Deregulation will be central to President Trump’s second-term policy agenda, just as it was in his first term.

Even when successful, deregulation is a difficult process that does not guarantee a firm or sector’s profitability and is less effectual than fundamental factors in the medium to long term.

In Trump’s second term, the administration may follow a “No New Rules” approach to deregulation, prioritizing a freeze in new regulations over amending or eliminating old ones.

Emerging industries like AI and crypto rather than established incumbents are likely to be among the chief beneficiaries of Trump’s deregulation efforts.

Whatever course Trump’s deregulation agenda or the current AI and crypto booms take, investors should embrace a philosophy that prioritizes fundamental metrics.

Deregulation is among President Donald Trump’s most enduring policy themes. In his 2016 campaign, he called for widespread deregulation and made it a central plank in both his economic1 and energy platforms.2 One of his first executive orders upon taking office in January 2017, E.O. 13771, stipulated that “for every new regulation issued, at least two prior regulations [must] be identified for elimination.”3 Deregulation, along with broad corporate and personal tax cuts, fueled business and consumer confidence and, in turn, boosted the equity markets during Trump’s first term.

Create your free account or log in to keep reading.

Register or Log in

Trump’s enthusiasm for deregulation has not waned and may even have intensified in the intervening years. U.S. equity markets have already rallied in anticipation of regulatory relief, with small companies, in particular, banking on lower compliance costs. Since markets have already priced in some of this news, investors must assess how durable and realistic such anticipation is. Will deregulation’s impact live up to expectations? What sectors will benefit the most? While Trump’s second-term policy agenda is not yet fully defined, the lessons of his first term can help us understand what form deregulation may take and what the implications may be for U.S. equity markets.

While Trump’s second-term policy agenda is not yet fully defined, the lessons of his first term can help us understand what form deregulation may take and what the implications may be for US equity markets.

”Deregulation: Harder Than It Looks

The first Trump administration sought to eliminate and amend environmental, labor, and banking regulations. Agency actions—executive orders and other directives to government agencies—were key to those efforts. Deregulation along these lines often follows the same path as new regulation: Such measures are subject to a notice and comment process as well as potential litigation that can delay or even halt their implementation altogether. In his first term, legal challenges often stalled or derailed Trump’s deregulatory agenda, according to analysis by both Brookings4 and the Cato Institute.5 The administration only won 22% of 246 lawsuits that resulted from its agency actions.6

Trump also attempted to cut red tape through the more cumbersome and time-consuming legislative process. The Economic Growth, Regulatory Relief, and Consumer Protection Act, for example, expanded consumer access to credit by raising the asset thresholds at which U.S. bank holding companies are subject to enhanced prudential standards and exempting regional and community banks from many Dodd-Frank requirements. Though widely discussed and anticipated by the industry and lawmakers during and after the 2016 campaign, the bill was only passed in 2018. Unlike most of Trump’s administrative actions, however, it was not circumvented by litigation and remains in force.

