Big market delusions (BMD) develop when investors anticipate that most early entrants in an exciting new market/technology will generate outsized returns. The recent electric vehicle (EV) craze demonstrates BMDs’ three-stage cycle of Frenetic expansion, eye-popping valuations, and painful consolidation.

Despite all the EV hype, a portfolio of traditional automakers would have outperformed one composed of EV specialists from late 2020 through 2024, and a simple S&P 500 portfolio would have left them both in the dust.

Investors who adopted a fundamental approach to the EV market, by sizing their bets based on sales rather than market cap, for example, could have avoided the worst of the shakeout.

Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.

”George Soros

Roll back the odometer to 2021 and the electric vehicle (EV) revolution looked unstoppable. Tesla’s ascent from niche automaker to Wall Street titan had ignited a speculative frenzy.1 With the auto industry going electric, investors saw a once-in-a-century opportunity and poured billions into EV startups, driving the sector’s market capitalization up 900% from 2020 to 2021.

Create your free account or log in to keep reading.

Register or Log in

The auto business was well understood. Throughout its 100-plus years, it had always been competitive and capital intensive. Yet the recent entrants, the EV manufacturers, were set to dominate the big new EV market. Or so it seemed. But big new markets often breed “big market delusions,” and the EV transformation was no exception.

Beneath the optimism, a familiar pattern developed. Investors were gripped by what Cornell and Damodaran (2020) termed a big market delusion (BMD): investors priced every EV firm as if it would be a winner and defied the fundamental economics—that the sum of the parts cannot be greater than the whole.

With the auto industry going electric, investors saw a once-in-a-century opportunity and poured billions into EV startups, driving the sector’s market capitalization up 900% from 2020 to 2021.

”Now, the EV shakeout is underway. When the dust settles, only a few players will remain. Many more will be relegated to the scrapyard of failed ambitions. The lesson, as always, is simple but seldom learned: The bigger the narrative, the greater the risk of overpaying for it.

A Familiar Delusion: Limitless Winners

A BMD takes root when investors believe that most early participants in a nascent, rapidly growing industry will succeed—and succeed spectacularly. Although the technology driving the industry often ends up changing the world for the better, for investors, the returns rarely dazzle for long and spectacular failure rather than success is more the rule than the exception. Speculative bubbles throughout history follow this rubric. The railroad mania of the 19th century fueled massive economic transformation but ended in several financial panics. More than 3,000 U.S. automakers emerged in the early 20th century, yet only a handful survived. The airline boom of the mid-20th century reshaped travel but left most airline investors grounded. The telegraph, telephone, and radio industries all cycled through the same stages: fevered expansion, inflated valuations, and painful consolidation.2

The dot-com bubble at the turn of the millennium was no different. Of the 10 most valuable tech stocks in early 2000, how many outperformed the S&P 500 over the next 15 years? None. Zero. Nada. After 20 years, only one—Microsoft—managed to edge ahead, by less than 2% per year.3 The dot-com narrative was absolutely right, even if the timeline was off: The internet did remake the world.4 But most of the “inevitable” winners never delivered the relentless growth that investors had counted on.

In each case—trains, automobiles, airlines, or the internet—the revolutionary hype turned out to be correct. The mistake was assuming that an early-mover advantage would lead to lasting dominance. Valuations soared as investors enthralled by the vision bet on the promise of a massive market only to discover that competition and capital intensity erode profitability. The EV sector, despite its transformative promise of a greener future, is a prime example of this rule.

Caution: EV Frenzy Ahead

By January 2021, the eyebrow-raising valuations and boundless investor enthusiasm associated with the EV sector were the financial equivalent of flashing yellow lights. We warned in March 2021 that the EV industry in 2020 exhibited all the hallmarks of a BMD.5 Our prediction turned out to be prescient.

By January 2021, the eyebrow-raising valuations and boundless investor enthusiasm associated with the EV sector were the financial equivalent of flashing yellow lights.

