Value investing has underperformed relative to growth investing since 2007. A number of narratives have been offered to explain why “this time is different” and why value’s poor relative performance may be the “new normal.”

Our research decomposes the returns of value into three components: profitability, migration, and revaluation. The decomposition shows that the primary driver of value’s post-2007 underperformance has been growth stocks getting more expensive relative to value stocks.

If history is a guide, current valuation levels imply that over the next five years, value stocks are poised to deliver an annualised excess return over the cap-weighted index of 3.0% a year in the United States and 1.2% a year in Australia.

Value strategies appear to be as attractive today as they have ever been historically. The future long-term expected returns for value strategies are very promising.

Over the last roughly 13 years, and exacerbated by the severe market downturn in the first quarter of 2020, US value stocks have experienced their longest and deepest drawdown since 1963. Prior to 2020, Australian value stocks were spared the underperformance of value, but the recent value–growth cycle has been daunting for any investor with a value orientation.

Because storytelling is central to the human existence, we instinctively gravitate to narratives as a way to understand our environment. A number of narratives have promoted the idea that value investing has become structurally impaired. While these popular explanations seem compelling and reasonable, are they supported by data? By identifying and studying the key components of the value premium, we can debunk or validate these explanations.

Let’s begin by putting the latest value drawdown into perspective, recalling value investing’s deep roots and long history. Then we will examine the most common narratives that seek to justify value’s death. Next, we will look at a decomposition of the three essential elements of return to understand the reasons for value’s underperformance. Finally, we will examine the performance of value and growth in the Australian markets, before concluding with our forward-looking return expectations for value strategies.

Putting Value’s Performance into Perspective

Arnott et al. (2020) studied why US value stocks have underperformed their growth counterparts by 50.0% since 2007, which is the longest and deepest drawdown since 1963. By comparison, the tech bubble drawdown from August 1998 to February 2000 was 40.7%. By duration, the current drawdown span of 13.3 years surpasses all others by a wide margin; the second-longest bout during the biotech bubble was in the early 1990s, which lasted for a much shorter 3.8 years.

Prior to the most recent period of underperformance, the value factor had experienced steady growth over the prior half-century, albeit temporarily interrupted by events such as the Nifty Fifty surge in the early 1970s, biotech bubble in the early 1990s, and tech bubble in the late 1990s, as illustrated in Figure 1. Unsurprisingly, the latest emergence of a deep, persistent bout of underperformance is raising questions about whether value is structurally impaired.

What’s “Wrong” with Value?

Because reports and narratives purporting value’s death are attention grabbing, it’s easy to overlook that value investing has solid economic foundations and a long history, extending back to the 1930s with the publication of Graham and Dodd’s classic book Security Analysis. Value is one of the most studied and academically recognised factors with empirical evidence of a value premium established over four decades ago by Basu (1977). While the source of the value premium is debatable, a plethora of academic studies in subsequent years consistently confirmed that the value effect is not an artifact of a data-mining exercise, but rather is robust across asset classes, geographies, and definition changes.

Given the jarring rift between value’s latest throes (post-2007) versus its long-run experience (pre-2007), investors are increasingly asking: What’s wrong with value?

Several narratives purport to explain value’s latest travails. One of these narratives is that the emergence of a technological revolution has driven longstanding brick-and-mortar companies out of business.1 If true, then growth companies relative to value companies should permanently be even more profitable than they have been historically.

Another common narrative is that value has become a crowded trade, implying dimmed return prospects. If true, then we should have seen a persistently narrow spread in valuation multiples between value and growth companies over the last 13.3 years.

Others contend that as markets and the economy have evolved, the relative valuation reversion between value and growth stocks has slowed; valuations have become more stable. If true, then compared to the past, fewer value stocks should be migrating to neutral and growth categories (and vice versa). These narratives, among others, imply value is structurally impaired.2

As humans we find these stories compelling and interesting, but as investors we should ask if the assumptions underlying these tales are not tall, but true. Basically, do the data support these explanations? Do we see any evidence of value’s demise in the drivers of the value–growth divergence? Is value structurally impaired, and if so, only in the United States or also globally? Rather than fixate on a story, we address these questions using a return decomposition framework.

Decomposing Value and Growth Portfolio Returns

We can decompose the total return of a portfolio or strategy into three components. We refer to these as profitability, migration, and revaluation. Profitability accounts for the growth in the book value and dividends of the companies held in the portfolio or strategy over time.

