Presidential Politics and Stock Returns: Is the Relation Real or Spurious?

An increasing body of research shows that previously documented relationships in the investment literature are the result of reporting bias, data mining, and selection bias. Using data for five international markets, we test the robustness of US results that show a relationship between US stock returns and presidential politics—stock returns are higher under Democratic presidents and lower under Republican presidents—and find the US results appear to be spurious.

Our analysis of the respective stock markets and incumbent political parties of Australia, Canada, France, Germany, and the United Kingdom finds a result opposite that identified in the US, indicating that investors should interpret historical statistical relationships with a healthy skepticism.

The current political environment in many developed nations has caused us to consider the robustness of the findings of Santa-Clara and Valkanov (2003), who present evidence that US stock market returns are much higher under Democratic presidents than under Republican presidents. Pastor and Veronesi (2017) update the work of Santa-Clara and Valkanov, finding that the effect is even stronger when the data are extended through the end of 2015. They report that from 1925 to 2015 the average excess market return under Democratic presidents is 10.7% a year, whereas under Republican presidents it is only −0.2% a year. The difference, almost 11.0% a year, is highly significant both economically and statistically.

Given the strength of their results, Pastor and Veronesi develop a model based on time-varying risk aversion to explain the pattern. They hypothesize that when risk aversion is high, such as in times of economic crisis, voters are more likely to elect a Democratic (left-leaning) president, and when risk aversion is low, to elect a Republican (right-leaning) president. Because risk aversion is higher under Democrats, the equity risk premium is greater, and therefore, average returns are higher. The hypothesis advanced by Pastor and Veronesi has intuitive appeal. Is it an ex post rationalization for an observed relationship or is it a real driver of returns? International results may help answer this question.

In statistical studies, it is often easy to overlook the details when examining the broad statistics. Two key events appear to be responsible for much of the differential returns under Democratic and Republican presidents. Specifically, a Republican was president during the two great financial and economic crashes that began in 1929 and in 2008, respectively; unsurprisingly, a Democrat held the office of president during the immense subsequent recoveries. This appears to explain a majority of the return difference. Had the order of incumbencies been reversed, the effect would be reversed, suggesting the finding may be serendipitous.1

To further explore this possibility, we turn to international data in five major countries as an out-of-sample test: Australia, Canada, Germany, France, and the United Kingdom. Consistent with our suspicion that the US results are spurious, we find no systematic relationship between the party in power and stock market returns outside the United States.2

Looking Beyond the United States

A growing body of the financial asset and investment literature has documented that a significant fraction of relationships found and reported in published articles may be spurious due to reporting bias (e.g., Lo and MacKinlay [1990], Black [1993], and MacKinlay [1995]). All too often, after results are identified in US markets, a rationale is then developed to explain the results; this is contrary to scientific method.

Related problems associated with data mining and selection bias are also present. In recent work, Harvey, Liu, and Zhu (2016) argue that because so many researchers are looking for statistical relationships using the same database, the traditional t-statistic of 2.0 to measure statistical significance is no longer an adequate hurdle, and they propose an elevated level of t-statistic should be used instead.

In an effort to remediate data-mining bias in factor and smart beta research, Hsu, Kalesnik, and Viswanathan (2015) suggest that a procedure of perturbing factor definitions and examining factor robustness in multiple geographies can serve as the basis for out-of-sample studies. And last year, Arnott et al. (2016) and Arnott, Beck, and Kalesnik (2016a,b) pointed out that academics have generally failed to adjust performance for changing valuation levels; that is, to disentangle factor performance arising from revaluation from factor performance that is structural, and hence, may be more reliable.

Using international data, we test the robustness of the findings of Santa-Clara and Valkanov and of Pastor and Veronesi by examining the relationship between a nation’s ruling-party political affiliation and its stock market performance. We select Australia, Canada, Germany, France, and the United Kingdom because each has a developed stock market, and each has experienced reversals in political control over the last several decades between left-leaning and right-leaning parties. We do not include, for example, Japan because in the post-WWII period, with the exception of relatively short intervals, the prime minister represented a single party, the Liberal Democratic Party.

The data we use are from a database maintained by Global Financial Data. The stock returns are monthly returns of the most widely reported market indices in each of the five countries: S&P/ASX in Australia, S&P/TSX in Canada, CAC 40 in France, DAX 30 in Germany, and FTSE All Shares in the United Kingdom. Following Pastor and Veronesi, we introduce a dummy variable equal to zero if the “right” party is in power, and one if the “left” party is in power; for example, in the United States, the dummy variable is set to zero for Republican control of the White House, and one for Democratic control. Considering the different political systems of the countries in our analysis, we define the ruling party as being the same as the political affiliation of the prime minister (Australia, Canada, and United Kingdom), chancellor (Germany), or president (France and United States). Table 1 summarizes the parties in each country designated as having a right or left orientation.