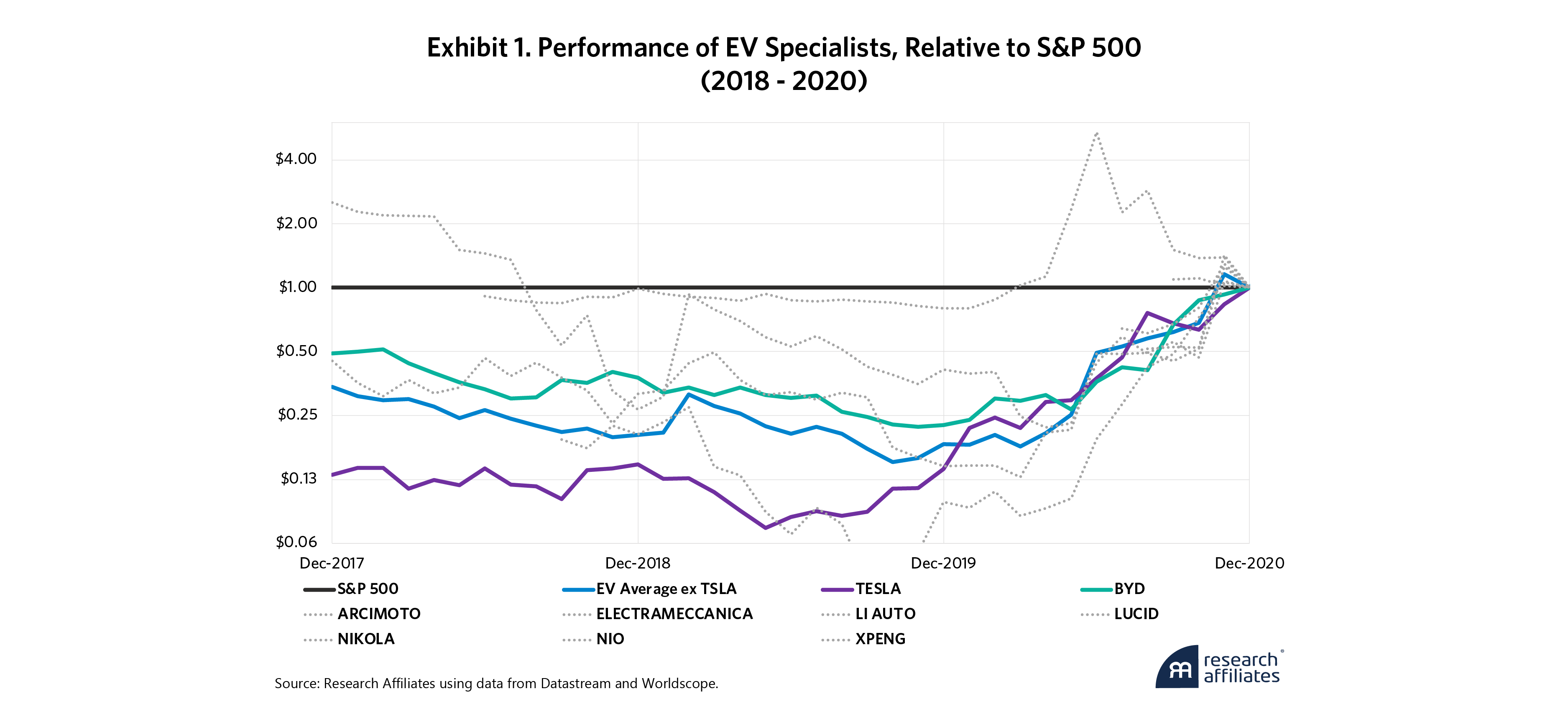

”As Exhibit 1 shows, EV specialists experienced a meteoric rise relative to the S&P 500. The graph is on a log scale, with 64-fold returns on the vertical axis. Tesla (purple line) struggled through 2018 and 2019, nearly running out of cash and facing regulatory scrutiny over Elon Musk’s claim to have “Funding secured” to take the company private, before suddenly regaining momentum. From May 2019 to January 2021, its stock price skyrocketed 16-fold. The rest of the EV sector followed, as non-Tesla EV specialists surged 800% in an even shorter period.

The narrative had taken on a life of its own. Investors weren’t just betting on the future of EVs—they were assuming inevitable market dominance and paying sky-high multiples for companies with unproven business models and limited production capacity. For a time, this created a self-fulfilling prophecy. Rising prices justified past purchases and encouraged future buys, sending EV stocks to heights untethered from fundamentals.

Tesla and Elon Musk: The "Fountain of Youth" Effect

Tesla remains the elephant in the room in any EV discussion. A young company by auto industry standards, it is ancient compared to other EV specialists. With Promethean vigor, Tesla set EVs on the road to mainstream acceptance as a viable alternative to traditional gasoline-powered automobiles. Tesla innovated a strategy of marketing to the prestige, high-margin luxury segment while achieving scale through vertical integration of its “giga-factories” while looking ahead to manufacturing mass market vehicles.

But despite Tesla’s successes, its market capitalization is hard to square with its fundamental economic footprint. Tesla is the most valuable auto manufacturer in the world, by far, yet its margins are middling, and its market share growth has stalled by year-end 2024. How, then, can the company be worth more than $1 trillion?

Tesla is the most valuable auto manufacturer in the world, by far, yet its margins are middling, and its market share growth has stalled by year-end 2024.

”Musk has a ready answer: Tesla should not be viewed merely as a car company.6 “In the long term, I expect Tesla Energy to be of the same, or roughly the same size, as Tesla’s automotive sector or business,” he opined back in 2019.7 In 2022, Musk said, “I think [Tesla’s robotics] has the potential to be more significant than the vehicle business over time.”8 In 2024, he clarified, “Tesla is an AI/robotics company that appears to many to be a car company.” As Cornell, et al. (2024) point out, in Musk’s framing, Tesla is a forever young company chasing massive potential markets.

Musk has encouraged those who view Tesla as an EV company not to buy its stock. Perhaps purchasing Tesla stock is an investment in Musk’s remarkable entrepreneurial abilities. If so, that may turn out to be a “rinse and repeat” BMD that cycles from one speculative surge to the next. However, many of Musk’s projects, SpaceX and The Boring Company, for example, are housed in distinct companies. If robotics becomes separate and independent of Tesla as well, then Musk’s extravagant ambitions will do little for Tesla shareholders.