Migration captures the return gained or lost from rebalancing: for instance, a value portfolio sheds some lower-yielding stocks that no longer qualify as value stocks and buys new deep-value stocks offering improved potential yield. The simple act of rebalancing raises the growth rate for dividend income in value portfolios and reduces it in growth portfolios according to the work of Chaves and Arnott (2012). Together, the returns from growth (profitability) and rebalancing (migration) form the structural components of a portfolio’s return.

The remaining component, revaluation, refers to the return from changes in relative valuation levels between value and growth stocks. Revaluation can contribute, either positively or negatively, to a portfolio’s overall return. Because the relative valuation of a strategy cannot grow endlessly one way or the other, this component should average roughly zero over a sufficiently long period.

We combine these three components into the equation shown in Figure 2.3 The decomposition holds exactly for the log return of a portfolio or strategy.

To bring the equation and concepts to life, we can use the example of a simple value portfolio. To form the portfolio, we sort stocks by their price-to-book value (P/B) ratio and assign the bottom third to our portfolio, similar to the value portfolio constituting the Fama–French high-minus-low (HML) factor. We build the portfolio at the start of the calendar year and rebalance it at the end of December. We will follow this simple value portfolio over an annual cycle.

On January 1, the portfolio, consisting of stocks with a P/B ratio ranked in the lowest third of the equity universe, has an overall P/B ratio of 1.97.4 As the year progresses, the companies held in the portfolio use profits to pay dividends (distributed earnings) and to increase book value (retained earnings). Assume the dividend yield averages 4.0% and the growth in book value is estimated at 2.4%. After experiencing this growth and the corresponding increase in valuations, many of the stocks no longer qualify for the value portfolio.

The portfolio no longer consists solely of value securities with P/B ratios ranked in the bottom third of the equity universe, but rather is composed of a rag-tag mix of value, neutral, and growth companies. The portfolio’s P/B ratio rises from 1.97 in January to 2.10 in December. Accordingly, in the annual rebalancing process, we substitute the stocks that no longer qualify for our value portfolio with replacements priced at lower valuation multiples and offering improved yields,5 which brings the portfolio’s P/B ratio back below 2.0 to 1.99.

At this point, we have all the information we need to decompose this simple portfolio’s return into the three components of revaluation, profitability, and migration. For fun, before you read on or peek at the footnote, grab a calculator or pull up Excel and try the computations. Do you get the following results? A 1.0% revaluation return, 6.4% profitability return, and 5.4% migration return that combine for a roughly 13.0% portfolio return.6 These annualised return decomposition outcomes closely match those of a US large-cap value strategy from July 1963 through December 2006, the 44-year period preceding value’s latest drawdown.

The fundamental measures of a portfolio rarely remain steady after each rebalancing cycle. In our simple example, the portfolio began the year with a P/B ratio of 1.97 and ended the year with a P/B ratio of 1.99, which implies a 1.0% revaluation return. Now imagine if our portfolio in January had a P/B ratio of 1.50 instead of 1.97. In that scenario, we would have witnessed a substantial repricing of value stocks, with a remarkable revaluation return of 28.3%! Because the portfolio’s P/B ratio reverts back below 2.0 (or 1.99 in our example) by year-end after its rebalancing, we can view the revaluation return as a one-off, unlikely to be repeated unless we witness continuous increases in price growth in excess of any growth in book value.

Having teased out the return drivers of a value portfolio, we can use the same decomposition lens on a growth portfolio. Over the same span from July 1963 through December 2006, a US large growth portfolio earned 9.4% a year, composed of a 1.1% revaluation return, –7.0% migration return, and 15.3% profitability return. In a growth portfolio, drag from the migration component is to be expected. Consistent with the results of Chaves and Arnott (2012), rebalancing or migrating away from higher-yielding value stocks into lower-yielding growth stocks reduces the potential growth of dividends in growth portfolios. Although the return from migration detracts from overall performance, a significant contribution from the profitability component more than offsets the aforementioned loss.

Given the temporary nature of revaluation changes, we focus on the structural drivers of return. In short, over the full 44-year span ending 2006, value beats growth because the pricing spread results in a migration difference of 12.4% that dwarfs the profitability difference of −8.8%.

Value vs. Growth in the Post-2007 Period

Having analysed the long-term structural return drivers of value and growth, we can hone in on the period after 2007, value’s latest drawdown. By comparing the contributions from each return driver across the two spans—pre-2007 and post-2007—we can determine if the extent of value’s latest travails against growth result from structural impairment or from a significant revaluation shift (i.e., falling relative valuations of value stocks versus growth stocks).