Deregulation Does Not Guarantee Profitability

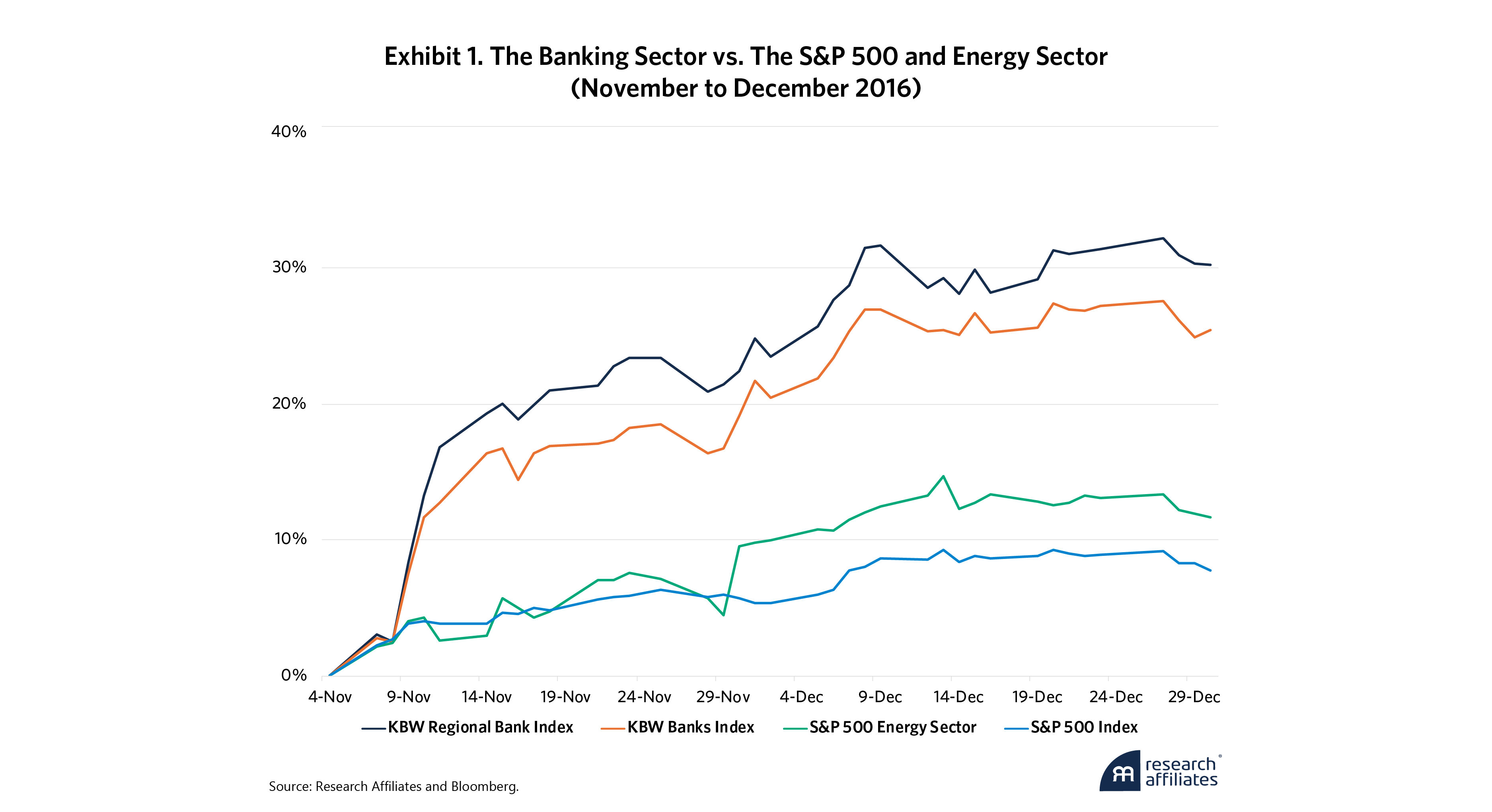

Today, as in 2016, markets priced in Trump’s deregulatory zeal prior to his inauguration. The financial and energy sectors, which were identified as targets for deregulation in his 2016 policy platform, understandably popped when Trump was elected the first time and outperformed the S&P 500 through year-end 2016, as shown in Exhibit 1. Smaller regional banks did especially well since they had the most to gain from lighter regulatory requirements.