All the speculation about Tesla’s growth options distorts the EV market and makes it difficult to evaluate with Tesla included. As such, we will take Musk’s word at face value and analyze the sector both with and without Tesla.

The Shakeout Begins

The EV market has evolved since we first waved the yellow caution flag back in 2021, and a shakeout has gained momentum. Fast-forward to today, and only Tesla has sustained its ascent, while many other EV firms have faltered or failed altogether. The hype-fueled rise of EV startups has collided with the harsh realities of competition, capital constraints, and unsustainable business models.

The warning signs were obvious all along. Nikola Motors should have been the industry’s “check engine light” moment. Dubbed the “Tesla of trucking,” Nikola went public as a special purpose acquisition company (SPAC) during the 2020 SPAC boom and briefly surpassed Ford in market value—despite having no viable vehicle.9 But, in September 2020, Hindenburg Research exposed Nikola as an “intricate fraud.” The company’s flagship truck was not self-powered; rather, it had just been rolled down a hill in a promotional video.10 The fallout was crushing: Valued at $15.5 billion in August 2020, Nikola’s market cap collapsed to just $100 million by the end of 2024.

Still investors didn’t hit the brakes, and the SPAC-fueled EV mania surged ahead. Each new EV startup promised to redefine transportation, but most failed to produce a sellable product. Electric Last Mile Solutions collapsed within a year. Lordstown Motors went public in 2020 only to fold by 2023 after its own Hindenburg report and an SEC probe. Proterra filed for bankruptcy just two years after its 2021 IPO. Fisker, Arrival, and Lion Electric briefly soared before fading into irrelevance. Canoo, another SPAC darling, went public in 2020 and was bankrupt by 2025.

Of those EV firms that have survived, many are barely clinging to life. Lucid Motors had a $38-billion valuation when it went public via SPAC in July 2021. In 2023, it sold just 6,000 vehicles, far short of expectations. By year-end 2024, its market cap sat at $9.1 billion. Despite support from Saudi Arabia’s sovereign wealth fund, Lucid’s finances remain precarious.

Rivian went public with a $100 billion valuation, but as it burned through cash and struggled to scale, its market cap collapsed to $13.6 billion by late 2024. Its –45% gross margin as of Q3 2024 highlights deep inefficiencies. Volkswagen stepped in with a $5.8 billion lifeline, but Rivian’s long-term outlook remains uncertain.11

Built on grand visions, easy capital, and the belief that a rising tide would lift all players, the big EV market delusion has now shattered. Companies once valued in the billions have been reduced to penny stocks or erased entirely. Those still standing face a brutal reality: Scaling production is hard, margins are razor-thin, and competition is relentless. In the end, most early entrants will be remembered not as pioneers but as cautionary tales.