The evidence since 2007 indicates no radical departure in the profitability or migration of value and growth. Said another way, the similarities in the profitability measures and migration rates across both time spans imply that the structural return drivers of value versus growth remain intact.

The migration of stocks between the value and growth categories has remained very close to 70% over both periods, and the profitability of value and growth companies, measured by return on equity and by earnings yield, is approximately the same from one period to the next and is actually lower, rather than higher, in the period beginning in 2007. In short, the evidence debunks common narratives of value’s structural impairment.

Table 1 places the structural return components for the two time spans side by side. As was the case from 1963 through 2006, in the post-2007 span the gain from migration (10.8%) overcomes the loss from profitability differences between value and growth stocks (−9.0%). Together they contribute to a structural return of 1.8% a year for value stocks compared to growth stocks from January 2007 through March 2020. Although the difference of 1.7% between the 3.5% and 1.8% structural returns in pre-2007 and post-2007, respectively, is economically meaningful, the returns are not statistically different from each other.

If the structural component of the value premium has remained intact, what explains the most recent drawdown? The revaluation component fully explains value’s 13-year shortfall! Falling relative valuations of large value stocks versus their growth counterparts over the post-2007 span have detracted 8.6% from the value premium.

In contrast, in the 44 years prior to 2007, revaluation changes positively contributed, albeit by a marginal 0.3%. As a result, the value premium flips from 3.8% in the first 44 years to an annualised shortfall averaging −6.8% in the last 13.3 years. Said another way, it took value cheapening by 8.6% a year to create a performance shortfall of −6.8% a year.

Should we expect this to persist? Unlikely. As we noted earlier, revaluation returns tend to be one-off. Consider that value stocks become relatively cheaper or more expensive over time compared to growth stocks as these investment styles come in and out of favor.

When the value style is in favor, assets flow in, returns are good, and value becomes expensive based on relative valuation. When the market tide turns, the opposite happens: funds flow out of value stocks, these flows generate negative price pressure, and value becomes relatively cheap as returns fall. If this holds, then, as we noted earlier, the falling relative valuation of value stocks versus growth stocks should be a temporary headwind.

Academic Factor HML

In our previous examples, we have focused on large US companies. To produce results more consistent with the traditional academic HML factor, we equally weight the results of stocks in both large (big) and small US universes as shown in Table 2. We observe that the HML return over the last 13.3 years is −5.4% a year compared to 6.1% in the full pre-2007 history. Although the share of decline attributable to changes in the structural and revaluation drivers is on average somewhat even at −6.8% and −6.7%, respectively, small companies have experienced a larger reduction in structural return, and large companies have experienced a greater reduction in revaluation return.

And What about Australia?

If value investing is dead, we would expect it to be a global phenomenon. As such, studying a similar decomposition analysis domestically may offer additional insight. We observe two time horizons—July 1990 through December 2006 (pre-2007) and the 13.3 years afterwards (post-2007)—as shown in Table 3.

As in the United States, the market returns in Australia have been meaningfully lower since 2007. In the pre-2007 period, the Australian large (big) value portfolio earned 16.2% a year and the large growth portfolio earned 11.8% a year. Over the last roughly 13 years, the Australian large value portfolio generated a 0.8% annualised return, surpassing the Australian large growth portfolio, which fell by 0.5% a year. The 1.2% annualised outperformance of value versus growth in the post-2007 period is more than a fourth lower than the results in the pre-2007 period. Growth underperformed value in both pre- and post-2007 periods. If value is structurally impaired, we would expect value companies to underperform in Australia, which is not the case.

Additionally, our analysis includes the performance for the first three months of 2020, during which value significantly underperformed growth against the backdrop of a COVID-19–induced recession. Our proprietary research shows that during market drawdowns caused by macroeconomic uncertainty about the likelihood of recession, value typically underperforms growth before recouping this underperformance, and more, as the market rebounds.

Regardless, the decomposition of the drivers of Australian returns is worthy of our focus. Across large companies, the structural return of value versus growth slightly increased from 6.7% a year in the pre-2007 span to 7.0% in the post-2007 span. Whereas the profitability of growth companies relative to value companies increased by 3.6%, they suffered far more from migration of −6.4% to lower valuation quintiles. The large-factor total return for the pre-2007 period and the post-2007 period through December 2019 were both 4.4%, but the post-2007 period through March 2020 dropped to 1.2%. Therefore, over half (3.2%) of the revaluation return for the post-2007 period occurred in the first three months of 2020.