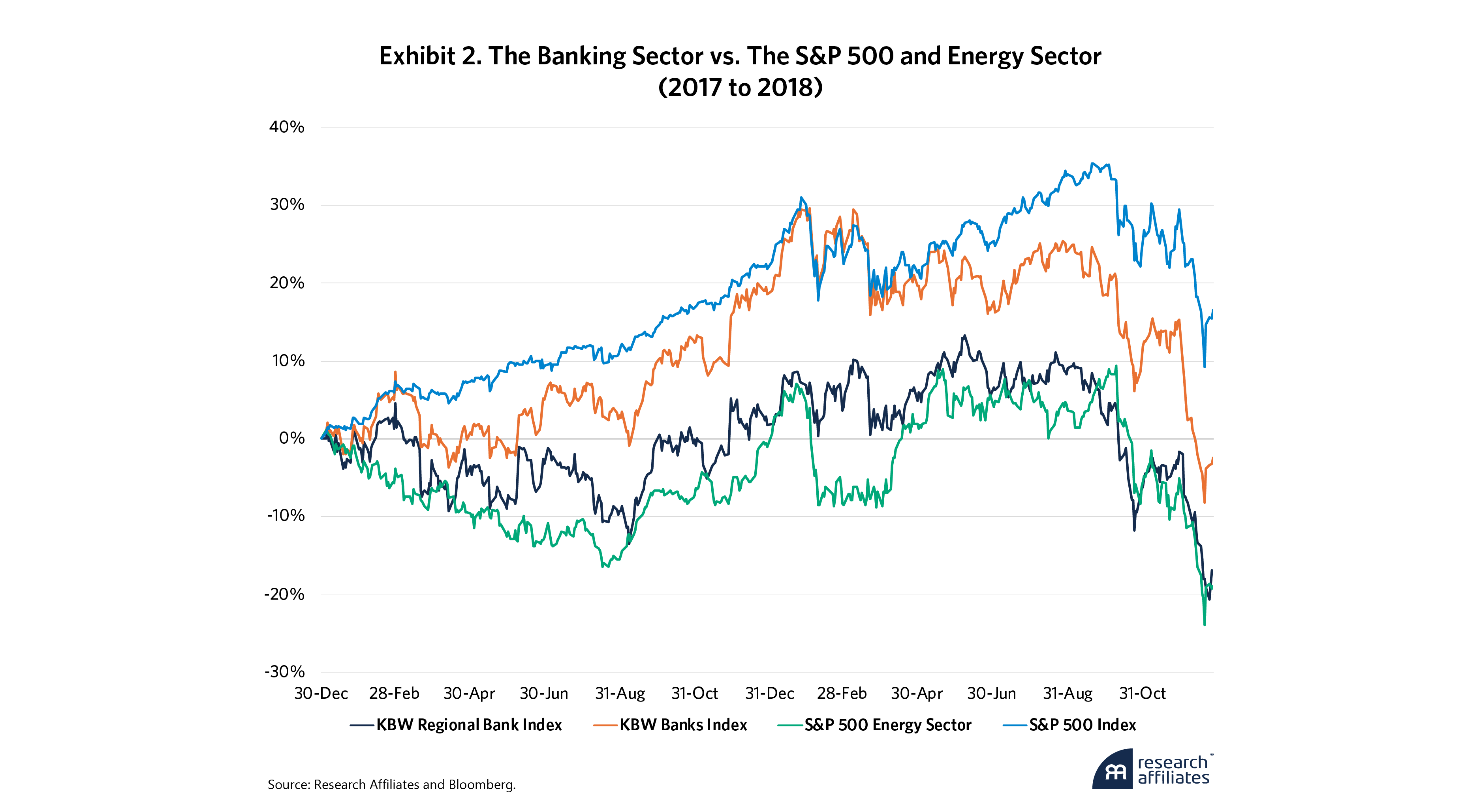

However, this bullish pattern was short-lived. Bank and energy stocks delivered negative returns in 2017 and 2018, while the S&P 500 remained in positive territory, as shown in Exhibit 2.

Deregulation alone was not enough to reverse the fundamental headwinds facing these two sectors. For banks, a relentlessly flattening yield curve in 2017 and 2018 placed structural pressure on their net interest margin (NIM). This took a harsh toll on small and regional banks, which are less diversified than their larger peers and more reliant on NIM.

In the energy sector, oil prices plunged from their 2014 highs. Though they recovered somewhat, supply headwinds persisted as U.S. companies ramped up production in the face of what they perceived as unsustainable OPEC cuts. Stagnantly low oil prices thus dimmed the sector’s profitability outlook.

The Easier Path: No New Rules. So, Who Will Benefit?