A Market Reckoning

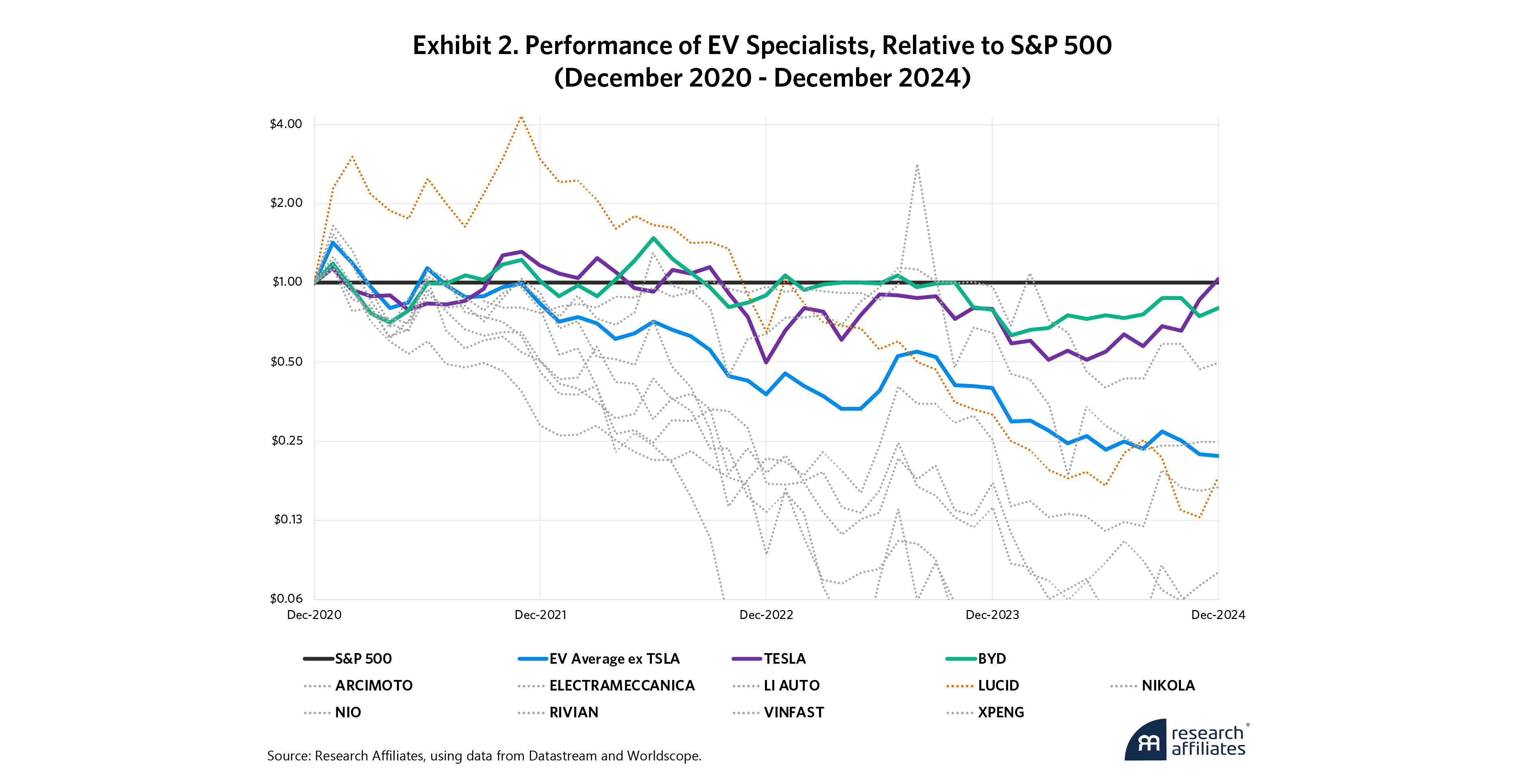

How have investors fared amid the EV pileup? Exhibit 2 examines EV specialists’ stock performance from 2021 to 2024. How many EV specialists outpaced the S&P 500 over one year? One, Lucid. Over two or three years? None. After four years? One, Tesla, barely. Even with Musk’s charisma, inventive mind, X social media platform, political influence, and promises of new markets beyond automobiles, Tesla only beat the S&P 500 by 1% per annum.12

An investor who equally weighted Tesla and the eight other EV specialists from our early-2021 study would have finished 2024 nearly 80% poorer than one who had simply put their money in the S&P 500. Besides Tesla, BYD was the only EV specialist that would have left an investor with even half the wealth of an S&P 500 index fund investor. BYD was also the only EV specialist in early 2021 with a price-to-sales ratio below 10x. The numbers don’t lie: Price matters.

