ and ‘factors’ that have consumed academic finance in recent decades unsurprising, perhaps even expected.

”Conversely, with a fear premium, might our frothy growth stock be priced at a negative fear premium? Of course! Whenever the fear of missing out (FOMO) leads investors to view low-risk assets with dread. Charlie Munger often observed, “The world is not driven by greed. It’s driven by envy.” It is difficult to imagine how any investor could view an investment in today’s “Magnificent Seven” as less risky than an investment in cash. But the “Mag-7” could easily sport a negative “fear premium,” priced to offer a lower future return than cash, if investors collectively fear the opportunity cost of idle cash reserves more than they fear the volatility of their beloved growth stocks.4

Several myths relating to the equity risk premium (ERP) have persisted for quite a while, so it is important to separate myth from fact to better understand the natural limits of the risk premium. Let’s begin with the unarguable: Stockholders are further down in the capital structure of a business. Bonds have first call on company resources, stocks are secondary. Therefore, for the capital markets to “work,” stocks should be priced at levels that can produce higher expected future returns than bonds. This relationship should hold particularly when comparing stocks to (ostensibly) risk-free government bonds. Unsurprisingly, stockholders have enjoyed outsized returns from their investments. When investors collectively expect a greater return for stocks relative to bonds or cash, we call this expectation the “equity risk premium.”

At its essence, the equity risk premium is the incremental return that we should earn relative to a risk-free asset, as a reward for our willingness to bear risk. But there is no risk-free asset. Cash may have zero volatility, but its purchasing power diminishes over time. Unless we’re planning to spend the money tomorrow, cash is not risk-free. Bonds may have a recurring coupon that creates an illusion of eliminating risk from our ability to fund our long-term spending needs. But most of us have spending needs that vary over time, notably rising with inflation. Long Treasury Inflation-Protected Securities (TIPS), inflation-linked bonds, can be used to fund a real spending plan, well into the future, with minimal risk. In short, the risk-free asset will vary from one investor to another, depending on what future spending our investments are intended to serve.5

At its essence, the equity risk premium is the incremental return that we should earn relative to a risk-free asset, as a reward for our willingness to bear risk.

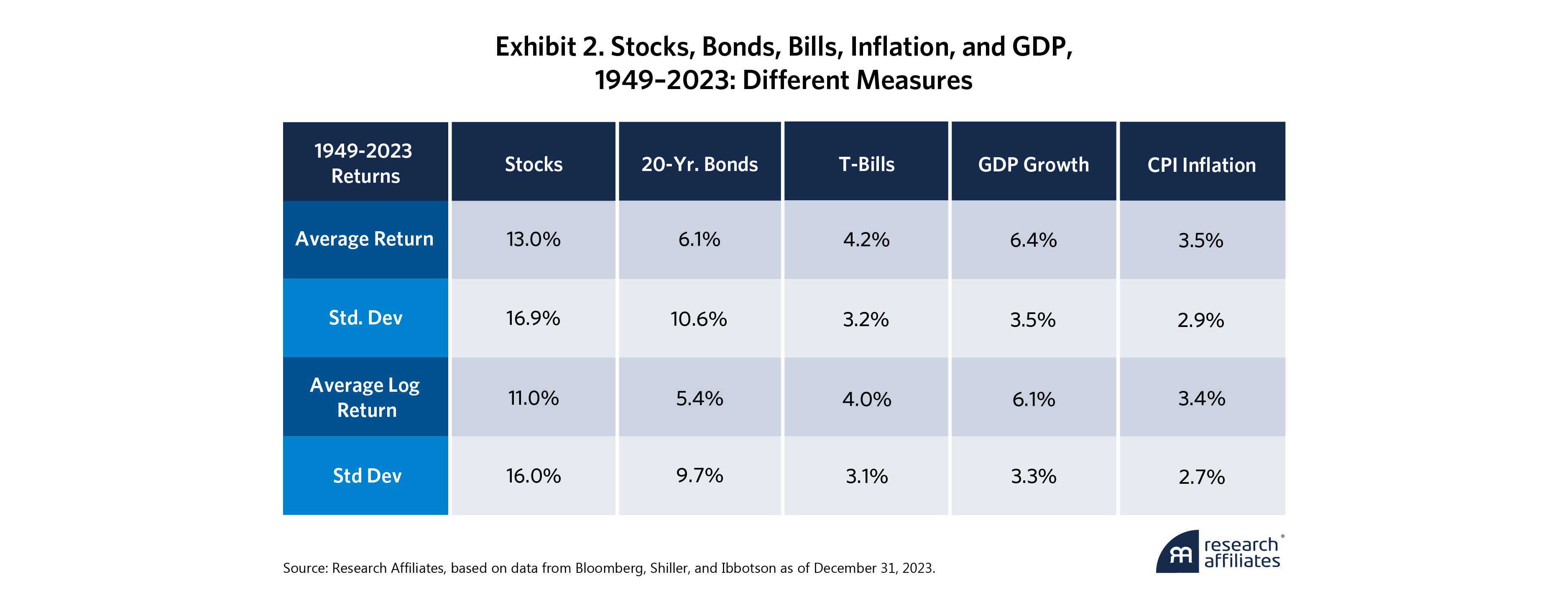

”Accordingly, we need to tightly define our meaning for the term “risk premium,” in order to avoid confusion or disagreements that are rooted in semantics, rather than true real-world differences of opinion. Not only do we need to define what our risk-free asset is (e.g., cash, bonds, or TIPS) and what our risky asset is (e.g., U.S. stocks, global stocks, individual stocks, or some other risky asset). We also need to specify what return difference we are using. A risk premium may be based on single-year expected arithmetic return differences, geometric return differences, log return differences, or compounded multiyear return differences. With such semantic differences, we risk talking past one another in any dialogue on the topic.