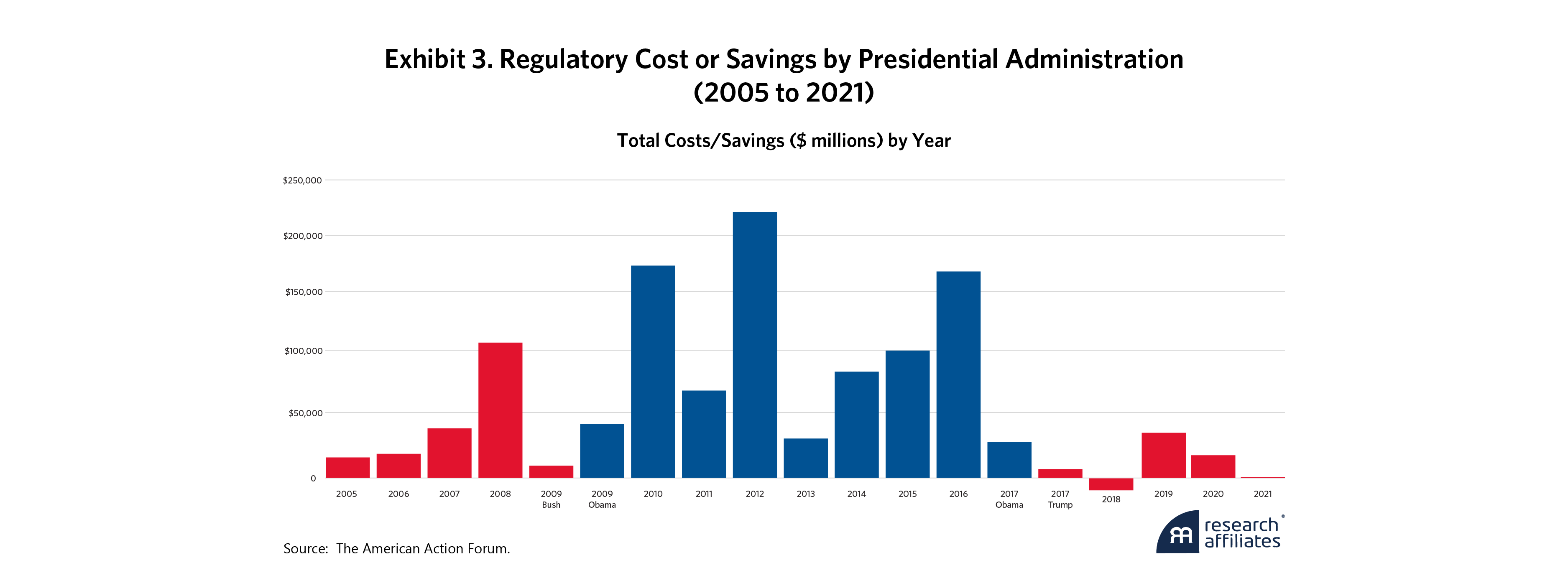

Mindful of the impediments to deregulation in the first term, the Trump 2.0 administration may chart a new course. Simply not making new rules is much easier than amending or eliminating old ones. This “No New Rules” approach is not exactly novel. Indeed, while the first Trump administration did not lower regulatory costs, it did manage to slow their growth relative to its predecessors. Exhibit 3 shows that estimated regulatory costs rose by $10 billion a year on average in Trump’s first term compared to $111 billion annually during President Barack Obama’s White House tenure.

A No New Rules environment has a higher potential upside for emerging sectors than incumbents. Crypto and artificial intelligence (AI), in particular, are among the obvious winners since they were due for greater regulatory scrutiny under a new Democratic administration.

[W]hile the first Trump administration did not lower regulatory costs, it did manage to slow their growth relative to its predecessors.