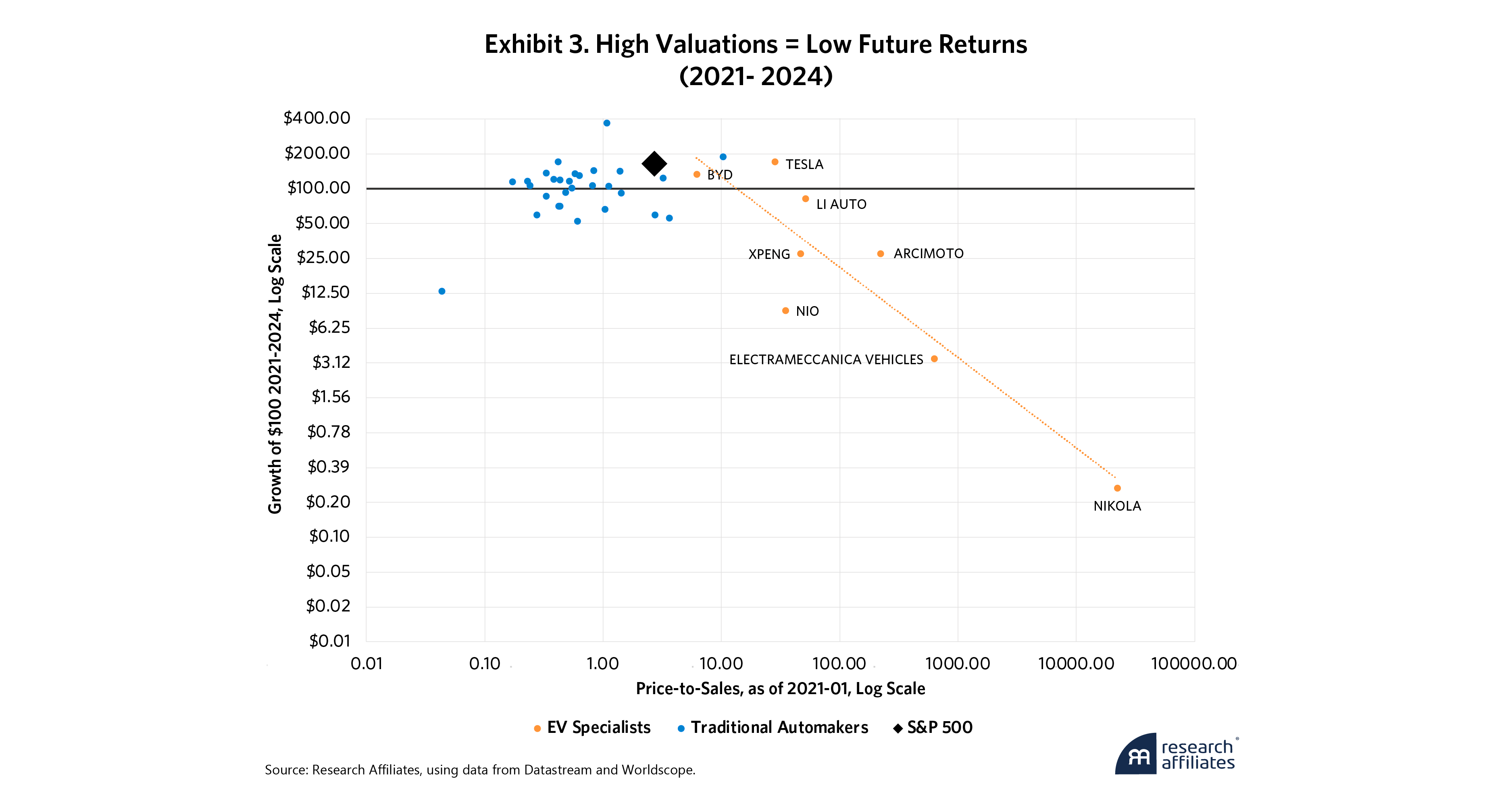

Exhibit 3 shows the relationship between starting price and subsequent performance among both traditional automakers and EV specialists. The scatter plot maps the price-to-sales ratios from our 2021 article (horizontal axis) against the growth of a $100 investment in each company from 2021 to 2024 (vertical axis), both shown in log scale. The divergence between EV specialists (orange) and traditional automakers (blue) paints a vivid picture.

The highest-valued companies in 2021—those furthest to the right—performed the worst. All except Ferrari were EV specialists (Ferrari is the rightmost non-EV stock). A $100 investment in these firms shrank to just $53, for a –46% return, on average.

The lowest-valued companies, those furthest to the left, were largely traditional automakers and fared far better. A $100 investment grew to $113, delivering a 13% return, on average.

Both groups failed to match the S&P 500, which gained 66% over the four years, thanks largely to the newest BMD, artificial intelligence (AI).

In relative terms, the average investment in traditional automakers would have made an investor more than twice as wealthy as one who bet on EV specialists—in just four years and at a fraction of the price. As of January 2021, the average price-to-sales ratio for EV specialists was a staggering 145 compared to just 1.20 for traditional automakers.13 There’s an old saying: The higher you climb (in price-to-sales ratios), the harder you fall. The EV bubble made that lesson painfully clear.

In the end, the hype didn’t translate into returns. More-sensibly priced traditional automakers outperformed their overvalued EV counterparts. Like other big market delusions, the EV shakeout has left few winners and many losers. So, how could investors have avoided the crash?

Price Matters: Weighting by Fundamentals

Those who end up on the wrong side of speculative bubbles often come away with hard-learned lessons and lighter wallets. Yet a straightforward, intuitive approach can help mitigate irrational exuberance, especially in markets where the fear of missing out (FOMO) often prevails. Just as games of chance reward those who size their bets according to the odds, successful investing can hinge on weighting portfolios based on a company’s economic fundamentals. Rather than trusting the market’s valuation and buying into implausible growth stories, we should anchor our investments to tangible metrics such as sales, cash flow, and book value.

So far, we have analyzed EV specialists’ stock performance individually and as an equal-weight average, excluding Tesla. What happens if we keep the equal-weight average and add two other portfolio weighting methods into the mix, market capitalization and a fundamental-weighted approach based on sales?14