We likewise follow Pastor and Veronesi in marking the transition point from party to party at the time the actual transition of governing power occurs: for presidents this is inauguration day, and for prime ministers this is the day they assume office. Using this methodology, the observation of the last partial month in office is fully allocated to the incumbent party. For example, if the transition occurs in March, the March observation is allocated to the incumbent party, and the April observation to the newly elected party.

From a competitive markets perspective, this seems an odd way to define the transition point in stock returns. Stock prices reflect investor expectations. Investor expectations do not change on the date a new president takes office. Expectations don’t even change on the date of the election, except in unusual years like 2016. We think a better way to study the market impact of politics would be based on the change in electoral expectations—when the outcome was deemed likely rather than waiting until election results are settled, let alone the formal transfer of power. Indeed, another reason to suspect the US results may be spurious is the fact that the US results are so strong when a somewhat irrelevant change-in-power date is used as the transition point. That said, we use the same method in order to hew to the current methodological norms; we will save election date and poll-based expectation-shift date studies for another time.

The datasets of the five countries we study are more limited than those of the United States. For Australia, Canada, and the United Kingdom, the data period we use is January 1950 (to avoid contamination by the two world wars) through February 2017. For France and Germany, the data begin in January 1988, the first month of both the CAC 40 and DAX 30 indices, and end in February 2017; prior to establishment of the CAC 40 and DAX 30, the public stock markets in France and Germany had limited depth.3