”The Crypto Outlook

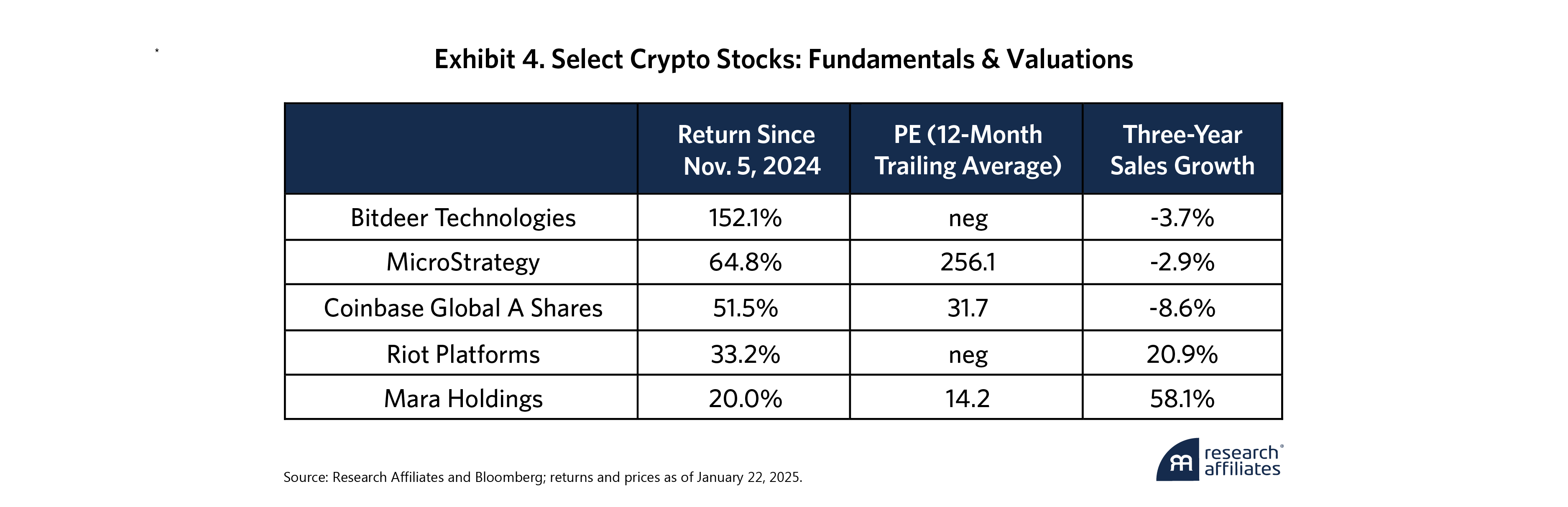

Trump has expressed unambiguous support for the crypto industry in both his policy proposals and personnel appointments. This has sparked considerable excitement in the space. Bitcoin is up nearly 50% since election day, and the share prices of Coinbase, MicroStrategy, and other crypto-access providers, as well as crypto-mining companies like Riot and Bitdeer, have all soared, as shown in Exhibit 4. Yet financial advisors have been slow to add crypto allocations to client portfolios,7 and while many are intrigued by blockchain technology, it has yet to be deployed at scale.

This No New Rules environment has a higher potential upside for emerging sectors than incumbents. Crypto and artificial intelligence (AI), in particular, are among the obvious winners.

”This makes sense. As fundamental investors, we view the crypto space with a mix of confusion and skepticism. What are the relevant fundamentals? Is the lack of fundamentals indicative of a market delusion?8 While valuations are down from their 2021 heights, most crypto and crypto-adjacent firms still seem richly priced amid lackluster top-line growth. By our analysis, the fortunes of crypto firms and cryptocurrencies depend more on sentiment than on the utility of the underlying technology or the health of the underlying business. Nevertheless, ongoing bullishness may continue to prop up their stock prices even as fundamentals defy their sky-high valuations.

Artificial Intelligence (AI)

We have written about the AI boom before,9 and while opinions may vary on the pace and significance of AI adoption, the technology has many obvious use cases. Businesses have deployed increasingly sophisticated AI applications and adoption is widespread. These trends are spurring ever greater investments in AI technology. The “picks and shovels” segment of the AI stack—Nvidia, for example—has been the early winner thus far. But the true champions—the Googles and Apples of the AI boom—will be those firms that develop the yet-to-emerge “killer apps.” The lighter the AI regulation, the more companies, entrepreneurs, and investors will reach for this brass ring and thus extend and expand the AI craze.

For value investors, this backdrop presents significant risks. If deregulation encourages greater speculation, a much larger bubble may form. Buying into speculative frenzies with ever rising price tags can be as unwise as sitting them out entirely and missing out on once-in-a-generation returns. For AI investors, the real threat may not materialize in the next few risk-on years but rather in the reckoning that comes after. In the dot-com bubble, for example, 1998 and 1999 were halcyon days. The real pain came during the next three years.