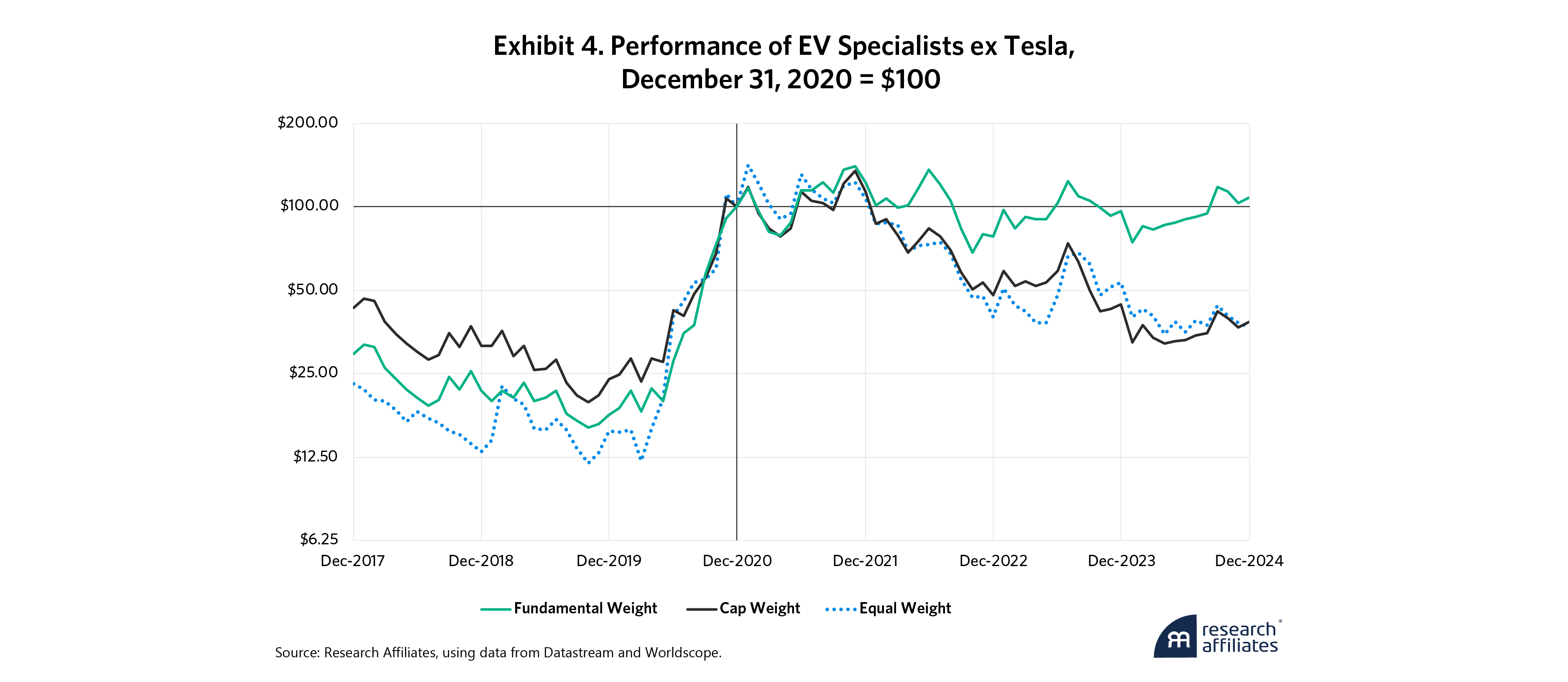

Exhibit 4 below shows the growth of the three portfolios relative to December 2020. All three blast off during the 2020 EV craze. Thereafter, their paths diverge.

The equal-weight portfolio (dotted blue line) and the cap-weight portfolio (black line) tumble nearly in lockstep. They peak in 2021 at around $140 and then fall to a terminal value of about $40 by year-end 2024, for about a –60% return since December 2020. But what if we allocate holdings based on a firm’s share of total EV sales (in dollars) rather than market capitalization? The result is striking.

The fundamental-weight portfolio (dotted green line) also peaks at around $140 in 2021 but exhibits more resilient performance than its equal- and cap-weighted counterparts through 2024. It trended to a low of about $70 in October 2022 before recovering to nearly $110 at year-end 2024, for an almost 10% return since December 2020. While hardly a world beater amid the S&P 500’s robust performance, the fundamental EV portfolio was nearly twice as valuable as the other two portfolios at the end of the sample period.

These results highlight a critical takeaway: Fundamental weighting not only tempers the effect of speculative bubbles but also positions investors to capitalize on a sector’s real long-term economic impact. By tying portfolio weights to material fundamentals, investors can avoid overvaluation traps and the harsh corrections that often follow.

Fundamental weighting not only tempers the effect of speculative bubbles but also positions investors to capitalize on a sector’s real long-term economic impact.

”The Rise of Chinese EV Manufacturers

China is an essential piece of the EV story. Chinese EV manufacturers are no paper tigers. As we noted in 2021, China’s has the world’s largest domestic EV market, which combined with the explicit ambitions of its state planners, promises a bumpy road for potential competitors. “If there are no trade barriers established,” Musk himself warned, “[Chinese EV manufacturers] will pretty much demolish most other car companies in the world.”15

Chinese policymakers have combined incentives, subsidies, industrial strategy, and, obviously, central government control to foster a fiercely competitive ecosystem. Aggressive state policy helped build a leading-edge battery industry, and Chinese batteries are now the cheapest in the world. Moreover, with their deep and well-structured supply chains, Chinese EV firms can offer integrated AI, seamless connectivity, and extended battery ranges at prices Western automakers will struggle to match.

Still, even in China, excess profits are difficult to harvest. Competition is so intense that, in a rare show of unity, major Chinese EV companies reportedly declared a truce to avoid a destructive price war.16 Yet even this effort did not offer much relief, as tech giants like Tencent and Huawei, goaded on by state planners, have entered the market, further intensifying the competition.

For Western automakers and EV specialists, capable and cheap Chinese vehicles present a formidable and potentially existential challenge. Only massive U.S. and European tariffs have slowed the flood of Chinese EVs into these markets.17 Already struggling to generate cash, Western EV specialists would likely flounder without state protection. Yet these protectionist measures come at a cost, raising prices for consumers, distorting markets, and diminishing incentives for domestic automakers to up their game.18

For Western automakers and EV specialists, capable and cheap Chinese vehicles present a formidable and potentially existential challenge. Only massive US and European tariffs have slowed the flood of Chinese EVs into these markets.