International Results

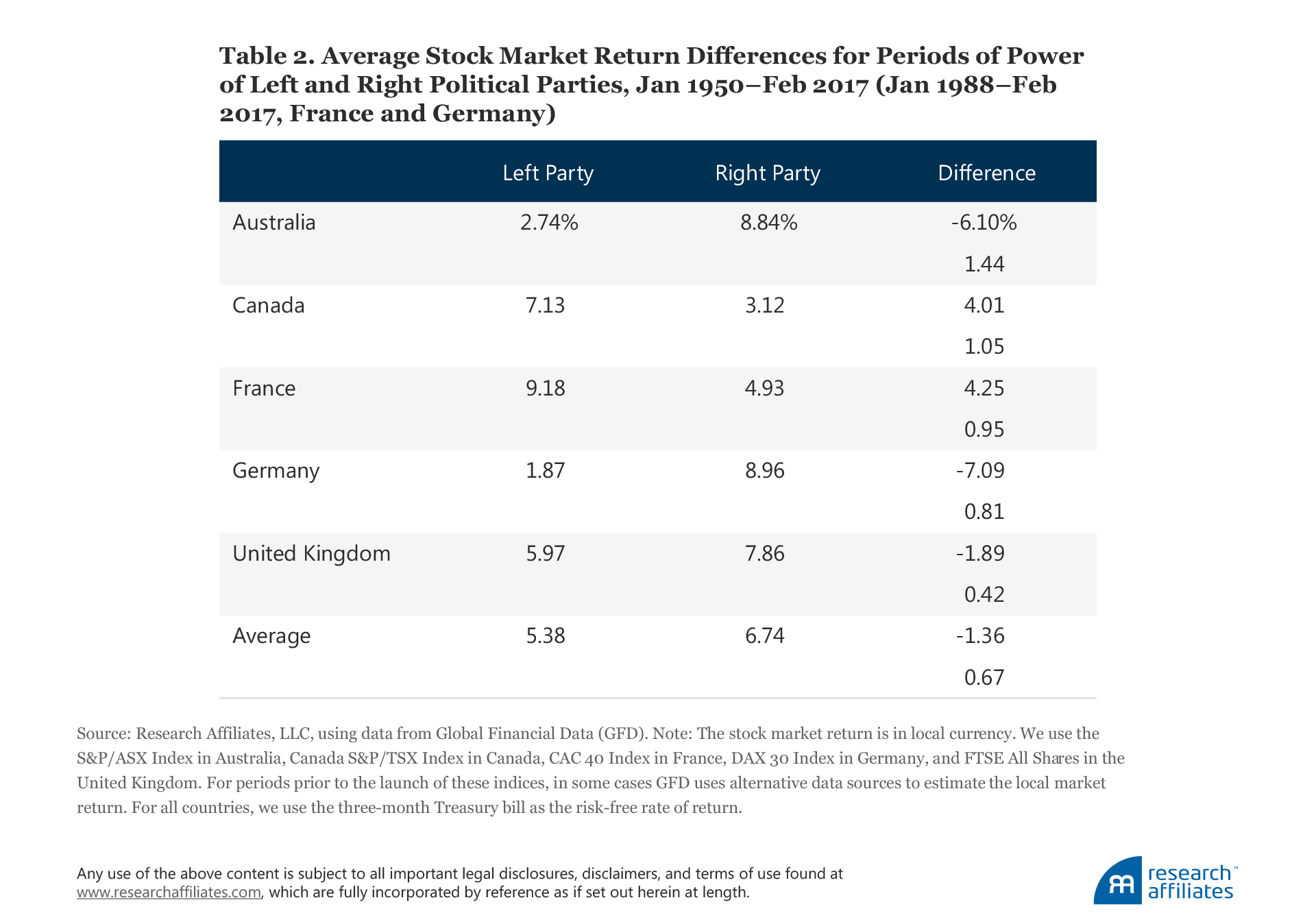

Outside the United States, we find no systematic relationship between the party in power and stock market returns. The average market returns when the left party is in power versus when the right party is in power are reported in Table 2. The results are mixed. In Canada and France, the returns are higher when the left party is in power, consistent with the findings of Santa-Clara and Valkanov and of Pastor and Veronesi, although the differences are not statistically significant. By contrast, in Australia, Germany, and the United Kingdom, the average returns are higher when the right party is in power, but again the differences are not statistically significant.

For the five countries as a whole, returns when the left party is in power are not significantly different from returns when the right party is in power; the average results, while insignificant, are the opposite of the US direction. We see no evidence that these results can be anything but random chance and find it hard to imagine the situation in the United States is so very different that the 10.9% return gap is anything other than a statistical outlier.

Pastor and Veronesi’s findings would predict that the left-minus-right gap would be highest when computed over the early years of party rule. In the United States, Pastor and Veronesi find that the Democrat-minus-Republican return gap is 36.88% a year, averaged over the first year following the inauguration of a new president. Table 3 reports the average return gap for the first year following a change in the controlling party in each of our five countries. Relatively few transitions occur over the study period—only two each in France and Germany—so the results should be interpreted with caution.

When measured in the first year of party rule, returns are higher following the left party coming to power in Canada, France, and the United Kingdom. In contrast, the ascension of the right party is associated with greater returns in Australia and Germany. Again, the evidence is far too noisy to support the hypothesis that any systematic factor is impacting stock returns as a result of either political party transitioning to or retaining power. The 36.88% return gap observed in the United States once again looks like a statistical outlier rather than the rule.

Complicating Factors

The countries we study are governed by different political systems and have varying political party spectrums and definitions. Thus, cross-country comparisons may be complicated, and any conclusions we may attempt to draw for the sample as a whole may be misleading. For example, it is sometimes whimsically observed—and not entirely inaccurate—that conservatives in Canada are to the left of liberals in the United States, and it’s quite clear that European liberals and North American liberals are very different. The extent to which these differences exist is beyond the scope of this article, but the potentiality presents another reason for skepticism that the relation between politics and market returns is stable across countries.

Neither of the two prior studies that prompted us to carry out these simple tests (Santa-Clara and Valkanov, and Pastor and Veronesi), nor our own study, properly recognize the fact that markets are forward looking. We have already noted this in the choice of the transition date. The relevant transition date—as far as the market is concerned—is not the inauguration date or the election date, but the date at which a change in ruling party seems likely, the date at which the capital markets will be expecting an upcoming change in policy. This nuance is difficult to test and lies beyond the scope of our research, but may be a fruitful direction for future research.

Another nuance easily overlooked is the subtle disconnect between entrepreneurial capitalism and liquid capital markets. The latter mostly represent capital that has already been allocated to established enterprises. Entrepreneurial capitalism involves allocating capital to new long-horizon risk-bearing initiatives—a different matter entirely. Entrepreneurial capitalism can be funded by several sources, such as venture capital, direct investment, or retained earnings. When the source is retained earnings, these companies are investing in new business initiatives rather than distributing earnings to shareholders through dividends (or stock buybacks or increasing management incentive compensation). When entrepreneurial capitalism is funded through venture capital or direct investment, capital can actually be diverted out of the liquid capital markets in order to fund new business initiatives. If this thesis is correct, then the party of the left may be good for the equity markets and bad for economic growth (with a lag), and the party of the right may be bad for the equity markets (short term) and good for economic growth.