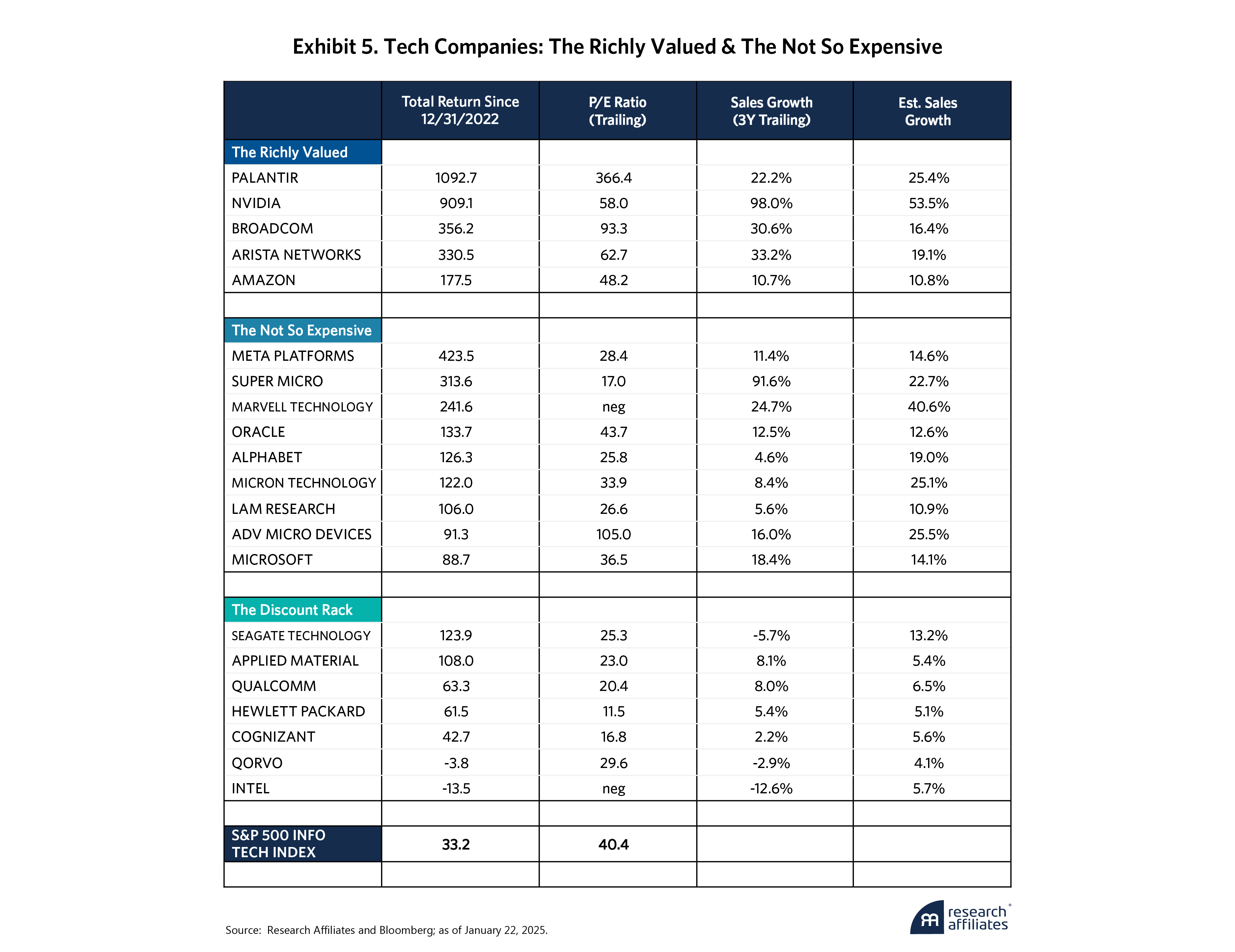

If AI becomes a decade-defining theme, investors should maintain broad exposure to AI firms and technology firms more generally while managing the risks. Despite the extreme multiples of the bubble’s bellwether names, well-priced investment opportunities in AI and AI-related companies haven’t completely dried up. While Exhibit 5 below is not exhaustive, it shows how some tech companies have fully participated in the AI enthusiasm and are quite richly valued, while others have not participated as extensively and trade at more reasonable valuation levels.