”Navigating the Road Ahead

Revolutionary technologies can be mesmerizing and often deliver on their promise of a brighter future. They may offer customers new and better choices. But they can be brutal on investors, especially those who arrive late to the party, after prices have already soared. An investor in EV specialists at the end of 2017 enjoyed a 363% gain by year-end 2020. By the time we wrote our March 2021 paper, share prices already reflected extravagant expectations, and the subsequent returns were awful.

In case after case, innovation inspires narratives that are spot-on about the new technology and the new markets. But there’s a difference between a nascent big market and a big market delusion. The former rocks our world at least once a generation. The latter develops when these markets are priced without acknowledging that disruptors get disrupted and that competition inevitably reduces prices and margins. When that happens, investors have been repeatedly and dramatically wrong about how stocks will price that future.19

This is not new. From the cotton gin to the railroad, the telephone to the personal computer, the big markets and the revolutions that inspired them were real, and the innovators who led them often became immensely wealthy. But most investors were behind the curve. Those who bought the hype after valuation multiples were priced for perfection were typically big losers.

The EV-driven transformation of the auto sector repeated this pattern. Since the industry’s early days, its steep capital requirements have made it almost impossible for companies to achieve the scale required to survive let alone generate outsized profits. This is just as true today as it was during the initial auto industry shakeout a century ago. Massive state-backed manufacturers in China only underscore the ferocity of the competition.20

A focus on fundamentals could have protected investors from the big EV market delusion. Portfolios that weighted their constituents based on fundamentals rather than market cap, for example, could have avoided the worst of the drawdown and mitigated the damage to investors’ wallets.

Is AI the next big market delusion? Probably. But that’s a discussion for another day.21

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

1. On December 21, 2020, Tesla joined the S&P 500, effective at the closing price the prior Friday. For the first time ever, a stock joined the index after it was already the fifth-largest company in the United States by market capitalization. By the end of December 2021, Tesla’s market cap had swelled to $1.06 trillion, helped in no small measure by its inclusion in the S&P!

2. Oppenheimer, Peter, et al. “AI: To Buy or Not to Buy—That Is the Question.” Goldman Sachs Research, September 5, 2024.

3. Arnott, Rob, Chris Brightman, and Thomas Verghese. “The NVIDIA/AI Singularity: Breakthrough, Bubble, or Both.” Research Affiliates, September 2023.

4. Human beings are loath to embrace change until they are good and ready, which is often far slower than the visionaries creating that brave new world tend to predict. Furthermore, many disruptors are themselves disrupted. Cisco is an infamous example. It built the routers and infrastructure that powered the internet revolution, but competitors innovated cheaper solutions and drove a revaluation of Cisco’s growth prospects.

5. Arnott, Rob, Bradford Cornell, and Lillian Wu. “Big Market Delusion: Electric Vehicles.” Research Affiliates, March 2021.

6. Shaban, Hamza. “Elon Musk Insists Tesla Isn’t a Car Company as Sales Falter.” Yahoo Finance, April 24, 2024.

7. Barhat, Vikram. “Tesla’s Musk Says Solar, Energy Storage Will Grow Faster Than Electric Cars, and There’s Some Truth to It.” CNBC, December 4, 2019.

8. Shead, Sam. “Elon Musk Says Production of Tesla’s Robot Could Start Next Year, But A.I. Experts Have Their Doubts.” CNBC, April 8, 2022.

9. SPACs enabled firms to go public bypassing the IPO roadshow process and the disclosures that went along with it. Bloomberg. “New Rules Will Force SPACs to Sober Up.” February 2, 2024.

10. When Hindenburg revealed the ruse, Nikola responded, “Nikola never stated its truck was driving under its own propulsion." Lee, Timothy B. “Nikola Admits Prototype Was Rolling Downhill in Promotional Video.” Ars Technica, September 14, 2020.

11. To be fair, Rivian has made notable progress in improving its profitability since its 2021 IPO. According to its 10-K filings, the company's gross margin has climbed steadily over the fiscal years 2021 to 2023, from –845%, to –188%, to finally –46%.

12. Still, Tesla lags the S&P 500 since the top of the EV bubble in January 2021.

13. The average price-to-sales of EV specialists excludes Nikola, which traded over a mind-blowing 2,200 price-to-sales ratio.

14. A more comprehensive description of the portfolio construction process is available in the appendix.

15. Reuters. “Tesla CEO Musk: Chinese EV Firms Will 'Demolish' Rivals without Trade Barriers.” January 25, 2024.

16. Reuters. “Explainer: What's behind China's Failed 'Truce' in EV Price War?” July 10, 2023.

17. Bloomberg News. “EU to Impose Tariffs Up to 45% on Chinese Electric Vehicles.” October 4, 2024.

18. Though arguably the original distortion is massive Chinese subsidies.

19. Tan, Ben. “What Were You Thinking?!” Medium, October 6, 2020. Sun Microsystems was an archetypal dot-com bubble stock. Its valuation peaked at 10-times revenues. Not long afterward, Sun CEO Scott McNealy explained what that implied:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

20. We do NOT advocate that the U.S. and Europe follow China’s planned economy model. Its success requires the national leadership to have a more inspired vision of the future than industry leaders and their customers operating in a competitive free economy.