[W]e need to tightly define our meaning for the term ‘risk premium,’ in order to avoid confusion or disagreements that are rooted in semantics, rather than true real-world differences of opinion.

”Exhibit 2 shows how this can happen. Suppose we are comparing past excess returns, which I define as the log-return difference between stock and bond returns, and you define as the annual arithmetic difference between stock and Treasury bill returns. Over the last 75 years, I would calculate a 5.6% excess return compared to your 8.8%. That’s a big difference, but we’d both be correct.6 Any discussion of either past excess returns or the expected equity risk premium must precisely specify what definitions we are using.

Conclusion

Many of modern finance’s foundational theories can be misleading or worse. That doesn’t mean they have no insight to offer. While ample evidence, from Roaring Kitty to Zoomability, may demonstrate that markets in the real world are far from efficient and that homo economicus is as elusive as Bigfoot, by seeking greater clarity and zeroing in on precisely what these concepts mean at the individual level, we can gain a better sense why and how markets and investors behave the way they do. Yes, investors are prone to irrational decision-making, to behavioral biases and cognitive errors. They may also have separate and distinct definitions of the equity risk premium and its components. But that doesn’t mean we should dispense with the ERP or any of the other fundamental principles of modern finance. Our task today should be to think like Hirschleifer did when he developed the equity fear premium and inefficient market hypothesis and seek to bridge the gap between conventional and behavioral finance.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

1. The 2013 Nobel Memorial Prize in Economic Sciences was—hilariously, IMHO—simultaneously awarded to Eugene Fama for his pioneering work in market efficiency, to Bob Shiller for demonstrating market inefficiency, and to Lars Peter Hansen for methods to measure and test both.

2. Consider this wonderful excerpt from David Hirschleifer (Hirschleifer, D. 2001. “Investor Psychology and Asset Price.” Journal of Finance 56 (4): 1533–1597): “In the muddled days before the rise of modern finance, some otherwise-reputable economists, such as Adam Smith, Irving Fisher, John Maynard Keynes, and Harry Markowitz, thought that individual psychology affects prices. What if the creators of asset pricing theory had followed this thread? Picture a school of sociologists at the University of Chicago proposing the Deficient Markets Hypothesis: that prices inaccurately reflect all available information. A brilliant Stanford psychologist, call him Bill Blunte, invents the Deranged Anticipation and Perception Model (or DAPM), in which proxies for market misvaluation are used to predict security returns. Imagine the euphoria when researchers discovered that these mispricing proxies (such as book/market, earnings/price, and past returns), and mood indicators such as amount of sunlight, turned out to be strong predictors of future returns. At this point, it would seem that the deficient markets hypothesis was the best-confirmed theory in the social sciences.”

3. Of course, if the beta or correlation of the asset is negative with the rest of your portfolio, a negative risk premium (or even a negative return) can make sense. Neoclassical finance also allows for a negative risk premium (indeed, the certainty, with assets like lottery tickets) by positing a preference for skew. Some people like the low odds of a big payout enough to tolerate negative mean and median expected returns. In this discussion, I am disregarding preference for skewness, because homo economicus should not value skew enough to tolerate a negative ERP. I view the "skew preference" as a convenient way to adapt the EMH to a world of irrational choices, not unlike an ERP that varies across time and across assets. Neither example is particularly helpful in our efforts to predict markets and asset prices.

4. Whoever coined the expression "Magnificent Seven" clearly did not see the movie. Four of the seven are dead by the end of the film.

5. See Arnott (2006) Fundamental Indexes: Current and Future Applications.

6. My long-standing preference, which has never really caught on, is geometric return differences for stocks versus inflation-linked bonds, as both have inflation passthrough. Cash yields are inherently short term and hugely variable, whereas forward-looking stock market returns are inherently long term and rather more stable. If we define our expected future stock market return as the sum of the current yield plus long-term expected growth in income, that sum is not likely to move more than 1 or 2 percentage points in a single year. Meanwhile, bonds offer a nominal return, while stocks and TIPS offer a real return. In an inflationary world, investors in stocks and TIPS both enjoy inflation passthrough, so that income (TIPS coupons or stock market dividends, and their respective asset prices) can rise with inflation. Treasury bonds do not. Rising inflation helps TIPS, can help stocks, and assuredly hurts bonds.

References

Hirshleifer, D. 2001. “Investor Psychology and Asset Price.” Journal of Finance 56 (4): 1533–1597.

Ibbotson, R. G., and R. A. Sinquefield. 1976. “Stocks, Bonds, Bills and Inflation: Year-by-Year Historical Returns (1926–1974).” Journal of Business 49 (1): 11-4.