The Role of the Fundamental Index™

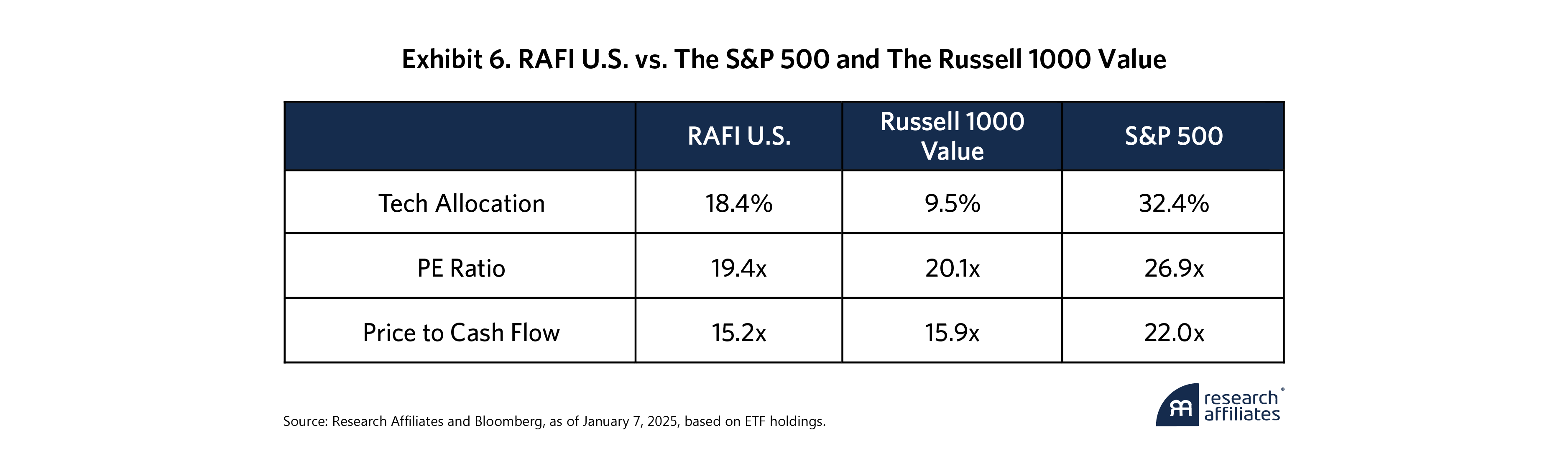

Our approach to value investing, the Research Affiliates Fundamental Index (RAFI), invests in all sectors—tech among them—using a systematic value-oriented approach that maintains diversification over time through disciplined rebalancing. Like conventional cap-weighted counterparts, RAFI U.S. owns most of the largest U.S. companies, including those tech giants associated with the AI boom. But unlike conventional indexes, RAFI weights firms by sales, cash flow, dividends, book value, and other fundamental metrics rather than their inflated market caps and gradually rebalances back to fundamental weights as stocks drift ahead of their fundamentals. This creates a methodical, sell high, buy low process. Exhibit 6 shows how RAFI U.S. maintains a healthy exposure to technology but with more reasonable valuation characteristics relative to a cap-weighted portfolio.