Conclusion

Our results underscore the importance of exercising caution when interpreting historical investment data, including as it relates to politics. As Harvey, Liu, and Zhu (2015) stress, the large number of ways in which the data can be analyzed in conjunction with the vast number of studies undertaken, opens the door to the discovery of spurious relations. The problem is compounded by the fact that political data are likely to be nonstationary. The claim that the left or right party has come to power can mean different things at different times or in different countries. In addition, the meaning of being “left” or “right” can depend on a number of factors such as the country in question, issues at stake, campaign positions of the opposing parties, and even the personalities of the candidates.

The international results we report here are consistent with the hypothesis that the correlation between US stock returns and US presidential elections, though dramatic, is spurious. Although US stock returns have been much higher when the left party was in power, this finding appears to be unique to the United States. The fact that the result is country specific, in combination with the observation that the US result is driven largely by two key observations associated with major market crashes, leads us to conclude that no persuasive relationship exists between the political party in power and stock returns.

Endnotes

1. We have constructed a counterfactual example in the United States in which we change the order of two two-term periods, 1929–1937 and 2005–2012, from the actual Republican-Democratic order to the counterfactual Democratic-Republican order. If with the actual sequence analyzed by Pastor and Veronesi (2017) the difference in the equity market performance for the period 1927–2015 is 10.6%, with the counterfactual history the difference in the stock market has the reverse sign, −6.6%. This stark difference highlights the sensitivity of the original study to the very limited number of data points.

2. That said, we remain sympathetic to the risk premium argument, but for slightly different reasons as we describe in the “Complicating Factors” section of the article.

3. Further complicating the analysis is that the political systems in France and Germany in the earlier part of the 1950–2017 time sample were undergoing material transformation. For example, France in 1958 experienced a constitutional reform with the establishment of the Fifth Republic, and 1965 marked the introduction of the direct, universally elected position of president. In addition, Valerie Giscard d’Estaing, president from 1974 to 1981, was a centrist and did not represent the two parties or movements in our classification. Thus, his term does not fit neatly into the left–right classification of Pastor and Veronesi. A similar situation is also true in Germany in the early part of the study period. We would argue that in the first few decades of the 1950–2017 period, the selection of chancellor was partly influenced by the occupying forces after WWII, not completely reflecting the electorate’s preferences. Considering the caveats regarding the quality of market data before 1988 as well as the political environments in France and Germany in the decades following WWII, an extension of the sample back to 1950 from 1988 by using several proxies for stock market return and varying classifications for the French president Giscard d’Estaing does not alter the qualitative conclusions of our study.

References

Arnott, Rob, Noah Beck, and Vitali Kalesnik. 2016a. “To Win with ‘Smart Beta’ Ask If the Price Is Right.” Research Affiliates (June).

———. 2016b. “Timing ‘Smart Beta” Strategies? Of Course! Buy Low, Sell High!” Research Affiliates (September).

Arnott, Rob, Noah Beck, Vitali Kalesnik, and John West. 2016. “How Can ‘Smart Beta’ Go Horribly Wrong?” Research Affiliates (February).

Black, Fischer. 1993. “Beta and Return.” Journal of Portfolio Management, vol. 20, no. 1 (Fall):8–18.

Harvey, Campbell, Yan Liu, and Heqing Zhu. 2016. “. . . and the Cross-Section of Expected Returns.” Review of Financial Studies, vol. 29, no. 1 (January):5–68.

Hsu, Jason, Vitali Kalesnik, and Vivek Viswanathan. 2015. “A Framework for Assessing Factors and Implementing Smart Beta Strategies.” Journal of Index Investing, vol. 6, no. 1 (Summer):89–97.

Lo, Andrew, and A. Craig MacKinlay. 1990. “Data-Snooping Biases in Tests of Financial Asset Pricing Models.” Review of Financial Studies, vol. 3, no. 3 (July):431–467.

MacKinlay, A. Craig. 1995. “Multifactor Models Do Not Explain Deviations from the CAPM.” Journal of Financial Economics, vol. 38, no. 1 (May):3–28.

Pastor, Lubos, and Pietro Veronesi 2017. “Political Cycles and Stock Returns.” University of Chicago unpublished working paper.

Santa-Clara, Pedro, and Rossen Valkanov. 2003. “The Presidential Puzzle: Political Cycles and the Stock Market.” Journal of Finance, vol. 58, no. 5 (October):1841–1872.