21. Full disclosure: We said that AI was a big market delusion in August 2023. We also said that one should never sell a bubble short, because it can last longer and go further than we can possibly imagine.

References

Arnott, Rob, Bradford Cornell, and Lillian Wu. “Big Market Delusion: Electric Vehicles.” Research Affiliates, March 2021.

Arnott, Rob, Chris Brightman, and Thomas Verghese. “The NVIDIA/AI Singularity: Breakthrough, Bubble, or Both.” Research Affiliates, September 2023.

Blenkinsop, Philip. “EU Slaps Tariffs on Chinese EVs, Risking Beijing Backlash.” Reuters, October 29, 2024.

Bloomberg News. “Tesla and Chinese Rivals Signal Truce in Brutal EV Price War.” July 6, 2023.

Cornell, Bradford, Shaun Cornell, and Andrew Cornell. “Tesla’s Valuation Fountain of Youth.” Cornell Capital Group, July 10, 2024.

Cornell, Bradford, Shaun Cornell, and Andrew Cornell. “Valuing the Automotive Industry.” Cornell Capital Group, November 22, 2021.

Cornell, Bradford, and Aswath Damodaran. “The Big Market Delusion: Valuation and Investment Implications.” Financial Analysts Journal. 76 (2), 15–25.

Oppenheimer, Peter, Guillaume Jaisson, Sharon Bell, and Lilia Peytavin. “AI: To Buy or Not to Buy—That Is the Question.” Goldman Sachs Research, September 5, 2024.

Hindenburg Research. “Nikola: How to Parlay an Ocean of Lies into a Partnership with the Largest Auto OEM in America.” September 10, 2020.

Lee, Timothy B. “Nikola Admits Prototype Was Rolling Downhill in Promotional Video.”Ars Technica, September 14, 2020.

Yang, Zeyi. “How Did China Come to Dominate the World of Electric Cars?” MIT Technology Review, February 21, 2023.

Appendix A: Sample and Data

In our March 2021 article, we constructed a dataset comprising the world’s 40 largest automakers by market capitalization, as reported by CompaniesMarketCap.com. These firms were categorized into two groups: electric vehicle (EV) specialists and traditional automakers. At the time, our analysis excluded Fisker, Tata Motors, and SsangYong Motor due to insufficient financial disclosures within our study period.

By 2024, the composition of the global auto market had evolved, necessitating updates to our dataset. We incorporated nine new entrants into CompaniesMarketCap.com’s top 40 automakers, bringing our total sample to 46 firms. Six of these additions are traditional automakers: Porsche, Tata Motors (now providing sufficient financial disclosures), SERES Group, Ford Otomotiv Sanayi, Guangzhou Automobile, and Tofas Turk Otomobil. Among them, Porsche stands out, having gone public on September 29, 2022, following a spin-off from Volkswagen. The remaining three additions—Rivian, VinFast, and Lucid—are EV specialists.

| Worldscope ID | EV Specialists |

|---|---|

| C840N0Z30 | TESLA INC |

| C344V68L0 | NIO INC |

| C156RI000 | BYD CO LTD |

| C344V7ZM0 | XPENG INC |

| C344V66J0 | LI AUTO INC |

| C840Q71R0 | NIKOLA CORP |

| C124ZZ1B0 | ELECTRAMECCANICA VEHICLES CORP |

| C840SG1J0 | ARCIMOTO INC |

| C840FZ610 | RIVIAN AUTOMOTIVE INC |

| C840NB4Y0 | VINFAST AUTO LTD |

| C840S48D0 | LUCID GROUP INC |

Our study spans the seven-year period from 2018 to 2024 and includes the latest available financial and market data. Company fundamentals are sourced from Worldscope to ensure comprehensive and standardized reporting across firms. Security price data are sourced from Datastream. All data reflect values as of December 31, 2024.

For consistency and comparability, we apply standardized adjustments for currency conversions, financial reporting discrepancies, and variations in fiscal year-end dates.

Appendix B: Portfolio Construction Methodology

The portfolios in this study are reconstituted and rebalanced monthly and incorporate such newly public firms as Rivian and Porsche as soon as they become investable. Two weighting schemes are used: market capitalization and sales.

Market capitalization-weighted portfolios are constructed using float-adjusted market capitalization so that only publicly available shares contribute to portfolio weights.

Sales-weighted portfolios are based on the prior fiscal year’s reported annual sales. Portfolio weights do not change between successive annual company reports, ceteris paribus.

By using these two weighting methodologies, we capture distinct dimensions of firm performance: Market cap-weighted portfolios reflect investor expectations and liquidity, while sales-weighted portfolios provide a fundamental anchor based on actual business activity.