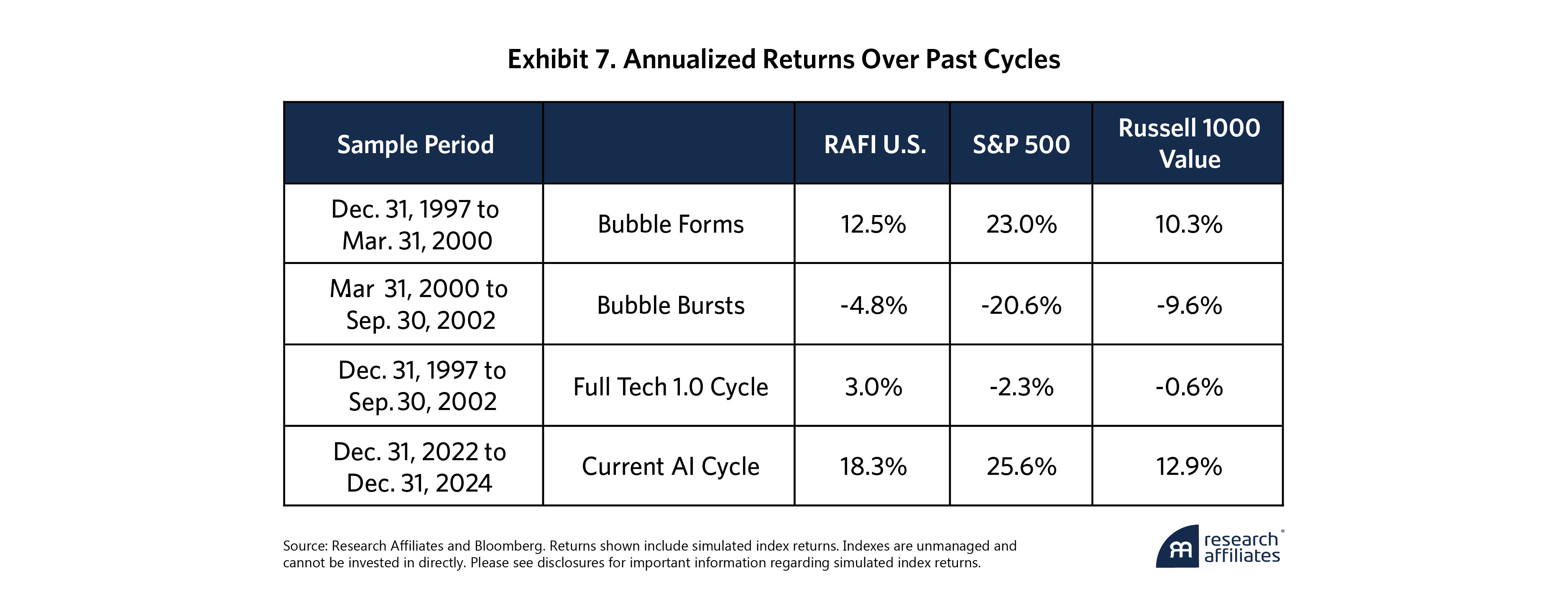

RAFI has fared well during past periods of irrational exuberance and amid the current AI bonanza. RAFI lagged the cap-weighted index as the dot-com bubble inflated but offered meaningful downside protection when it burst. Over the full tech cycle, it outperformed both the S&P 500 and traditional value indexes.

In the recent AI surge, as shown in Exhibit 7, RAFI has trailed the S&P 500 index by a smaller margin than during the dot-com bubble, and by maintaining fundamentally based exposures to technology companies, it has outperformed the Russell 1000 Value.

While hardly a crystal ball, by tying investments to fundamentals, RAFI provides a compass to help investors navigate market uncertainty. And that will serve them well no matter how Trump’s deregulation agenda and the current AI and crypto booms play out.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

End Notes

1. Charles, J. Brian. “Transcript of Donald Trump’s Economic Policy Speech to Detroit Economic Club.” The Hill, August 8, 2016.

2. Miller, John W. “Donald Trump Promises Deregulation of Energy Production.” The Wall Street Journal, September 22, 2016.

3. “Reducing Regulation and Controlling Regulatory Costs.” Federal Register, February 3, 2017.

4. Wallach, Philip A., and Kelly Kennedy. “Examining Some of Trump’s Deregulation Efforts: Lessons from the Brookings Regulatory Tracker.” Brookings, March 8, 2022.

5. Belton, Keith B., and John D. Graham. “Deregulation under Trump.” Cato Institute, Summer 2020.

6. “Roundup: Trump-Era Agency Policy in the Courts.” Institute for Policy Integrity, April 25, 2022.

7. “Financial Advisors Still Bearish on Cryptocurrency Use." Cerulli Associates, July 2, 2024.

8. A big market delusion is when all the firms in the evolving industry rise together even though they are often direct competitors. See Arnott, Rob, Brad Cornell, Lillian Wu. “Big Market Delusion: Electric Vehicles,” Research Affiliates, March 2021.

9. Arnott, Rob, Chris Brightman, and Thomas Verghese. “The NVIDIA/AI Singularity: Breakthrough, Bubble, or Both.” Research Affiliates, September 2023. Nguyen, Que. “Learn from Last Tech Bubble to Embrace GenAI Mania.” Research Affiliates, May 2024.