The Australian HML factor, constructed as an equal weight between large and small firms, experienced a decline in structural return from 10.4% a year in the pre-2007 period to 3.7% a year in the post-2007 period. The reduced structural return was driven solely by small firms’ lower profitability. The revaluation return increased, cushioning some of the loss in structural return. The HML portfolio’s pre-2007 return of 6.7% fell to 1.0% in the period beginning 2007 through March 2020, a smaller but positive result.

Forward-Looking Expected Returns for Value

Many narratives purport to explain why “this time is different” and to offer reasons that imply value is structurally impaired. These narratives include the new-normal interest rate environment, growth of private markets, crowding, and technological change, among others. We turn to the data to consider the strength or weakness of several of the more popular value-is-dead narratives. We examine these explanations and find insufficient evidence to conclude that value is indeed dead.

Our simple model decomposes the returns of value relative to growth. The framework attributes the relative performance to three components: migration, profitability, and change in relative valuation. Our evidence suggests that migration (e.g., individual value stocks becoming growth stocks) and profitability are not materially changed over the pre- and post-2007 periods. These two components, which we refer to as structural return, are a net positive contributor to the value premium.

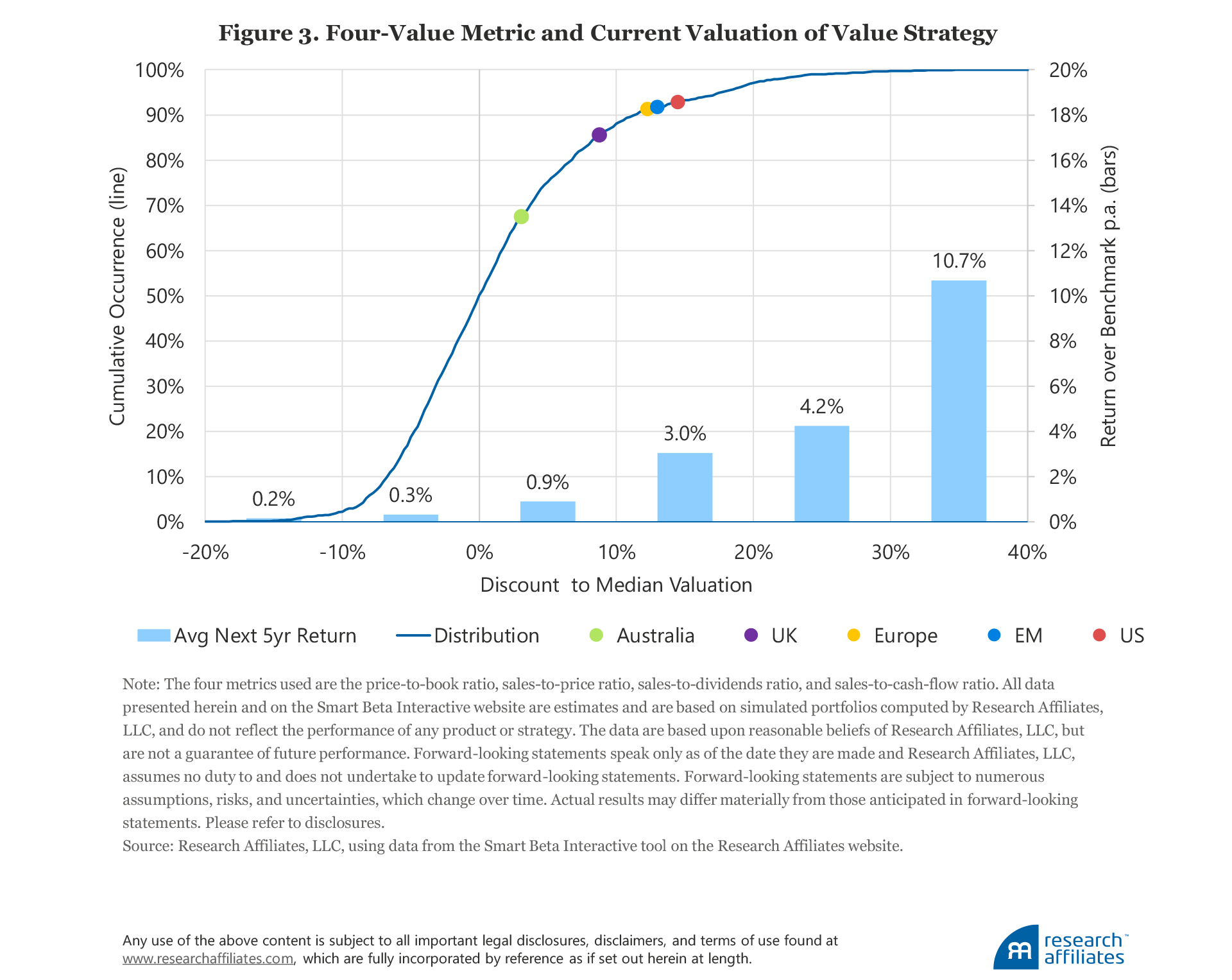

Before we delve into our forward-looking prospects for value versus growth, we should acknowledge that studying value through just one lens, the P/B ratio, and that building an uninvestable factor by equally weighting large and small companies could lead to a skewed view of the factor. Therefore, we will expand our definitions of value to include the sales-to-price ratio, sales-to-dividends ratio, and sales-to-cash flow ratio in each of the following regions: United States, Europe, United Kingdom, Australia, and Emerging Markets.

These markets have a wide spread of average valuation relative to their own market. Notably, as shown in Figure 3, the US premium to median valuation of 15% is at the cheapest end of the scale. This premium arises from the value portfolio being priced at a 37% discount to a cap-based portfolio, when throughout history it has averaged a 22% discount. Australia is trading at a 3% premium to median valuation.

If history is a guide, current valuation levels imply that over the next five years, value stocks are poised to deliver an annualised excess return over the cap-weighted index of 3.0% a year in the United States and 1.2% a year in Australia. The other markets’ annualised expected excess returns over the next five years are bookended by those of the United States and Australia: Emerging Markets, 2.8%; Europe, 2.6%; and United Kingdom, 2.1%.

The Promising Prognosis for Value

We cannot dismiss the fact that returns are noisy. While the expected returns of value relative to growth are compelling, particularly in the US and emerging markets, the role of luck (both good and bad outliers that are not explained by our simple model) creates a wide distribution of outcomes over shorter spans, even over the next five years. Value strategies appear as attractive (if not more so) as they have ever been, but elevated expected returns are never a guarantee that value will outperform growth in the short run. This caveat aside, what we can say with greater assurance brings us back full circle to the title of our article: “Is value investing structurally impaired?” The answer is a resounding “No!” Value is alive and well.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Endnotes

- Frank (2014) provided a summary of winner-takes-all theory, the effects the digital economy is having on the economic landscape.

- We discuss three examples of narratives. Interested readers can find an expanded list, which is analysed by Arnott et al. (2020).

- Interested readers can trace the equation’s derivation in Appendix A of Arnott et al. (2020).

- Assigning a P/B ratio to its hundredth place seems unnecessarily exact. As with the other unrounded input in this example, we include this level of precision for instructive purposes, so that the calculations yield outcomes that tie closely to actual results. Spoiler alert: The results from this example’s assumed inputs will resemble the results of a US large value portfolio from July 1963 to December 2007, as shown in Appendix A, Table A1, of Arnott et al. (2020).

- As Chaves and Arnott (2012) examined, this very act of rebalancing creates a continual source of dividends for value portfolios, while significantly reducing the potential growth in dividends from growth portfolios.

- Please email us at info@rallc.com if you would like a spreadsheet with the calculations for the example simple value portfolio. The return from revaluation at 1.0% is the difference between the portfolio’s P/B ratio at year-end versus its P/B ratio at the start of the year: ln (1.99) minus ln (1.97). Next, given a dividend yield of 4.0% and a growth in book value of 2.4%, the combined return from profitability is 6.4%. Finally, the 5.3% return from migration is approximately equal to the difference between the portfolio’s post-rebalanced P/B ratio at year-end and its P/B ratio after the companies held in the portfolio paid dividends and increased their book value prior to the rebalancing: ln (1.99) minus ln (2.10). Together, these three components constitute the estimated 13.0% return of the US large-cap value strategy. The components will not add up exactly to the total strategy return because we have approximated log returns with simple returns.

References

Arnott, Robert, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa. 2020. “Reports of Value’s Death May Be Greatly Exaggerated.” Research Affiliates Publications (January).

Basu, Sanjoy. 1977. “Investment Performance of Common Stocks in Relation to their Price–Earnings Ratio: A Test of the Efficient Market Hypothesis.” Journal of Finance, vol. 32, no. 3 (June):663–682.

Chaves, Denis, and Robert D. Arnott. 2012. “Rebalancing and the Value Effect.” Journal of Portfolio Management, vol. 38, no. 2 (Fall):59–74.

Frank, Robert. 2014. “Winners Take All, but Can’t We Still Dream?” New York Times (February 22).

Graham, Benjamin, and David Dodd. 1934. Security Analysis. New York: McGraw-Hill.